Admission of a Partner Class 12 MCQ with Answer are covered in this Article. Admission of a Partner MCQ Test contains 33 questions. Answers to MCQ on Admission of a Partner Class 12 Accountancy are available at the end of the last question. These MCQ have been made for Class 12 students to help check the concept you have learnt from detailed classroom sessions and application of your knowledge.

Admission of a Partner Class 12 MCQ

1.How Sacrificing ratio is calculated ?

(a) New ratio – Old ratio

(b) Old ratio – New ratio

(c) New ratio – gaining ratio

(d) None of the above

Answer

Answer: (b) Old ratio – New ratio

Explanation: Sacrificing ratio is the ratio in which old partners sacrifice their share of profit in favour of the new partner, this is calculated by taking the difference between old profit sharing ratio and new profit sharing ratio.

2.Reasons for preparing Revaluation Account are:

(a) An incoming partner will not like to suffer any loss relating to the period prior to his admission.

(b) Old partners will not like to share the gain relating to the period prior to his admission.

(c) Both (a) and( b)

(d) None of the above

Answer

Answer: (c) Both (a) and( b)

Explanation: At the time of admission of a new partner, assets and liabilities are required to be reassessed so that profit/loss on such revaluation upto the date of admission may be ascertained and adjusted to the capital accounts of old partners in their old profit sharing ratio because it belongs to old partners.

3.When revaluation account is prepared, at what figures the assets and liabilities appear in the books of reconstituted firm?

(a) At their original values

(b) At their revised (Revalued) values

(c) Both (a) and (b)

(d) None of the above

Answer

Answer: (b) At their revised (Revalued) values

Explanation: Assets and liabilities shown at revised value in the books of reconstituted firm so that any profit/ loss prior to the admission of new partner adjusted to the capital accounts of old partners

4.The value of Plant and machinery increased by 20% revaluation account will be :

(a) Credited

(b) Debited

(c) Both (a) and (b)

(d) None of the above

Answer

Answer: (a) Credited

Explanation: Nature of revaluation account is nominal account when value of Plant and machinery will increase it will be credited into revaluation account.

5.Journal entry during admission of a partner for unrecorded Investment in the books of the firm will be :

(a) Investment A/c Dr

To Revaluation A/c

(b) Revaluation A/c Dr

To Investment A/c

(c) Investment A/c Dr

To Profit and loss adjustment A/c

(d) Both (a) and (c)

Answer

Answer: (d) Both (a) and (c)

Explanation: Revaluation account and profit and loss adjustment account are same account and credited for any unrecorded asset.

6.Journal entry during admission of a partner for unrecorded libilities towards Suppliers in the books of the firm will be

(a) Suppliers A/c Dr

To Revaluation A/c

(b) Revaluation A/c Dr

To Suppliers A/c

(c) Suppliers A/c Dr

To Profit and loss adjustment A/c

(d) Both (a) and (b)

Answer

Answer: (b) Revaluation A/c Dr

To Suppliers A/c

Explanation: Revaluation account is debited when there is any unrecorded liability during the time of admission of a partner because the nature of revaluation account is nominal account.

7.In which ratio Reserve fund, General reserve, Undistributed profit will be distributed to old partners’ capital account?

(a) New profit sharing ratio

(b) Sacrificing ratio

(c) Old ratio

(d) None of the above

Answer

Answer: (c) Old ratio

8.Dinu and Sinu are partners sharing profits and losses in the ratio of 3/4 and1/4 respectively. Rinu is admitted into partnership for 1/3 share in the profits of the firm which he will acquire 2/3 from Dinu and 1/4 from Sinu. What will be the new profit sharing ratio between partners?

