Admission of a partner involves addition of a new partner into the partnership business by the existing partners. This would results in change in profit sharing ratio of the existing partners. A partner may be admitted into the partnership firm under the following circumstances:

- When there is requirement of additional capital

- The partnership firm needs a competent and experienced person for efficient running of the business

- For appreciation of an efficient employee

- Sometimes a reputed person is being admitted into the partnership firm when the firm wants to increase the goodwill and reputation of the business

Computing new partnership ratio, when percentage of new partner is given

In such a case, the steps to be followed are as under :-

- Assume total profit of the firm = 1

- Subtract share of new partner from the total profit to get the share of the remaining partners

- Calculate the ratio of existing partners amongst themselves

- Distribute the remaining profits of the firm in the ratio of profit sharing of existing partners

Admission of a New Partner

All the existing partners must agree on admission of a partner in the partnership firm, unless otherwise specified.

Admission of a partner leads to reconstitution of the partnership firm and therefore all the partners enter into a new agreement.

The new partner is entitled to all the rights available to the existing partners. To name a few –

- Right of sharing profits of the partnership firm in the agreed profit sharing ratio,

- Right of sharing the assets of the partnership firm,

- Right to access and inspect the books of accounts.

To avail above rights, a newly admitted partner is required to contribute an agreed sum as capital either in cash or in kind. Some firms may also require the partner to bring in an amount in the form of goodwill over and above the capital amount.

With the admission of the new partner, the profit sharing ratio of the existing partners gets reduced as it is now distributed among the old plus the new partner. To compensate the existing partners for the sacrifice of their share in the profits of the firm, the new partner is required to bring in capital and goodwill.

Adjusted capital of old partners

Admission of a Partner : Example 1

Akash and Aman are partners sharing profits and losses in the ratio of 3/4 and 1/4 respectively. Anubhav is admitted into partnership for 1/3 share in profits.The capitals of Akash and Aman before adjustments are Rs. 160000 and Rs. 120000 respectively.Profit on revaluation of assets and liabilities – Rs. 16000 ,General Reserve – Rs. 12000 .Calculate the adjusted capital of Aman .

Explanation:-

Calculation of adjusted capitals of old partners

Aman s capital before adjustment = 160000

Add: Share in general reserve 12000 X 1/4 = 3000

Add: Profit on revaluation 16000 X 1/4 = 4000

Total = 167000

Capital brought by new partner as per capital of old Partner

Admission of a Partner : Example 2

Abhya and Amol are partners sharing profits and losses in the ratio of 3/5 and 2/5 respectively. Arpit is admitted into partnership for 1/3 share in profits.The capitals of Abhya and Amol before adjustments are 100000 and 100000 respectively.Profit on revaluation of assets and liabilities-Rs. 10000 ,General Reserve-Rs. 10000 what will be the amount of capital to be brought in by Arpit ?

Explanation:-

Calculation of adjusted capitals of old partners

Abhya s capital before adjustment = 100000

Add share in general reserve 10000 X 3/5 = 6000

Add profit on revaluation 10000 X 3/5 = 6000

Total = 112000

Amol s capital before adjustment = 100000

Add share in general reserve 10000 X 2/5 = 4000

Add profit on revaluation 10000 X 2/5 = 4000

Total = 108000

Calculation of total capital of new firm:

Total share of the firm = 1 , Arpit s share = 1/3

Remaining share for Abhya and Amol = 1 – 1/3 = 2/3

Total capital = Combined adjusted old capital of old partners X Reciprocal of proportion of share of old partners

= 112000 + 108000 X 3/2

= 220000 X 3/2 = 330000

Capital of Arpit = Total capital X Share of Arpit in profits

= 330000 X 1/3

= 110000

Capital of old partners on the basis of new partners capital

Admission of a Partner : Example 3

Aksh and Naksh are partners sharing profits and losses in the ratio of 3/5 and 2/5 respectively. Daksh admitted into partnership and it was decided that New profit sharing ratio among Aksh , Naksh and Daksh will be 3: 4: 2. Daksh brought 1200000 as his capital and old partners capital will be valued on the basis of Daksh s capital.What will be the capital all partners?

