Cash Flow Statement Class 12 MCQ with Answer are covered in this chapter. Cash Flow Statement Class 12 MCQs Test contains 20 questions. Answers to MCQs on Cash Flow Statement Class 12 Accountancy are available at the end of the last question.

Cash Flow Statement Class 12 MCQ with Answer – Calculation of net profit before tax and extraordinary items – Question 1 –

Following is the extract from the Balance sheets of Insta LTD

| Liabilities | 31st March 2017 | 31st March 2016 |

| Surplus i.e, Balance in Statement of Profit and Loss | 230000 | 190000 |

| Proposed Dividend | 60000 | 40000 |

| Dividend Payable | 9000 | – |

Net profit before Tax and Extraordinary items will be:

a) 1,90,000

b) 40,000

c) 1,00,000

d) None of the above

Cash Flow Statement Class 12 MCQ with Answer – Calculation of net profit before tax and extraordinary items – Question 2 –

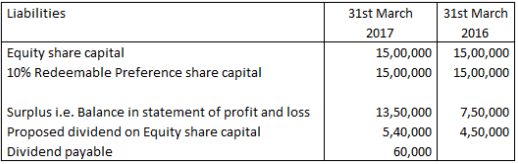

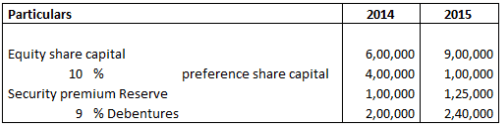

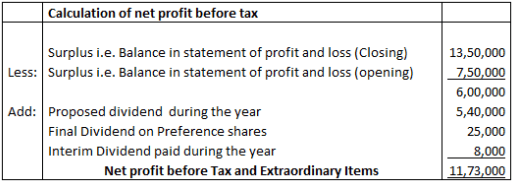

Following is the extract from the Balance sheets of Atul Ltd

Additional Information: Final dividend on preference share of Rs 25,000 and Interim dividend of Rs 8000 on Equity share was paid on 31st march 2017. Net profit before Tax and Extraordinary items will be:

a) 7,50,000

b) 11,73,000

c) 6,00,000

d) None of the above

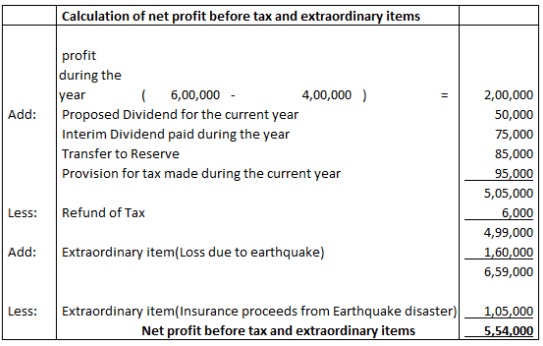

Cash Flow Statement Class 12 MCQ with Answer – Calculation of net profit before tax and extraordinary items – Question 3 –

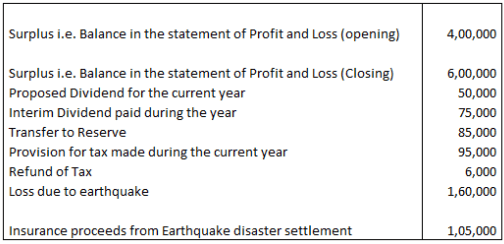

Following is the information available from the records of HP LTD

Net profit before Tax and Extraordinary Items will be:

a) 5,54,000

b) 4,99,000

c) 6,59,000

d) None of the above

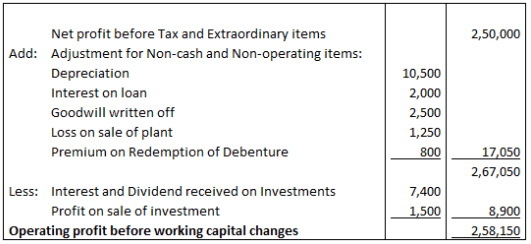

Cash Flow Statement Class 12 MCQ with Answer – Calculation of Operating profit before working capital changes – Question 4 –