(a) 19 : 6 : 12

(b) 2 : 1 : 2

(c) 1 : 1 : 1

(d) None of the above

Answer

Answer: (a) 19 : 6 : 12

Explanation: Rinu admitted into partnership for = (1/3) share in profits

Rinu will acquire from Dinu = (2/3) of (1/3) = (2/9)

Rinu will acquire from Sinu = (1/4) of (1/3) = (1/12)

Remaining share of Dinu = (3/4) -(2/9) = (2/7)−(8/36) = (19/36)

Remaining share of Sinu = (1/4) -(1/12) = (3−1)/12 = 2/12

New profit sharing ratio between Dinu , Sinu and Rinu

= (19/36) :(2/12): (1/3)

= (19:6:12)/36

= 19 : 6 : 12

Admission of a Partner Class 12 MCQ

9.Anuj and Akash are partners sharing profits and losses in the ratio of 2/7 and 5/7 respectively. Anmol is admitted into partnership for 2/5 share in the profits of the firm which he will acquire 1/2 from Anuj and 1/3 from Akash. Calculate the share sacrificed by Anuj .

(a) 2/5

(b) 2/10

(c) 1/2

(d) None of the above

Answer

Answer: (b) 2/10

Explanation: Anmol admitted into partnership for = 25 share in profits

Anmol will acquire share from Anuj = (1/2) of (2/5) = 2/10

10.Akash and Gagan are partners sharing profits and losses in the ratio of 2/3 and 1/3 respectively. Aman is admitted into partnership. Akash surrenders 5/3 of his share and Gagan surrenders 3/5 of his share in favour of Aman. How much share is surrendered by Akash?

(a) 10/9

(b) 5/3

(c) 2/3

(d) None of the above

Answer

Answer: (a) 10/9

Explanation: Share surrendered by Akash (5/3) of (2/3) = 10/9

11.Himash and Akash are partners sharing profits and losses in the ratio of 5/6 and 1/6 respectively. Vedansh is admitted into partnership for 2/3 share in the profits of the firm which he acquired entirely from Akash. Calculate the share sacrificed by Akash?

(a) 3/6

(b) 1/6

(c) 2/3

(d) None of the above

Answer

Answer: (c) 2/3

Explanation: Vedansh admitted into partnership for 2/3 share in profits

Vedansh will acquire entirely from Akash = 2/3

12.Di and Pi are partners sharing profits and losses in the ratio of 1/4 and 3/4 respectively. Ni admitted into partnership for 20% share in profits. What will be the new profit sharing ratio between partners?

(a) 3 : 8 : 24

(b) 8 : 24 : 8

(c) 1 : 3 : 10

(d) None of the above

Answer

Answer: (b) 8 : 24 : 8

Explanation: Let total profit of the firm = 1

Ni s share = 20% = 20/100 =2/10

Remaining profit after admission of Ni = 1 – (2/10)

= (10−2)/10

= 8/10

Di will get 1 of 8/10 =8/40

Pi will get 3 of 8/10 =24/40

New profit sharing ratio between Di , Pi and Ni

= (8/40) :(24/40) : (2/10)

= 8 : 24 : 8

13.Red and Blue are partners sharing profits and losses in the ratio of 2 and 5 respectively. A new partner Green is admitted into partnership for 10% share in profits. What will be the sacrificing ratio between partners?

(a) 2 : 5

(b) 5 : 9

(c) 2 : 9

(d) None of the above

Answer

Answer: (a) 2 : 5

Explanation: Let total profit of the firm = 1

Green s share = 10% = 10/100 =1/10

Remaining profit after admission of Green = 1 – (1/10)

= (10−1)/10

= 9/10

Red will get (2/7) of (9/10)=18/70

Blue will get (5/7) of (9/10) = 45/70

New profit sharing ration between Red , Blue and Green

= (18/70) :(45/70):(1/10)

= 18:45:(7/700)

= 18 : 45 : 7

Sacrificing ratio = Old ratio – New ratio

Red = (2/7) -(18/70) = (20−18)/70

= 2/70

Blue = (5/7) -(45/70) = (50−45)/70

= 5/70

Sacrificing ratio = 2 : 5

14.Sun and Moon are partners sharing profits and losses in the ratio of 3/8 and 5/8 respectively. Star is admitted into partnership for 2/3 share in the profits of the firm which he will acquire 12 from Sun and 1/3 from Moon. Calculate the remaining share of Sun.

