Activity Ratio Analysis

Activity Ratio Analysis: Activity ratios are financial analysis tools used to measure a business’ ability to convert its assets into cash. These ratios are known as turnover ratios because they indicate the rapidity with which the resources available to the concern are being used to produce revenue from operations.

The different types of activity ratios are:

- Inventory Turnover Ratio

- Trade Receivables Turnover Ratio

- Trade Payables Turnover Ratio

- Working Capital Turnover Ratio

- Net Assets or Capital Employed Turnover Ratio

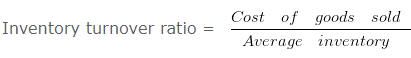

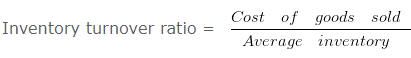

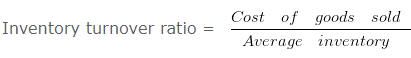

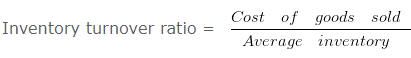

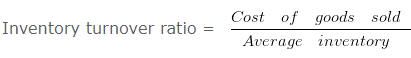

1. Inventory Turnover Ratio – Type of Activity Ratio

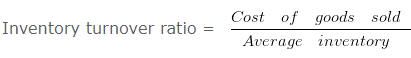

It indicates the relationship between the cost of revenue from operations during the year and average inventory during the year.

Here, Cost of Revenue from Opearions = Opening Inventory + Purchases + Carriage Inward + Wages + Other Direct Charges – Closing Inventory

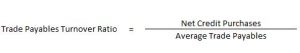

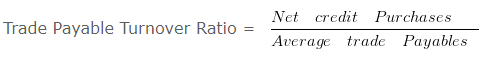

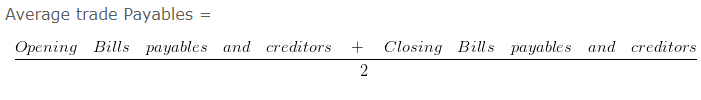

2. Trade Payables Turnover Ratio – Type of Activity Ratio

It indicates the relationship between credit purchases and average trade payables during the year.

Trade Payables include Creditors and Bills Payables.

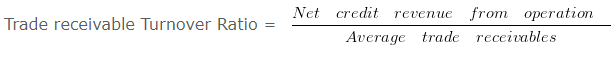

3. Trade Receivables Turnover Ratio – Type of Activity Ratio

It indicates the relationship between credit revenue from operations and average trade receivables during the year.

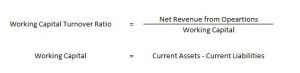

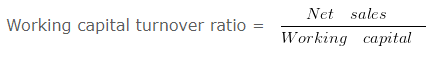

4. Working Capital Turnover Ratio – Type of Activity Ratio

This ratio is important in non-manufacturing concerns where current assets play a major role in generating sales. It indicates the efficient use of working capital.

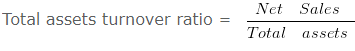

5. Net Assets or Capital Employed Turnover Ratio

It signifies the relationship that exists between the sales of an enterprise and its net assets (capital employed). The higher the ratio the better it is, as it reflects the better performance of the business.

The formula for calculating the Net Assets or Capital Employed Turnover Ratio :

= Revenue from Operation/ Capital Employed

Activity Ratio Examples

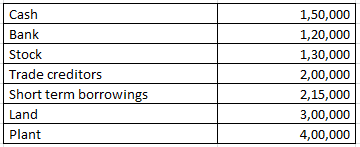

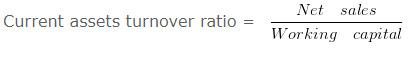

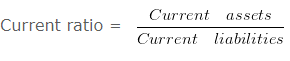

Calculation of current assets turnover ratio – Activity Ratio Analysis – Question 1

From the following information calculate the Current assets turnover ratio:

Revenue from the operation for the year were RS. 2800000

Explanation : –

Current assets turnover ratio = 2800000/400000

Current assets turnover ratio = 7 Times

Working note 1 : Current assets = Cash + Bank + Stock

Current assets = 150000 + 120000 + 130000

Current assets = 400000

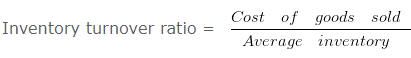

Calculation of inventories when Inventory Ratio is given – Activity Ratio Analysis – Question 2

Calculate the value of opening Inventory from the following information.

