Introduction to Partnership Accounts MCQ are covered in this Article. Introduction to Partnership Accounts MCQs Test contains 17 questions. Answers to MCQ on Introduction to Partnership Accounts Class 12 Accountancy are available at the end of the last question. These MCQ have been made for Class 12 students to help check the concept you have learnt from detailed classroom sessions and application of your knowledge. For more MCQ’s, subscribe to our email list.

Introduction to Partnership Accounts MCQ Class 12 Accountancy

1. Mr. P makes drawings of Rs. 2000 per month on the last day of every month. If the rate of interest is 5% p.a. Then what will be the total interest on drawings?

(a) Rs. 650

(b) Rs. 550

(c) Rs. 600

(d) Rs. 700

2. L and M are partners in M/s LM Co. and are sharing profits and losses in the ratio of 4 : 1. N was a manager who received a salary of Rs. 4000 p.m. in addition to a commission of 5% on net profits after charging such commission. If the profits for FY 2020-21 are Rs. 6,78,000 before charging salary. Find total remuneration of N :

(a) Rs. 78,000

(b) Rs. 88,000

(c) Rs. 76,500

(d) Rs. 78,500

3. When partners have not made any partnership deed, which of these are they still entitled to receive?

(a) Salary

(b) Interest on loans and advances

(c) Commission

(d) Share of profit

4. When the partnership deed does not show any fixed interest on the partner’s loan, by the provision of law, at what rate is the partner entitled to receive interest on loan?

(a) 12% p.a.

(b) 6% p.a.

(c) 18% p.a.

(d) 10% p.a.

5. P and Q are partners in PQ & Co. P’s capital is Rs. 20,000 and Q’s Capital is Rs. 12,000. Interest is payable @ 6% p.a. Q is entitled to a salary of Rs. 600 per month. Profit for the year before interest and salary to Q are Rs. 16,000. Profits between P and Q will be divided : –

(a) Rs. 3,440 to P and Rs. 3,440 to Q

(b) Rs. 4000 to P and Rs. 2880 to Q

(c) Rs. 2880 to P and Rs. 4000 to Q

(d) None

6. Suni is a partner in Raman & Co. He made drawings as follows : –

July 1 Rs. 600

August 1 Rs. 600

September 1 Rs. 900

November 1 Rs. 150

February 1 Rs. 300

If the rate of interest on drawings is 6% and accounts are closed on March 31, 2021 the interest on drawing of Sunil for the FY 2020-21 is:

(a) Rs. 89.25

(b) Rs. 105

(c) Rs. 90

(d) Rs. 120

Introduction to Partnership Accounts MCQ

7. When a Fluctuating Capital Account is prepared for partners, which of the following are credited to this account?

(a) Interest on Capital

(b) Remuneration to the partners

(c) Profit of the year

(d) All of these

8. Sunil and Anil, are partner’s in Jhabbu Lal and Co. They draw for private use Rs. 16,000 and Rs. 8,000 respectively. Interest is changeable @ 6 percent per annum on drawings. What is the interest ?

(a) Sunil Rs. 480 and Anil Rs. 240

(b) Sunil Rs. 960 and Anil Rs. 480

(c) Sunil 930 and Anil Rs. 200

(d) None

9. As per Section 37 of the Indian Partnership Act, 1932, at what rate the executors would be entitled to receive interest from the date of death till the date of payment on the final amount due to the deceased partner?

(a) 7

(b) 4

(c) 6

(d) 12

10. Interest on Partners capital is :

(a) An expenditure

(b) An appropriation

(c) A receipt

(d) None of these

11. Aman and Chaman are partners with a capital of Rs. 150,000 and Rs. 180,000 respectively. Interest on capital is given @ 5% p.a. Profits earned by the partnership, after appropriation of interest on capital for the year were Rs. 13,800. What will be partners’ share of profit?

(a) Rs. 9,000 and Rs. 7,500

(b) Rs. 6,272 and Rs. 7,527

(c) Rs. 7,500 and Rs. 6,273

(d) None of these

12. A and B are running a partnership firm, without a partnership deed. In such a case, what will be the rate of interest on capital?

(a) 6%

(b) 7%

(c) 8%

(d) Nil

Introduction to Partnership Accounts MCQ

13. Interest on Drawings is:

(a) Debited to Profit and Loss A/c

(b) Debited to Capital A/c

(c) Credited to Profit and Loss A/c

(d) None

14. Profit or loss on revaluation is shared among the old partners in ______ ratio.

(a) New Profit Sharing

(b) Old Profit Sharing

(c) Capital

(d) Average Profit Sharing

15. A partnership firm consisted of three partners A, B & C, which was based on a written partnership deed. In such a case, interest on capital shall be provided out of the : –

(a) Profits of the firm

(b) Sale of Assets

(c) Banks

(d) None of these.

16. Interest on drawings of partners is a :

(a) Liability of the Firm

(b) Expenditure

(c) Revenue of the Firm

(d) None of the above.

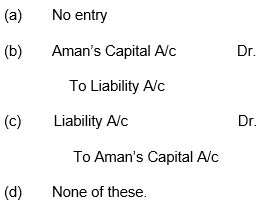

17. Aman is a partner in a firm, which had purchased an asset of Rs. 10,000 from Sunil & Co. Aman discharged the liability of Rs. 10,000 from his personal bank account. In this case, what will be the entry in the firm’s books of accounts?

Introduction to Partnership Accounts MCQ – Correct Answers

- [a] Rs. 650

- [a] Rs. 78,000

- [d] Share of profit

- [b] 6% p.a.

- [a] Rs. 3,440 to P and Rs. 3,440 to Q

- [a] Rs. 89.25

- [d] All of these

- [b] Sunil Rs. 960 and Anil Rs. 480

- [c] 6

- [b] An appropriation

- [d] None of these

- [d] Nil

- [b] Debited to capital A/c

- [b] Old profit sharing ratio

- [a] Profits of firm

- [b] Expenditure

- [b] Aman’s Capital A/c Dr.

To Liability A/c