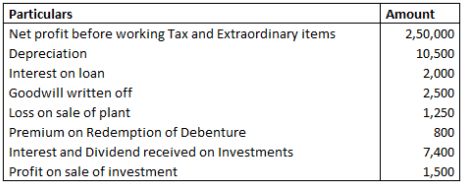

From the following information, Calculate operating profit before working capital changes

a) 2,58,150

b) 2,67,050

c) 2,50,000

d) None of the above

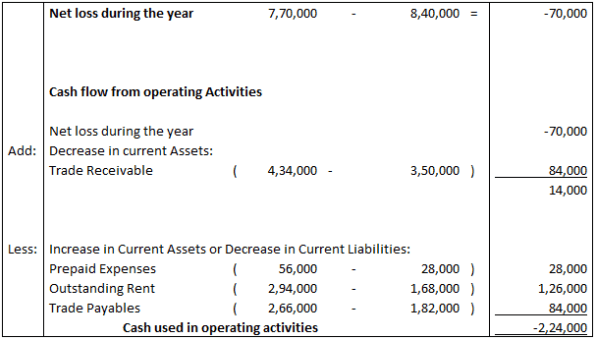

Cash Flow Statement Class 12 MCQ with Answer – Calculation of cash flow from operating activities – Question 5 –

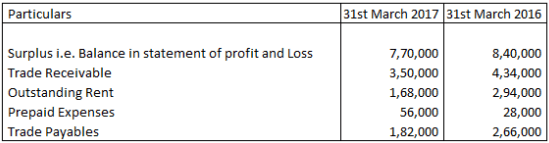

What is the Cash flow from operating activities from the following information ?

a) 14,000

b) -70,000

c) -2,24,000

d) None of the above

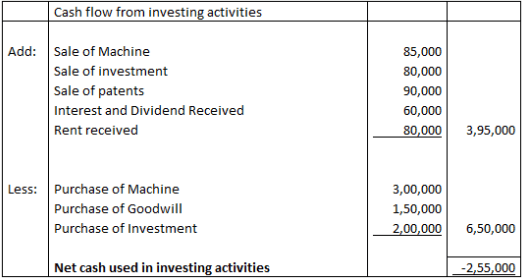

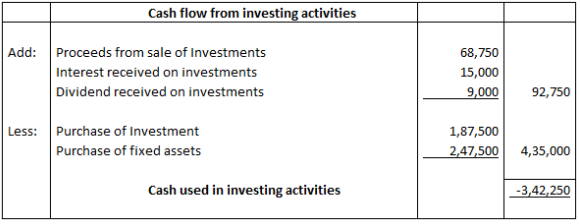

Cash Flow Statement Class 12 MCQ with Answer – Calculation of cash flow from Investing activities – Question 6 –

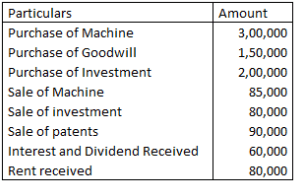

Calculate Cash flow from investing activities from the following information:

a) -2,55,000

b) 6,50,000

c) 3,95,000

d) None of the above

Cash Flow Statement Class 12 MCQ with Answer – Calculation of cash flow from Investing activities – Question 7 –

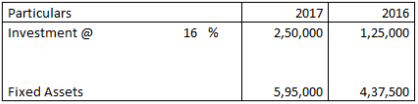

Following is the information available from M Ltd

Additional information:

1. Half of the investment held in the beginning of the year was sold at a profit of 10 %.

2. Depreciation on fixed Assets was Rs 90,000 for the year

3. Interest received on investment was Rs 15,000

4 . Dividend received on investment Rs 9000

What is the Cash Flow from Investing activities?

a) 4,35,000

b) -3,42,250

c) -3,27,250

d) None of the above

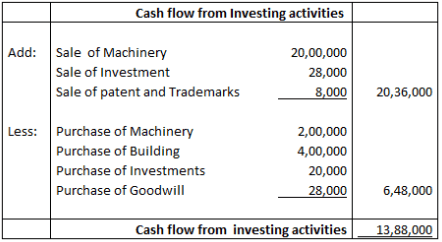

Cash Flow Statement Class 12 MCQ with Answer – Calculation of cash flow from Investing activities – Question 8 –