Explanation:-

Total capital of the firm = Capital brought by Daksh X Reciprocal of proportion of share of Daksh

= 1200000 X 9/2

= 5400000

Aksh s new capital = 5400000 X 3/9 = 1800000

Naksh s new capital = 5400000 X 4/9 = 2400000

Capital of partners when total capital of the new firm given

Admission of a Partner : Example 4

Amar and Akbar are partners Antony is admitted into partnership and it was decided that new profit sharing ratio between Amar , Akbar and Antony will be 3/6 , 1/6 and 2/6 respectively.The total capital of the firm is fixed at Rs. 1200000 what will be the capital among Amar , Akbar and Antony ?

Explanation:-

Capital of partners = Total capital of the firm X New profit sharing ratio of partner

Amar s capital = 1200000 X 3/6 = 600000

Akbar s capital = 1200000 X 1/6 = 200000

Antony s capital = 1200000 X 2/6 = 400000

Entry for distribution of goodwill among sacrificing partner

Admission of a Partner : Example 5

Ajay and Ram are partners sharing profits and losses in the ratio of 5/12 and 7/12 respectively Shyam admitted into partnership for 1/3th share in the profits of the firm. He brought Rs 12000 for goodwill. What will be the journal entry for distribution of goodwill among old partners.

Explanation:-

Old ratio between existing partners is 3 : 2

So, Ajay s share of goodwill = 12000 X 5/12= 5000

Ram s share of goodwill = 12000 X 7/12 = 7000

Premium for goodwill A/c Dr 12000

To Ajay s capital A/c 5000

To Ram s capital A/c 7000

Existing partner’s sacrificing ratio when partner admitted

Admission of a Partner : Example 6

Aadi and Aarav are partners sharing profits and losses in the ratio of 1/4 and 3/4 respectively. Arnav is admitted into partnership for 2/5 share in the profits of the firm which he will acquire 1/5 from Aadi and 2/3 from Aarav. Calculate the share sacrificed by Aarav .

Explanation:-

Arnav admitted into partnership for = 2/5 share in profits

Arnav will acquire share from Aarav = 2/3 of 2/5 = 4/15

Goodwill value based on goodwill brought in by new partner

Admission of a Partner : Example 7

Ahem and Ankit are partners sharing profits and losses in the ratio of 1/2 and 1/2 respectively. Anshul is admitted into partnership for 4/3th share in the profits of the firm. He brought Rs. 12000 for goodwill and Rs. 20000 as capital. What will be the value of total goodwill?

Explanation:-

C s share of profit = 4/3

Goodwill brought in by C = 12000

So, value of total goodwill = 12000 x 3/4

= 9000

Journal Entry for the treatment of goodwill

Admission of a Partner : Example 8

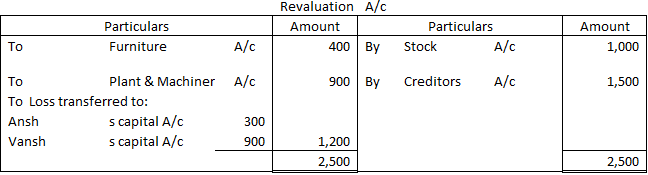

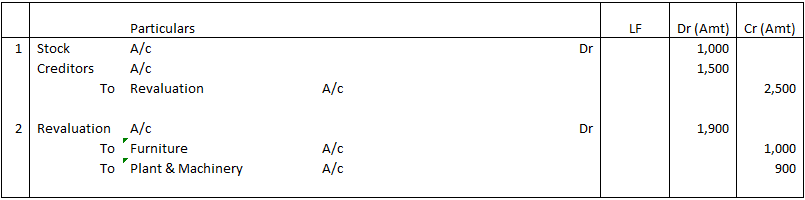

Ansh and Vansh are partners sharing profits in the ratio of 1/4 and 3/4 respectively.They admitted Nived as a new partner for 2/3 share in the profits of the firm. Following is the Revaluation account prepared after the admission of Nived . What will be the entries in the books of the firm regarding revaluation of assets and liabilities. .