The cost of revenue from operations is 1200000 and the Inventory turnover ratio is 3 Times. and opening inventory is 40000 less than the closing inventory

Explanation: –

3 = 1200000/Average inventory

Average inventory = 400000

Workings:

Opening inventory = 400000 (-)40000/2

Opening inventory 380000

Closing inventory = 400000 (+)40000/2

Closing inventory = 420000

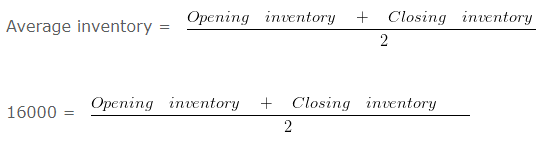

Activity Ratio Analysis – Activity Ratio Analysis – Question 3

Calculate the value of opening Inventory from the following information:

The cost of revenue from operations is 16000 and the Inventory turnover ratio is 1 Time. and opening inventory is 6 Times More than the closing inventory.

Explanation : –

1 = 16000/Average inventory

Average inventory = 16000

Workings:

32000 = Opening inventory + Closing inventory

Since the opening inventory is 6 Times More than the closing inventory, therefore, the ratio between opening inventory and closing inventory will be 7: 1

Opening inventory = 32000 x 7/8

Opening inventory = 28000

Closing inventory = 32000 x 1/8

Closing inventory = 4000

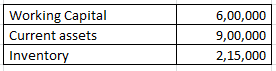

When inventory and current assets given – Activity Ratio Analysis – Question 4

From the following information compute the current ratio.

Explanation: –

Current Ratio = 900000/300000

Current Ratio = 3 :1

Workings:

Working Capital = Current assets (-) Current liabilities

600000 = 900000 (-) Current liabilities

Current liabilities = 300000

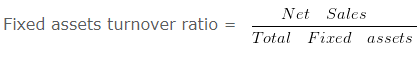

Fixed assets turnover ratio – Activity Ratio Analysis – Question 5

From the following information, calculate fixed assets turnover ratio:

Revenue from the operation for the year were RS. 2000000

Explanation : –

Fixed assets turnover ratio = 2000000/500000

Fixed assets turnover ratio = 4 Times

Total Fixed assets = Land + Building + Furniture

Total Fixed assets = 300000 + 50000 + 150000

Total Fixed assets = 500000

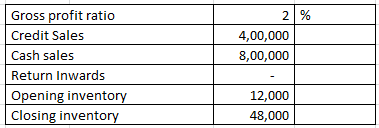

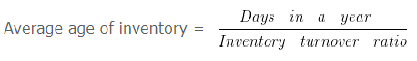

Inventory turnover ratio and the average age of inventory – Question 6

Calculate Inventory turnover ratio and the average age of inventory from the following information:

Explanation: –

Inventory turnover ratio = 1176000/30000

Inventory turnover ratio = 39.2 Times

The average age of inventory = 360/39.2

= 9.18 Days

Workings:

Cost of goods sold = Net Sales (-) gross profit

1200000 (-) 2% X 1200000

1200000 (-) 24000

1176000

Net sales = Cash sales + Credit Sales (-) Return Inwards

800000 + 400000 (-) 0

1200000

= 30000

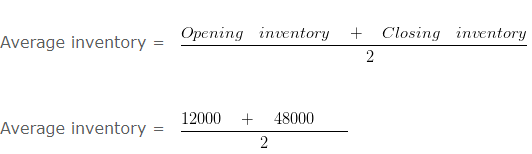

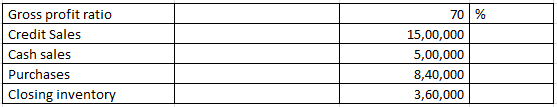

Inventory turnover ratio when closing stock is given – Activity Ratio Analysis – Question 7