(a) 2/6

(b) 1/24

(c) 1/2

(d) None of the above

Answer

Answer: (b) 1/24

Explanation: Star admitted into partnership for = 2/3 share in profits

Star will acquire from Sun = (1/2) of (2/3) = 2/6

Star will acquire from Moon = (1/3) of (2/3) = 2/9

Remaining share of Sun = (3/8) -(2/6) = (9−8)/24 =1/24

15.Anuj and Akash are partners sharing profits and losses in the ratio of 1/3 and 2/3 respectively. Anmol is admitted into partnership for 2/5 share in the profits of the firm which he will acquire 1/2 from Anuj and 1/3 from Akash. Calculate the remaining share of Akash .

(a) 2/10

(b) 1/2

(c) 8/15

(d) None of the above

Answer

Answer: (c) 8/15

Explanation: Anmol admitted into partnership for = (2/5) share in profits

Anmol will acquire from Anuj = (1/2) of (2/5) = 2/10

Anmol will acquire from Akash = (1/3) of (2/5) = 2/15

Remaining share of Akash = (2/3) – (2/15) = (10−2)/15 = 8/15

16.Good and Better are partners sharing profits and losses in the ratio of 1/4 and 3/4 respectively. Best is admitted into partnership. Good Surrenders 3/2 of his share and Better Surrenders 1/2 of his share in favour of Best. What will be Best’s share of profit?

(a) 4/2

(b) 6/8

(c) 4/4

(d) None of the above

Answer

Answer: (b) 6/8

Explanation: Share surrendered by Good (3/2) of(1/4) = 3/8

Share surrendered by Better (1/2) of (3/4) = 3/8

now Best’s share in profit of the firm = (3/8) +(3/8)

= (3+3)/8

= 6/8

Admission of a Partner Class 12 MCQ

17.Anu and Manu are partners sharing profits and losses in the ratio of 5/7 and 2/7 respectively. Ranu is admitted into partnership for 1/6 share in the profits of the firm which he acquired entirely from Anu. Calculate the new share of Anu .

(a) 1/6

(b) 23/42

(c) 5/42

(d) None of the above

Answer

Answer: (b) 23/42

Explanation: Ranu admitted into partnership for (1/6) share in profits

Ranu will acquire entirely from Anu = 1/6

Anu’s new share = (5/7) -(1/6)= (30−7)/42

= 23/42

18.Hira and Hemant are partners sharing profits and losses in the ratio of 3/5 and 2/5 respectively. Harsh is admitted into partnership for 1/2 share in the profits of the firm which he acquired entirely from Hemant. What will be the new profit sharing ratio between Hira & Hemant ?

(a) 3 : 1

(b) 6 : 1

(c) 1 : 3

Answer

Answer: (b) 6 : 1

Explanation: Harsh is admitted into partnership for (1/2) share in profits

Harsh will acquire share from Hemant = 1/2

Hemant’s new share = (3/5) -(1/2)= (6−5)/10

= 1/10

New profit sharing ratio between Hira & Hemant = (3/5) :(1/10)

= (6:1)/10

= 6 : 1

19.P and Q are partners sharing profits and losses in the ratio of 3/4 and 1/4respectively. R is admitted into partnership for 1/3. For expanding the business and to meet the requirement of additional capital S is admitted as a new partner for 1/7 share in profits which he acquired from P and Q in 5 : 3 .What will be the new share of profit of P after admission of R?

(a) 2/3

(b) 3/4

(c) 6/12

(d) None of the above

Answer

Answer: (c) 6/12

Explanation: Let total profit of the firm = 1

Remaining profit after admission of R = 1 – (1/3)

= (3−1)/3

= 2/3

P will get (3/4) of (2/3) = 6/12

Q will get (1/4) of (2/3) = 2/12

20.Ram and Mohan are partners sharing profits and losses in the ratio of 2/3 and 1/3 respectively. Sharan is admitted into partnership for 1/3. For expanding the business and to meet the requirement of additional capital Gautam is admitted as a new partner for 1/2 share in profits which he acquired from Ram and Mohan in 3 : 2. What will be the new share of profit of Mohan after admission of Gautam?