Explanation:-

Journal Entry for the treatment of goodwill appeared in B.S

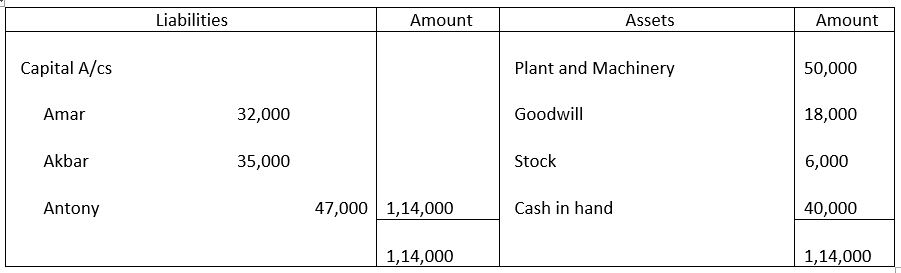

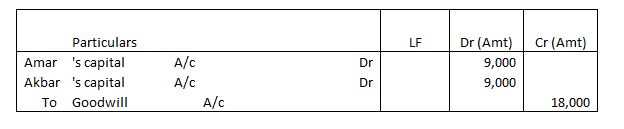

Admission of a Partner : Example 9

Amar and Akbar are partners sharing profits in the ratio of 1/2 and 1/2 respectively.They admitted Antony as a new partner for 1/3 share in the profits of the firm.following is the Balance sheet of the old firm.What will be the journal entry to record the treatment of goodwill after admission of Antony ?

Explanation:-

Journal Entry to record decrease in the value of asset

Admission of a Partner : Example 10

A and B are partners with profit sharing ratio 2/5 and 3/5 respectively.They admitted C as a new partner for 1/3 share in the profits of the firm.following is the Balance sheet of the new firm after admission of C .What will be the journal entry to record the Decrease in the value of Plant and Machinery .