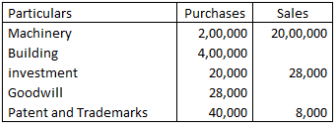

Following is the information available from the books of Amit Ltd:

Calculate Cash Flow from investing activities:

a) 20,36,000

b) 6,48,000

c) 7,40,000

d) 13,88,000

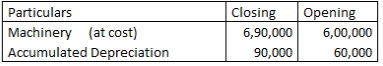

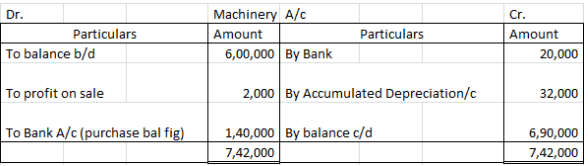

Cash Flow Statement Class 12 MCQ with Answer – Determination of Asset purchased during the year – Question 9 –

From the following information what will be the amount of assets purchased during the year?

Additional information: During the year a machine costing Rs 50,000 accumulated depreciation Rs 32,000 was sold for Rs 20,000.

a) 1,40,000

b) 1,20,000

c) 1,55,000

d) None of the above

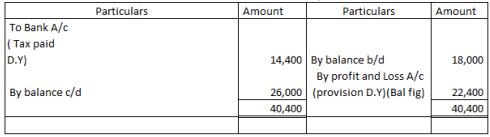

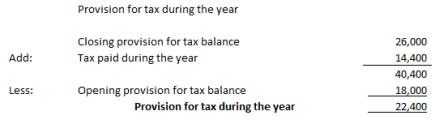

Cash Flow Statement Class 12 MCQ with Answer – Calculation of provision for tax made during the year – Question 10 –

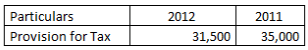

Following is the information relating to EXON Ltd.

![]()

If tax paid during the year is 14,400, what is the provision for tax during the year?

a) 21,500

b) 21,400

c) 22,400

d) None of the above

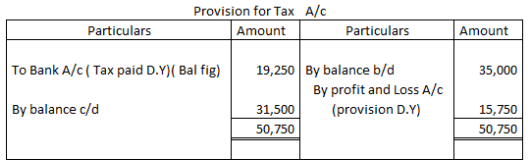

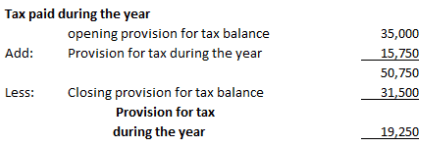

Cash Flow Statement Class 12 MCQ with Answer – Calculation of tax paid during the year – Question 11 –

Following is the information relating to B Ltd

If provision for tax made during the year is 15,750, calculate tax paid during the year.

a) 16,850

b) 18,450

c) 37,700

d) 19,250

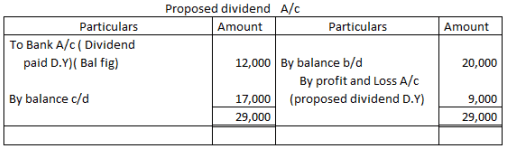

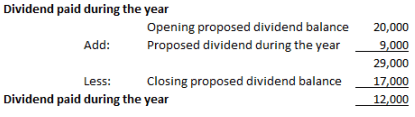

Cash Flow Statement Class 12 MCQ with Answer – Calculation of proposed dividend paid during the year – Question 12 –

Following is the information relating to LP Ltd

| Particulars | 2016 | 2015 |

| Proposed Dividend | 17000 | 20000 |

If proposed dividend during the year is 9000, dividend paid during the year is:

a) 10,000

b) 1400

c) 10,600

d) 12,000

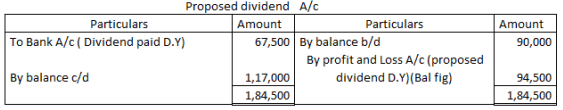

Cash Flow Statement Class 12 MCQ with Answer – Calculation of proposed dividend made during the year – Question 13 –