(a) 2/3

(b) 2/90

(c) 2/30

(d) None of the above

Answer

Answer: (b) 2/90

Explanation: Let total profit of the firm = 1

Remaining profit after admission of Sharan = 1 – (1/3)

= (3−1)/3

= 2/3

Ram will get (2/3) of (2/3) = 4/9

Mohan will get (1/3) of (2/3) = 2/9

Gautam will acquire from Mohan = (1/2) X (2/5) = 2/10

Mohan s new share = (2/9) -(2/10) = (20−18)/90

= 2/90

21.Hemu and Ramu are partners sharing profits and losses in the ratio of 7/10 and 3/10 respectively Raju admitted into partnership for 4/5th share in the profits of the firm. He brought Rs 20000 for goodwill. What will be the journal entry for distribution of goodwill among old partners?

(a) Premium for goodwill A/c Dr 20000

To Hemu s capital A/c 14000

To Ramu s capital A/c 6000

(b) Ramu s capital A/c Dr 14000

Hemu s capital A/c Dr 6000

To Premium for goodwill A/c 20000

(c) Premium for goodwill A/c Dr 20000

To Hemu s capital A/c 6000

To Ramu s capital A/c 14000

(d) None of the above

Answer

Answer: (a) Premium for goodwill A/c Dr 20000

To Hemu s capital A/c 14000

To Ramu s capital A/c 6000

Explanation: Old ratio between existing partners is 3 : 2

So, Hemu s share of goodwill = 20000 X (7/10) = 14000

Ramu s share of goodwill = 20000 X (3/10) = 6000

Premium for goodwill A/c Dr 20000

To Hemu s capital A/c 14000

To Ramu s capital A/c 6000

22.Chirag and Chaman are partners sharing profits and losses in the ratio of 4/7 and 3/7 respectively. Suman is admitted into partnership and it was decided that new profit sharing ratio among Chirag , Chaman and Suman will be 4: 3: 2. Suman brought 1800000 as his capital and old partners capital will be valued on the basis of Suman s capital. What will be the capital all partners?

(a) 2900000 , 3400000 , 1800000

(b) 1800000 , 2700000 , 1800000

(c) 3600000 , 2700000 , 1800000

(d) None of the above

Answer

Answer: (c) 3600000 , 2700000 , 1800000

Explanation: Total capital of the firm = Capital brought by Suman X Reciprocal of proportion of share of Suman

= 1800000 X (9/2)

= 8100000

Chirag s new capital = 8100000 X (4/9) = 3600000

Chaman s new capital = 8100000 X (3/9) = 2700000

23.Shree and Sai are partners Sameer is admitted into partnership and it was decided that new profit sharing ratio between Shree , Sai and Sameer will be 1/4 , 2/4 and 1/4 respectively. The total capital of the firm is fixed at Rs. 800000 what will be the capital among Shree , Sai and Sameer ?

(a) 400000 , 200000 , 200000

(b) 180000 , 380000 , 390000

(c) 200000 , 400000 , 200000

(d) None of the above

Answer

Answer: (c) 200000 , 400000 , 200000

Explanation: Capital of partners = Total capital of the firm X New profit sharing ratio of partner

Shree s capital = 800000 X (1/4) = 200000

Sai s capital = 800000 X (2/4) = 400000

Sameer s capital = 800000 X (1/4) = 200000

24.P and Q are partners sharing profits and losses in the ratio of 1/2 and 1/2 respectively. R is admitted into partnership for 2/3 share in profits. The capitals of P and Q before adjustments are Rs. 200000 and Rs. 150000 respectively. Profit on revaluation of assets and liabilities – Rs. 20000, General Reserve – Rs. 15000. Calculate the adjusted capital of P.

(a)210000

(b) 200000

(c) 217500

(d) None of the above

Answer

Answer: (c) 217500

Explanation: Calculation of adjusted capitals of old partners

P s capital before adjustment = 200000

Add: Share in general reserve 15000 X (1/2) = 7500

Add: Profit on revaluation 20000 X (1/2) = 10000

Total = 217500

Admission of a Partner Class 12 MCQ

25.Suri and Puri are partners sharing profits and losses in the ratio of 1/3 and 2/3 respectively. Guri is admitted into partnership for 2/3 share in profits. The capitals of Suri and Puri before adjustments are 150000 and 100000 respectively. Profit on revaluation of assets and liabilities-Rs. 15000, General Reserve-Rs. 9000. What will be the amount of capital to be brought in by Guri ?