Explanation:-

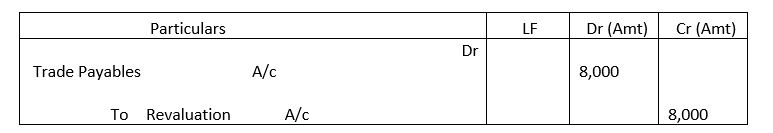

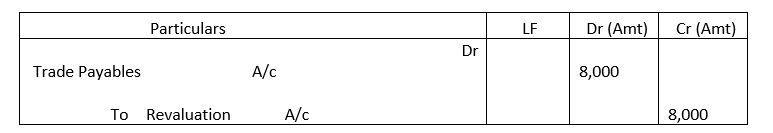

Journal entry to record decrease in the value of liability

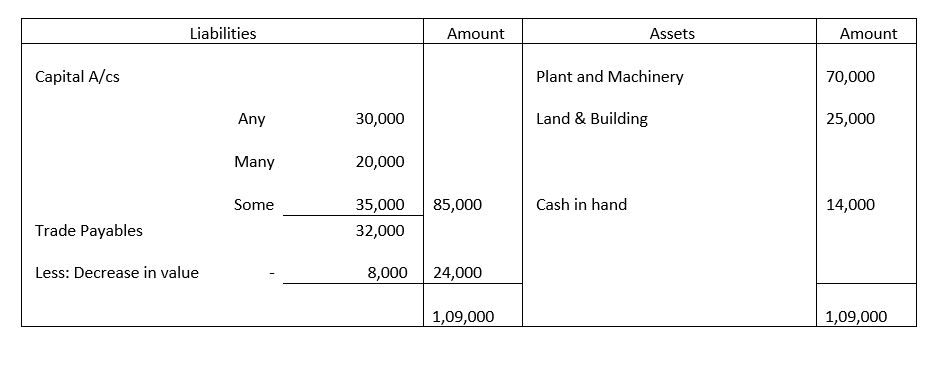

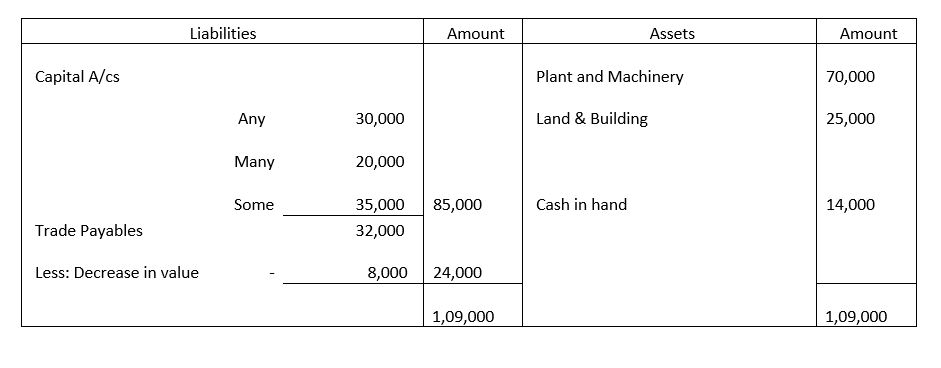

Admission of a Partner : Example 11

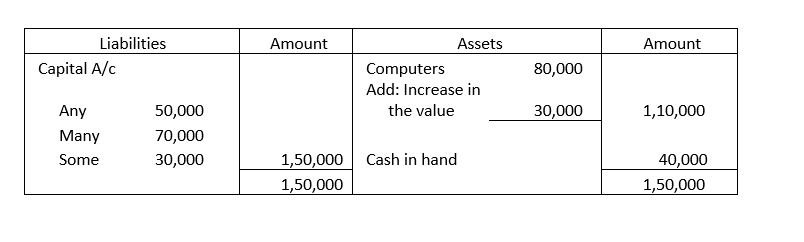

Any and Many are partners with profit sharing ratio 2/7 and 5/7 respectively.They admitted Some as a new partner for 1/3 share in the profits of the firm. Following is the Balance sheet of the new firm after admission of Some .What will be the journal entry to record the Decrease in the value of Trade Payables .

Explanation:-

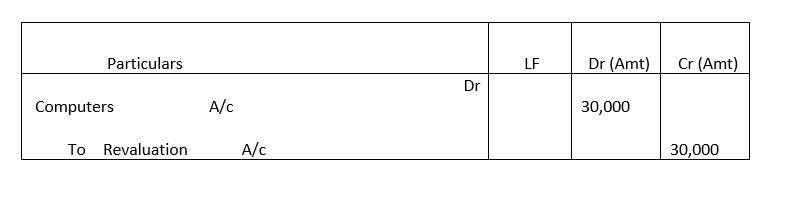

Journal entry to record Increase in the value of asset

Admission of a Partner : Example 12

Any and Many are partners with profit sharing ratio 3/7 and 4/7 respectively.They admitted Some as a new partner for 1/5 share in the profits of the firm. Following is the Balance sheet of the new firm after admission of Some .What will be the journal entry to record the increase in the value of Computers .

Explanation:-

Journal Entry-capital and goodwill brought in by new partner

Admission of a Partner : Example 13

Ahem and Ankit are partners sharing profits and losses in the ratio of 1/2 and 1/2 respectively. Anshul is admitted into partnership for 3/2th share in the profits of the firm. He brought Rs. 8000 for goodwill and Rs. 20000 as capital.what will be the journal entry for recording capital and goodwill brought in by Anshul ?