Calculate the Inventory turnover ratio from the following information:

Explanation: –

Inventory turnover ratio = 600000/240000

= 2.5 Times

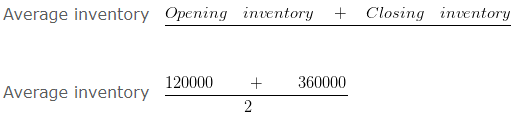

Workings:

Cost of goods sold = Net Sales (-) gross profit

= 2000000 (-) 70% x 2000000

= 2000000 (-) 1400000

= 600000

Net sales = Cash sales + Credit Sales

500000 + 1500000

2000000

Average inventory = 240000

Cost of goods sold = Opening inventory + Purchases (-) Closing inventory

600000 = Opening inventory + 840000 (-) 360000

= Opening inventory + 480000

Opening inventory = 120000

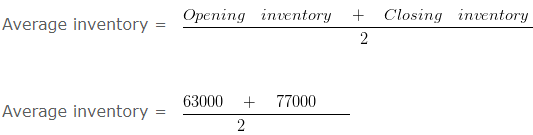

Inventory turnover ratio when GP ratio based on cost – Activity Ratio Analysis – Question 8

Calculate Inventory turnover ratio from the following information: Gross profit ratio is 10 % Of cost and revenue from the operation is RS. 770000. Opening inventory was 9/11 of closing inventory and closing inventory was 10 % of revenue from the operation.

Explanation : –

Inventory turnover ratio = 700000/70000

Inventory turnover ratio = 10 Times

Working note: = Gross profit ratio is 10% Of cost

Therefore goods costing Rs. = 100 is sold for RS. 110

Cost of goods sold = 100

If revenue from operation is = 770000

Cost of goods sold = 700000 ( 770000 X 100/110 )

= 70000

Closing inventory = 10% x Revenue from operation

Closing inventory = 10% x 770000

Closing inventory = 77000

Opening inventory = 9/11 x Closing inventory

Opening inventory = 9/11 x 77000

Opening inventory = 63000

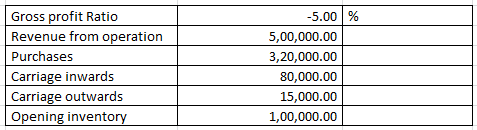

Inventory turnover ratio when GP ratio is negative – Activity Ratio Analysis – Question 9

Calculate the Inventory turnover ratio from the following information:

Explanation: –

Inventory turnover ratio = 525000/37500

Inventory turnover ratio = 14 Times

Workings:

Cost of goods sold = Revenue from operation (-) gross profit

= 500000 (-) -5% X 500000

= 500000 (-) -25000

= 525000

= 37500

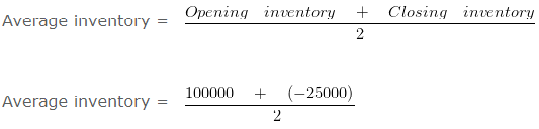

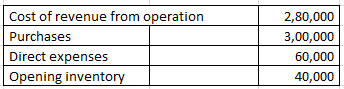

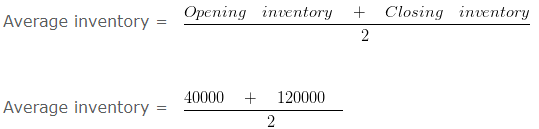

Inventory turnover ratio when opening stock is given – Activity Ratio Analysis – Question 10

Calculate the Inventory turnover ratio from the following information:

Explanation: –

Inventory turnover ratio = 280000/80000

Inventory turn over ratio = 3.5 Times

Workings:

Cost of goods sold = Opening inventory + Purchases + Direct expenses – Closing inventory

280000 = 40000 + 300000 + 60000 – Closing inventory

Closing inventory = 120000

Average inventory = 80000

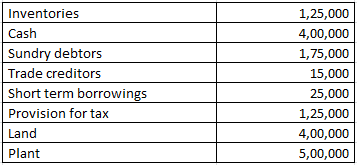

Total assets turnover ratio – Question 11

From the following information calculate the total assets turnover ratio.

Revenue from the operation for the year was RS. 4800000

Explanation: –

Total assets turnover ratio = 4800000/1600000

Total assets turnover ratio = 3 Times

Working note 1 : Total assets = Inventories + Cash + Sundry debtors + Land + Plant

Total assets = 125000 + 400000 + 175000 + 400000 + 500000

Total assets = 1600000

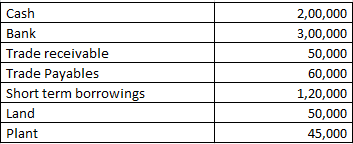

Working capital turnover ratio – Question 12

From the following information calculate the working capital turnover ratio:

Revenue from the operation for the year was RS. 1850000

Explanation : –

Working capital turnover ratio = 1850000/370000

Working capital turnover ratio = 5 Times

Working note 1: Working capital = Current assets (-) Current liabilities

Working capital = 550000 (-) 180000

Working capital = 370000

Working note 2 : Current assets = Cash + Bank + Trade receivable

Current assets = 200000 + 300000 + 50000

Current assets = 550000

Working note 3: Current liabilities = Trade Payables + Short term borrowings

Current liabilities = 60000 + 120000

Current liabilities = 180000

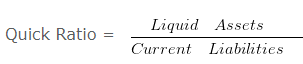

Determination of current assets when current ratio is given – Question 13

The current ratio of a business is 13: 11 and the Quick Ratio is 0.75.

If Working Capital is Rs. 200000 then calculate the value of current assets and inventory.

Explanation : –

Working Capital = Current Assets (-) Current Liabilities

or

Current Liabilities = Current Assets (-) Working Capital

= 1300000 (-) 200000

= 1100000

or

Liquid Assets = Current Liabilities x Quick Ratio

= 1100000 x 0.75

= 825000

Inventory = Current Assets (-) Liquid Assets

= 1300000 (-) 825000

= 475000

Working Note 1 :

Working Capital = Current Assets (-) Current Liabilities

Working Capital = 13 (-) 11

Working Capital = 2

When working capital = 2 then Current Assets = 13

When working capital = 200000 then Current Assets = 1300000

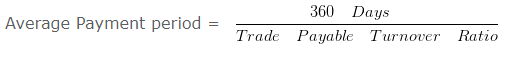

Trade payable turnover ratio – Activity Ratio Analysis – Question 14

Calculate the trade payable turnover ratio and average payment period From the following information. Credit purchases during 2016-2017 are 1000000. Balance of opening Creditors and Bills payable on 01.04.2016 is RS. 40000 and 15000 and the Balance of Closing Creditors and bills payable on 31.03.2017 is RS. 35000 and 10000

Explanation: –

Trade Payable Turnover Ratio = 1000000/50000

Trade Payable Turnover Ratio = 20 Times

Average Payment period = 360/20

Average Payment period = 18 Days

Workings:

Average trade Payables = 100000/2

Average trade Payables = 50000

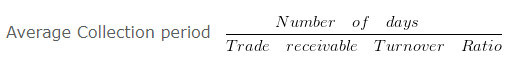

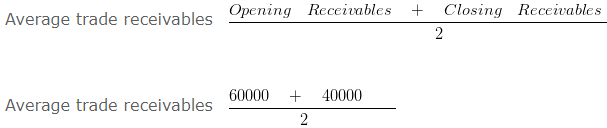

Trade receivable turnover ratio – Activity Ratio Analysis – Question 15

Calculate the Trade receivable Turnover Ratio and average collection period from the following information: Total revenue from the operation is 100000 and cash revenue is 10 % of total revenue from the operation. The balance of opening receivable on 01.04.2016 is RS. 60000 and the Balance of Closing receivable on 31.03.2017 is 40000

Explanation: –

Trade receivable Turnover Ratio = 90000/50000

Trade receivable Turnover Ratio = 1.8 Times

Average Collection period = 360/1.8

Average Collection period = 200 Days

Workings:

Credit sales = 100000 x 0.9

= 90000

Average trade receivables 50000

Chapter 5 – Accounting Ratios