(a) 274000

(b) 158000

(c) 411000

(d) None of the above

Answer

Answer: (a) 274000

Explanation: Calculation of adjusted capitals of old partners

Suri s capital before adjustment = 150000

Add share in general reserve 9000 X (1/3) = 3000

Add profit on revaluation 15000 X (1/3) = 5000

Total = 158000

Puri s capital before adjustment = 100000

Add share in general reserve 9000 X (2/3) = 6000

Add profit on revaluation 15000 X (2/3) = 10000

Total = 116000

Calculation of total capital of new firm:

Total share of the firm = 1 , Guri s share = 2/3

Remaining share for Suri and Puri = 1 – (2/3) =2/3

Total capital = Combined adjusted old capital of old partners X Reciprocal of proportion of share of old partners

= 158000 + 116000 X (3/2)

= 274000 X (3/2) = 411000

Capital of Guri = Total capital X Share of Guri in profits

= 411000 X (2/3)

= 274000

26.Earth and Sky are partners sharing profits and losses in the ratio of 2/5 and 3/5 respectively. Star is admitted into partnership for 1/2th share in the profits of the firm. He brought Rs. 8000 for goodwill and Rs. 50000 as capital. What will be the journal entry for recording capital and goodwill brought in by Star ?

(a) Star s capital A/c Dr 50000

Premium for goodwill A/c Dr 8000

To Bank / Cash 58000

(b) Bank / Cash Dr 58000

To Star s capital A/c 58000

(c) Bank / Cash A/c Dr 58000

To Star s capital A/c 50000

To Premium for goodwill A/c 8000

(d) None of the above

Answer

Answer:

(c) Bank / Cash A/c Dr 58000

To Star s capital A/c 50000

To Premium for goodwill A/c 8000

Explanation: Bank / Cash A/c Dr 58000

To Star s capital A/c 50000

To Premium for goodwill A/c 8000

27.Anil and Sunil are partners sharing profits and losses in the ratio of 3/4 and 1/4 respectively. Manish is admitted into partnership for 1/3th share in the profits of the firm. He brought Rs. 18000 for goodwill and Rs. 40000 as capital. What will be the value of total goodwill?

(a) 18000

(b) 54000

(c) 36000

(d) None of the above

Answer

Answer: (b) 54000

Explanation: C s share of profit = 1/3

Goodwill brought in by C = 18000

So, value of total goodwill = 18000 x (3/1)

= 54000

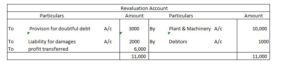

28.G and H are partners sharing profits and losses in the ratio of 3/8 and 5/8 respectively. I is admitted into partnership for 1/4 share in profits on the terms that Plant & Machinery increased by Rs 10000 , Provison for doubtful debt to be create Rs 3000 , Claim to be create against Liability for damages Rs. 2000 , Value of Debtors Increased by 1000. What will be the revaluation profit?

(a) 5000

(b) 4000

(c) 6000

(d) None of the above

Answer

Answer: (c) 6000

Explanation:

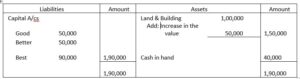

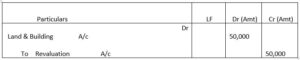

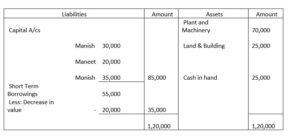

29.Good and Better are partners with profit sharing ratio 1/2 and 1/2 respectively. They admitted Best as a new partner for 2/3 share in the profits of the firm. Following is the Balance sheet of the new firm after admission of Best. What will be the journal entry to record the increase in the value of Land & Building?

(a) Revaluation A/c Dr 50000

To Land & Building A/c 50000

(b) Land & Building A/c Dr 150000

To Profit and loss A/c 150000

(c) Land & Building A/c Dr 50000

To Revaluation A/c 50000

Answer

Answer:

(c) Land & Building A/c Dr 50000

To Revaluation A/c 50000

Explanation:

30.Any and Many are partners with profit sharing ratio 3/5 and 2/5 respectively. They admitted Some as a new partner for 1/3 share in the profits of the firm. following is the Balance sheet of the new firm after admission of Some. What will be the journal entry to record the Decrease in the value of Short Term Borrowings?