Explanation:-

Bank / Cash A/c Dr 28000

To Anshul s capital A/c 20000

To Premium for goowill A/c 8000

New partner acquires the entire share from existing partner

Admission of a Partner : Example 14

Aksh and Naksh are partners sharing profits and losses in the ratio of 7/9 and 2/9 respectively. Daksh is admitted into partnership for 1/2 share in the profits of the firm which he acquired entirely from Naksh .Calculate the share sacrificed by Naksh .

Explanation:-

Daksh admitted into partnership for 1/2 share in profits

Daksh will acquire entirely from Naksh = 1/2

New partner’s share when old partners’ surrender their share

Admission of a Partner : Example 15

Anuj and Akash are partners sharing profits and losses in the ratio of 1/5 and 4/5 respectively. Aman is admitted into partnership. Anuj Surrenders 2/3 of his share and Akash Surrenders 1/5 of his share in favour of Aman .What will be Aman s share of profit?

Explanation:-

Share surrendered by Anuj 2/3 of 1/5 = 2/15

Share surrendered by Akash 1/5 of 4/5= 4/25

now Aman s share in profit of the firm =2/15 + 4/25

= (10+12)/75

= 22/75

New profit share of old partner when two partners are added

Admission of a Partner : Example 16

Akash and Gagan are partners sharing profits and losses in the ratio of 3/8 and 5/8 respectively. Vayu is admitted into partnership for 2/5 For expanding the business and to meet the requirement of additional capital Indra is admitted as a new partner for 3/2 share in profits which he acquired from Akash and Gagan in 4 : 1 .What will be the new share of profit of Gagan after admission of Indra ?

Explanation:-

Let total profit of the firm = 1

Remaining profit after admission of Vayu = 1 – 2/5

= (5-2)/5

= 3/5

Akash will get 3/8 of 3/5 = 9/40

Gagan will get 5/8 of 3/5 = 15/40

Indra will acquire from Gagan = 3/2 X 1/5 = 3/10

Gagan s new share =15/40 – 3/10 = (15-12)/40

= 3/40

New PSR when new partner acquires entire share from 1 partner

Admission of a Partner : Example 17

Anu and Manu are partners sharing profits and losses in the ratio of 4/7 and 3/7 respectively. Ranu is admitted into partnership for 1/2 share in the profits of the firm which he acquired entirely from Anu .What will be the new profit sharing ratio between Anu & Manu ?

Explanation:-

Ranu is admitted into partnership for 1/2 share in profits

Ranu will acquire share from Anu = 1/2

Anu s new share =4/7 – 1/2 = (8 – 7)/14

= 1/14

New profit sharing ratio between Anu & Manu = 1/14 : 3/7

= (1 : 6)/14

= 1:6

New Profit Sharing Ratio when partner acquires shares in fraction

Example 18

Aadi and Aarav are partners sharing profits and losses in the ratio of 1/3 and 2/3 respectively. Arnav is admitted into partnership for 2/5 share in the profits of the firm which he will acquire 1/5 from Aadi and 2/3 from Aarav .What will be the new profit sharing ratio between partners.

Explanation:-

Arnav admitted into partnership for = 2/5 share in profits

Arnav will acquire from Aadi = 1/5 of 2/5 = 2/25

Arnav will acquire from Aarav = 2/3 of 2/5 = 4/15

Remaining share of Aadi = 1/3 – 2/25 = (25 – 6)/75 = 19/75

Remaining share of Aarav = 2/3 – 4/15 = (10 – 4)/15 = 6/15

New profit sharing ratio between Aadi , Aarav and Arnav

= 19/75 : 6/15 : 2/5

= (19 : 30 : 30)/75

= 19 : 30 : 30

New PSR when partner admitted for profit%

Admission of a Partner : Example 19

Aa and Bb are partners sharing profits and losses in the ratio of 3/7 and 4/7 respectively. Cc admitted into partnership for 10 % share in profits.What will be the new profit sharing ratio between partners?