Following is the information relating to Joy Ltd.

| Particulars | 2017 | 2016 |

| Proposed Dividend | 117000 | 90000 |

If Dividend paid during the year is 67,500, Proposed dividend during the year is:

a) 90,900

b) 93,300

c) 94,500

d) None of the above

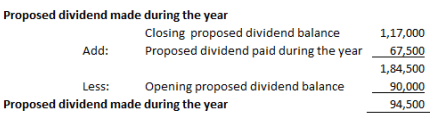

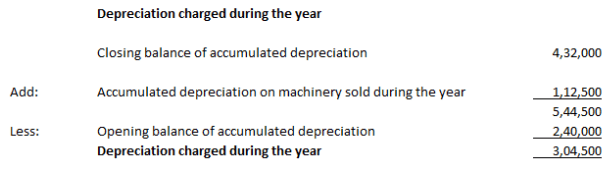

Cash Flow Statement Class 12 MCQ with Answer – Calculation of depreciation on asset during the year when accumulated depreciation balance is given – Question 14 –

Following is the information relating to Anju Ltd

| Particulars | 2011 | 2012 |

| Accumulated Depreciation on Machinery | 240000 | 432000 |

During the year a Machine sold for Rs 75,000, on which Accumulated depreciation was Rs 1,12,500. Depreciation charged on machinery during the year is:

a) 3,02,100

b) 3,03,700

c) 3,04,500

d) None of the above

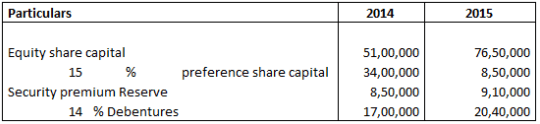

Calculation of amount paid to preference shareholder-When Preference shares are redeem on premium – Question 15 –

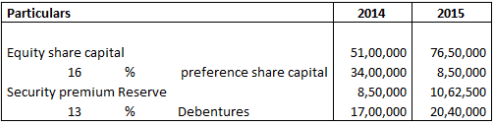

Following particulars are provided by JK Ltd .

Additional information:

1) Preference dividend on preference shares and an interim dividend on equity shares @ 15 % were paid on 30th September 2014 .

2) Preference shares were redeemed on 31st March 2015 at a premium of 18 %.Such premium has been provided out of profits. New shares and debentures were issued on 1st October 2014.

What will be the total amount paid to preference shareholders?

a) 35,25,000

b) 35,19,000

c) 35,22,000

d) None of the above

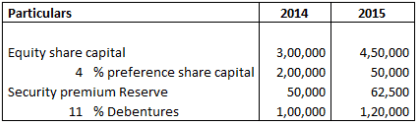

Cash Flow Statement Class 12 MCQ with Answer – Total amount received from issue of equity shares – Question 16 –

Following particulars are provided by Ankit Ltd .

Additional information:

a) Preference dividend on preference shares and an interim dividend on equity shares @ 10 % were paid on 30th September 2014 .

b )Preference shares were redeemed on 31st March 2015 at a premium of 3 %. Such a premium has been provided out of profits. New shares and debentures issued on 1st October 2014.

What is the total money received from the issue of equity shares?

a) 78,500

b) 1,14,500

c) 1,32,500

d) None of the above

Cash Flow Statement Class 12 MCQ with Answer – Calculation of interest paid to debenture holders when new debentures are issued in the middle of the year – Question 17 –

From the following particulars provided by Better Ltd. calculate interest paid on debenture during the year.

Additional information:

a) Preference dividend on preference shares and an interim dividend on equity shares @ 15 % were paid on 30th September 2014 .

b) Preference shares were redeemed on 31st March 2015 at a premium of 8 %.Such premium has been provided out of profits. New shares and debentures issued on 1st October 2014.

a) 58,800

b) 50,300

c) 55,800

d) 52,800

Cash Flow Statement Class 12 MCQ with Answer – Calculation of total dividend paid during the year on preference shares – Question 18 –

Following particulars are provided by Asha Ltd. Calculate dividend paid on preference shares.

Additional information:

a) Preference dividend on preference shares and an interim dividend on equity shares @ 10 % were paid on 30th September 2014 .

b) Preference shares were redeemed on 31st March 2015 at a premium of 2 %.Such premium has been provided out of profits. New shares and debentures issued on 1st October 2014.

a) 40,000

b) 46,000

c) 43,000

d) None of the above

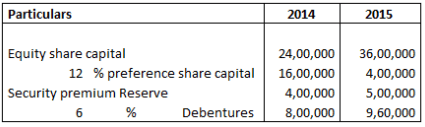

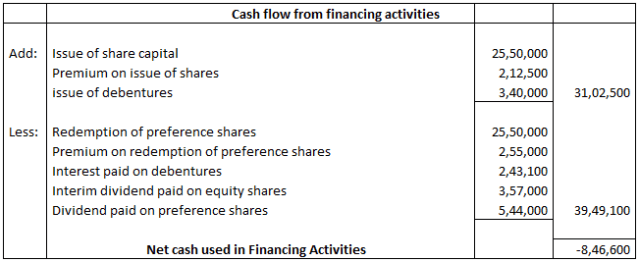

Cash Flow Statement Class 12 MCQ with Answer – Cash flow from financing activities – Question 19 –

From the following particulars provided by Anil Ltd, calculate Net cash flow from financing activities.

Additional information:

a Preference dividend on preference shares and an interim dividend on equity shares @ 7 % were paid on 30th September 2014 .

b Preference shares were redeemed on 31st March 2015 at a premium of 10 %.Such premium has been provided out of profits. New shares and debentures issued on 1st October 2014.

a) -8,46,600

b) -8,40,600

c) -8,43,600

d) None of the above

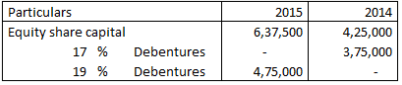

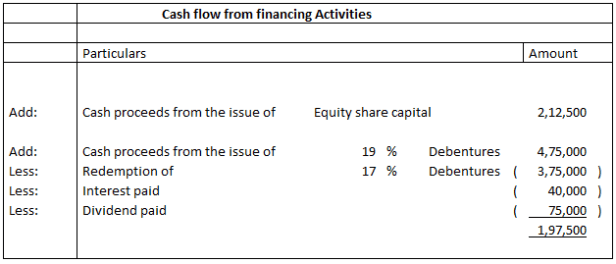

Cash Flow Statement Class 12 MCQ – Calculation of cash flow from financing activities – Question 20 –

Best Ltd provides the following information. Calculate Cash flow from financing activities.

Additional information:

1) Interest paid on debentures Rs 40,000 .

2) Dividend paid Rs 75,000 .

a) 1,97,000

b) 1,97,500

c) 1,96,000

d) None of the above

Cash Flow Statement Class 12 MCQ – Correct Answers with Explanation

Cash Flow Statement Class 12 MCQ with Answer – Explanation 1:-

| Net Profit before Tax | ||

| Surplus i.e, Balance in statement of Profit and Loss (Closing) | 230000 | |

| Less: | Surplus i.e, Balance in statement of Profit and Loss (Opening) | 190000 |

| 40000 | ||

| Add: | Proposed dividend during the year | 60000 |

| Net Profit before Tax and Extraordinary items | 100000 |

Correct Answers : [C]

Explanation 2:-

Correct Answer: [B]

Explanation 3:-

Correct Answer : [A]

Explanation 4:-

Correct Answer : [A]

Explanation 5:-

Correct Answer: [C]

Cash Flow Statement Class 12 MCQ with Answer – Explanation 6:-

Correct Answer: [A]

Explanation 7:-

Investment A/c

| Particulars | Amount | Particulars | Amount |

| To balance b/d | 125000 | By Bank | 68750 |

| To profit on sale | 6250 | By Bank c/d | 250000 |

| To Bank A/c (Purchase bal fig) | 187500 | ||

| 318750 | 318750 |

Fixed Assets A/c

| Particulars | Amount | Particulars | Amount |

| To balance b/d | 437500 | By Depreciation A/c | 90000 |

| To Bank A/c (Purchase bal fig) | 247500 | By Balance c/d | 595000 |

| 685000 | 685000 |

Sale of Investment = 1/2 of 125000

= 62500

Add : Profit = 6250 (62500 x 10/100)

Sale Value = 68750

Correct Answer: [B]

Explanation 8:-

Correct Answer: [D]

Explanation 9:-

Correct Answer: [A]

Explanation 10:-

Provision for Tax A/c

OR

Correct Answer: [C]

Cash Flow Statement Class 12 MCQ – Explanation 11:-

“OR”

Correct Answer: [D]

Explanation 12:-

“OR”

Correct Answer: [D]

Explanation 13:-

“OR”

Correct Answer: [C]

Explanation 14:-

“OR”

Correct Answer: [C]

Cash Flow Statement Class 12 MCQ with Answer – Explanation 15:-

Redemption of preference shares = Opening balance of preference shares (-) Closing balance of preference shares

= 34,00,000 (-) 8,50,000

= 25,50,000

Premium on redemption of preference shares = 25,50,000 X (18/100) = 4,59,000

Preference dividend = 34,00,000 x 15%

= 5,10,000

Total amount paid = 25,50,000 + 4,59,000 + 5,10,000

= 35,19,000

Correct Answer: [B]

Explanation 16:-

Issue of share capital = Closing balance of share capital (-) Opening balance of share capital

Equity share capital = 4,50,000 (-) 3,00,000

= 1,50,000

Premium on issue of shares = Closing balance of security premium (-) opening balance of security premium

= 62,500 (-) 50,000

= 12,500

Interim dividend paid = 3,00,000 x 10 %

= 30,000

Total amount received from issue of equity shares = Total amount of shares issued + Security premium received

on issue (-) Interim dividend paid

= 1,50,000 + 12,500 (-) 30,000

= 1,32,500

Correct Answer: [C]

Explanation 17:-

Issue of debentures = Closing balance of debentures (-) Opening balance of debentures

= 9,60,000 (-) 8,00,000

= 1,60,000

New debenture issued = 1st October 2014

Month up to 31st March = 6

Total month in a year = 12

Interest paid on debentures = 8,00,000 X 6% = 48,000

Add: Interest on new debentures issued = 1,60,000 X 6% X (6/12) = 4800

Total interest on debentures = 48,000 + 4800

= 52,800

Correct Answer: [D]

Explanation 18:-

Rate of dividend on preference shares = 10%

Dividend paid on preference shares = 4,00,000 X 10%

= 40,000

Correct Answer: [A]

Explanation 19:-

Issue of share capital = Closing balance of share capital (-) Opening balance of share capital

Equity share capital = 76,50,000 (-) 51,00,000

= 25,50,000

Premium on issue of shares = Closing balance of security premium (-) opening balance of security premium

= 10,62,500 (-) 8,50,000

= 2,12,500

Issue of debentures = Closing balance of debentures (-) Opening balance of debentures

= 20,40,000 (-) 17,00,000

= 3,40,000

Redemption of preference shares = Opening balance of preference shares (-) Closing balance of preference shares

= 34,00,000 (-) 8,50,000

= 25,50,000

Premium on redemption of preference shares = 25,50,000 X (10/100) = 2,55,000

Interest paid on debentures = 17,00,000 X 13% = 2,21,000

Add: Interest on new debentures issued = 3,40,000 X 13% X (6/12) = 22,100

Total interest on debentures = 2,21,000 + 22,100

= 2,43,100

Dividend paid on equity shares = 51,00,000 X (7/100) = 3,57,000

Dividend paid on preference shares = 34,00,000 X (16/100)

= 5,44,000

Correct Answer: [A]

Explanation 20:-

Issue of equity share capital Closing balance of debentures (-) opening balance of debentures

= 6,37,500 (-) 4,25,000

= 2,12,500

Cash proceeds from 19 % Debentures = Closing balance of debentures (-) opening balance of

debentures

= 4,75,000 (-) 0

= 4,75,000

Redemption of 17 % Debentures = opening balance of debentures (-) Closing balance of debentures

= 3,75,000 (-) 0

= 3,75,000

Correct Answer: [B]