(a) Short Term Borrowings A/c Dr 20000

To Revaluation A/c 20000

(b) Revaluation A/c Dr 20000

To Short Term Borrowings A/c 20000

(c) Short Term Borrowings A/c Dr 75000

To Profit and loss A/c 75000

(d) None of the above

Answer

Answer:

(b) Revaluation A/c Dr 20000

To Short Term Borrowings A/c 20000

Explanation:

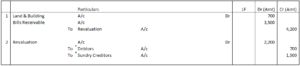

31.Shakti and Shivansh are partners sharing profits in the ratio of 2/7 and 5/7 respectively. They admitted Saadik as a new partner for 1/4 share in the profits of the firm. Following is the Revaluation account prepared after the admission of Saadik . What will be the entries in the books of the firm regarding revaluation of assets and liabilities.

(a) Land & Building A/c Dr 700

Bills Receivable A/c Dr 3500

Debtors A/c Dr 700

Sundry Creditors A/c Dr 1500

To Revaluation A/c 6400

(b) Revaluation A/c Dr 4200

To Land & Building A/c 700

To Bills Receivable A/c 3500

Debtors A/c Dr 700

Sundry Creditors A/c Dr 1500

To Revaluation A/c 2200

(c) Land & Building A/c Dr 700

Bills Receivable A/c Dr 3500

To Revaluation A/c 4200

Revaluation A/c Dr 2200

To Debtors A/c 700

To Sundry Creditors A/c 1500

(d) None of the above

Answer

Answer:

(c) Land & Building A/c Dr 700

Bills Receivable A/c Dr 3500

To Revaluation A/c 4200

Revaluation A/c Dr 2200

To Debtors A/c 700

To Sundry Creditors A/c 1500

Explanation:

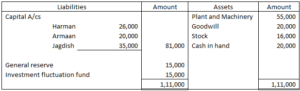

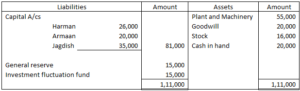

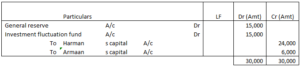

32.Harman and Armaan are partners sharing profits in the ratio of 4/5 and 1/5 respectively. They admitted Jagdish as a new partner for 1/4 share in the profits of the firm. Following is the Balance sheet of the old firm. What will be the journal entry to record the treatment of General reserve and Investment fluctuation fund after admission of Jagdish ?

(a) General reserve A/c Dr 15000

Investment fluctuation fund A/c Dr 15000

To Harman’s capital A/c 24000

To Armaan’s capital A/c 6000

(b) Harman’s capital A/c Dr 24000

Armaan’s capital A/c Dr 6000

To General reserve A/c 15000

To Investment fluctuation fund A/c 15000

(c) General reserve A/c Dr 15000

Investment fluctuation fund A/c Dr 15000

To Harman’s capital A/c 15000

To Armaan’s capital A/c 15000

(d) None of the above

Answer

Answer:

(a) General reserve A/c Dr 15000

Investment fluctuation fund A/c Dr 15000

To Harman’s capital A/c 24000

To Armaan’s capital A/c 6000

Explanation:

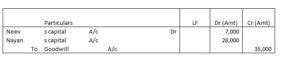

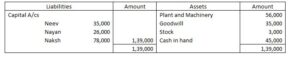

33.Neev and Nayan are partners sharing profits in the ratio of 1/5 and 4/5 respectively. They admitted Naksh as a new partner for 1/6 share in the profits of the firm. Following is the Balance sheet of the old firm. What will be the journal entry to record the treatment of goodwill after admission of Naksh ?

(a) Goodwill A/c Dr 35000

To Neev’s capital A/c 7000

To Nayan’s capital A/c 28000

(b) Neev’s capital A/c Dr 7000

Nayan’s capital A/c Dr 28000

To Goodwill A/c 35000

(c) Neev’s capital A/c Dr 17500

Nayan’s capital A/c Dr 17500

To Goodwill A/c 35000

(d) None of the above

Answer

Answer:

(b) Neev’s capital A/c Dr 7000

Nayan’s capital A/c Dr 28000

To Goodwill A/c 35000

Explanation: