Cash Flow from Operating Activities

Cash flow from operating activities indicates the amount of money a company brings in from regular business activities, such as manufacturing and selling goods or providing a service. It does not include long-term capital, borrowing cost, or investment costs.

Cash Flow From Operating Activities Example

- Cash received from Debtors and Bills Receivables

- Payment made to Creditors and Bills Payable

- Cash receipts from the sale of goods and rendering of services

- Cash payments for the purchase of goods and services

- Payments made or refunds of income tax

- Wages, salaries, and other payments to employees

- Receipts in cash from royalties, fees, commission, and other revenue

Cash flow from operating activities example 1:

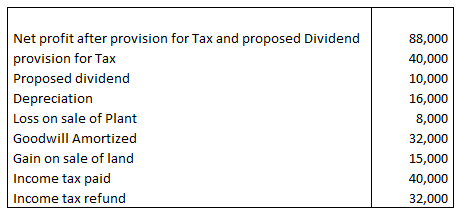

Calculate cash flow from operating activities from the following information.

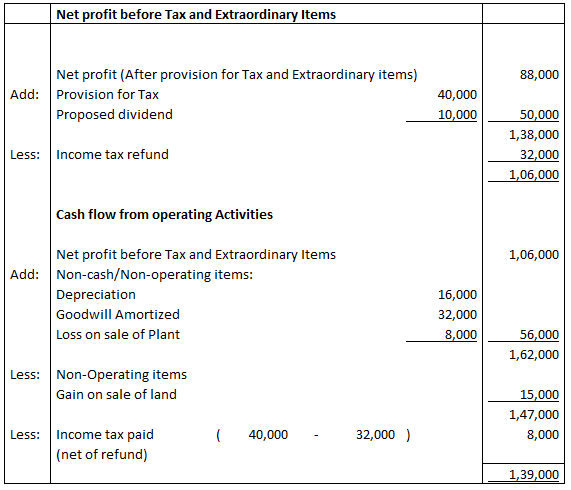

Explanation: –

Cash flow from operating activities example 2:

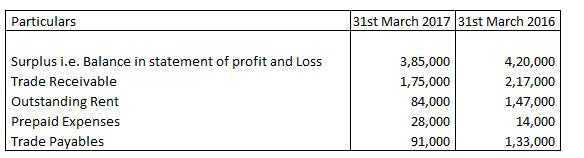

Cash flow from operating activities from the following information will be:

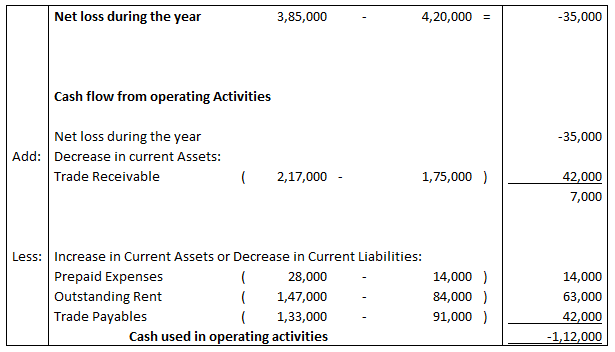

Explanation: –

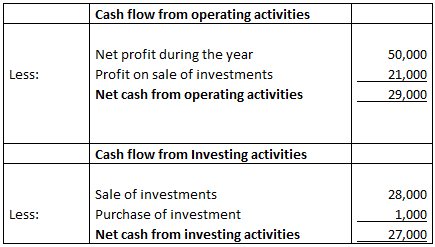

Cash flow from operating activities example 3:

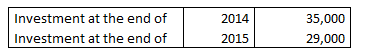

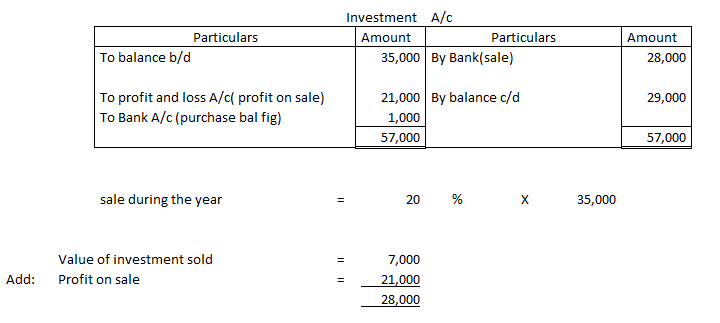

AB Ltd had the following balances:

During the year, the company had sold 20 % of its investment at a profit of Rs 21,000. Calculate cash flow from operating activities and cash flow from investing activity if the company earned a profit of Rs 50,000 during the year.

Explanation: –

Chapter 6 – Cash Flow Statement

- Objectives and Benefits of Cash Flow Statement

- Cash, Cash Equivalents and Cash flows

- Ascertaining Cash Flow from Operating Activities

- Ascertainment of Cash Flow from Investing

- Cash Flow and Financing Activities

- Preparation of Cash Flow Statement