Explanation:-

Let total profit of the firm = 1

Cc s share = 10% = 10/100 = 1/10

Remaining profit after admission of Cc = 1 – 1/10

= (10-1)/10

= 9/10

Aa will get 3 of 9/10 = 27/70

Bb will get 4 of 9/10 = 36/70

New profit sharing ratio between Aa , Bb and Cc

= 27/70 : 36/70 : 1/10

= 27 : 36 : 7

New PSR-Admission of 2 partners, one after another

Admission of a Partner : Example 20

Akash and Gagan are partners sharing profits and losses in the ratio of 3/8 and 5/8 respectively. Vayu is admitted into partnership for 2/5 For expanding the business and to meet the requirement of additional capital Indra is admitted as a new partner for 3/2 share in profits which he acquired from Akash and Gagan in 4 : 1 .What will be the new share of profit of Akash after admission of Vayu ?

Explanation:-

Let total profit of the firm = 1

Remaining profit after admission of Vayu = 1 – 2/5

= (5-2)/5

= 3/5

Akash will get 3/8 of 3/5 = 9/40

Gagan will get 5/8 of 3/5 = 15/40

New share of old partner after admission of a new partner

Admission of a Partner : Example 21

Aadi and Aarav are partners sharing profits and losses in the ratio of 1/4 and 3/4 respectively. Arnav is admitted into partnership for 2/5 share in the profits of the firm which he will acquire 1/5 from Aadi and 2/3 from Aarav. Calculate the remaining share of Aadi.

Explanation:-

Arnav admitted into partnership for = 2/5 share in profits

Arnav will acquired from Aadi = 1/5 of 2/5 = 2/25

Arnav will acquired from Aarav =2/3 of 2/5 = 4/15

Remaining share of Aadi = 1/4 – 2/25 = (25 – 8)/100 = 17/100

New share of old partner after admission of a new partner

Admission of a Partner : Example 22

Aadi and Aarav are partners sharing profits and losses in the ratio of 1/2 and 1/2 respectively. Arnav is admitted into partnership for 2/5 share in the profits of the firm which he will acquire 1/5 from Aadi and 2/3 from Aarav. Calculate the remaining share of Aarav.

Explanation:-

Arnav admitted into partnership for = 2/5 share in profits

Arnav will acquire from Aadi = 1/5 of 2/5 = 2/25

Arnav will acquire from Aarav = 2/3 of 2/5 = 4/15

Remaining share of Aarav = 1/2 – 4/15 = (15 – 8)/30 = 7/30

New share of old partner after surrender of shares

Admission of a Partner : Example 23

A and B are partners sharing profits and losses in the ratio of 5/8 and 3/8 respectively. C is admitted into partnership. A surrenders 1/3 of his share and B surrenders 2/5 of his share in favour of C .How much share is surrendered by B .

Explanation:-

Share surrendered by B 2/5 of 3/8 = 6/40

Profit on Revaluation of Assets and Liabilities

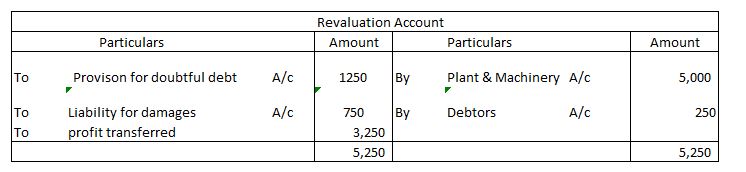

Admission of a Partner : Example 24

A and D are partners sharing profits and losses in the ratio of 3/10 and 7/10 respectively K admitted into partnership for 1/4 share in profits on the terms that Plant & Machinery increased by Rs 5000 , Provison for doubtful debt to be create Rs 1250 , Claim to be create against Liability for damages Rs. 750 , Value of Debtors Increased by 250 . What will be the revaluation profit?

Explanation:-

Sacrificing ratio of existing partner when partner admitted

Admission of a Partner : Example 25

Aadi and Aarav are partners sharing profits and losses in the ratio of 1/4 and 3/4 respectively. Arnav is admitted into partnership for 2/5 share in the profits of the firm which he will acquire 1/5 from Aadi and 2/3 from Aarav. Calculate the share sacrificed by Aadi .

Explanation:-

Arnav admitted into partnership for = 2/5 share in profits

Arnav will acquire share from Aadi = 1/5 of 2/5 = 2/25

Sacrificing ratio when partner admitted for profit%

Admission of a Partner : Example 26

ABC and XYZ are partners sharing profits and losses in the ratio of 3 and 2 respectively. A new partner PQR is admitted into partnership for 20 % share in profits.What will be the sacrificing ratio between partners?

Explanation:-

Let total profit of the firm = 1

PQR s share = 20% = 20/100 = 2/10

Remaining profit after admission of PQR = 1 – 2/10

= (10-2)/10

= 8/10

ABC will get 3/5 of 8/10 = 24/50

XYZ will get 2/5 of 8/10 = 16/50

New profit sharing ration between ABC , XYZ and PQR

= 24/50 : 16/50 : 2/10

= (24 : 16 : 1)/50

= 24 : 16 : 10

Sacrificing ratio = Old ratio – New ratio

ABC = 3/5 – 24/50 = (30 – 24)/50

= 6/50

XYZ = 2/5 – 16/50 = (20 – 16)/50

= 4/50

Sacrificing ratio = 6 : 4

Sacrificing share-entire share acquired from old partner

Admission of a Partner : Example 27

Aksh and Naksh are partners sharing profits and losses in the ratio of 7/9 and 2/9 respectively. Daksh is admitted into partnership for 1/2 share in the profits of the firm which he acquired entirely from Aksh .Calculate the new share of Aksh .

Explanation:-

Daksh admitted into partnership for 1/2 share in profits

Daksh will acquire entirely from Aksh = 1/2

Aksh s new share = 7/9 – 1/2 = (14 – 9)/18

= 5/18

Treatment of Reserves and accumulated Profits or Losses

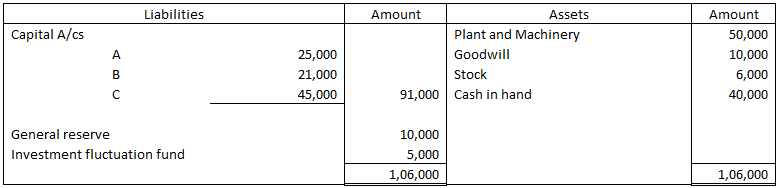

Admission of a Partner : Example 28

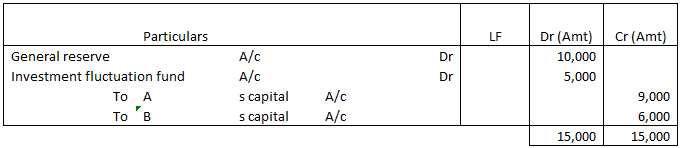

A and B are partners sharing profits in the ratio of 3/5 and 2/5 respectively.They admitted C as a new partner for 1/3 share in the profits of the firm. Following is the Balance sheet of the old firm.What will be the journal entry to record the treatment of General reserve and Investment fluctuation fund after admission of C ?

Explanation:-

Theory Question

Admission of a Partner : Example 29

How Sacrificing ratio is calculated ?

Explanation:-

Sacrificing ratio is the ratio in which old partners sacrifice their share of profit in favour of the new partner this is calculated by taking difference between old profit sharing ratio and new profit sharing ratio.

Chapter 3 Reconstitution of a Partnership Firm – Admission of a Partner