Cash Flow Statement Examples with Solutions

A statement that shows the inflow and outflow of cash during a particular period of time is known as a cash flow statement. A cash flow statement contains all payments and receipts in cash. It is a summary of sources and applications of cash during a specified period. The cash flow statement reflects a firm’s liquidity.

The cash flow statement is divided into three types of activities: operating activities, investing activities, and financing activities.

- The transactions which are related to revenue generation come under the category of operating activities.

- The items which are related to the purchase and sale of fixed assets come under the category of investing activities.

- The transactions which are related to change in capital and borrowings comes under the category of financing activities.

Cash Flow Statement Examples with Solutions

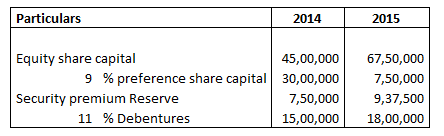

The amount received from the issue of equity shares – Cash Flow Statement Example 1:

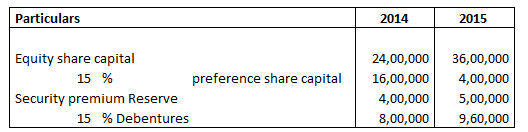

Following particulars are provided by Akash Ltd. The total money received from the issue of equity shares will be:

Additional information:

a Preference dividend on preference shares and an interim dividend on equity shares @ 3 % were paid on 30th September 2014.

b Preference shares were redeemed on 31st March 2015 at a premium of 18 %. Such premium has been provided out of profits. New shares and debentures were issued on 1st October 2014.

Explanation: –

Issue of share capital = Closing balance of share capital (-) Opening balance of share capital

Equity share capital = 6750000 (-) 4500000

= 2250000

Premium on issue of shares = Closing balance of security premium (-) opening balance of security premium

= 937500 (-) 750000

= 187500

Interim dividend paid = 4500000 x 3 %

= 135000

Total amount received from issue of equity shares = Total amount of shares issued + Security premium received on issue (-) Interim dividend paid

= 2250000 + 187500 (-) 135000

= 2302500

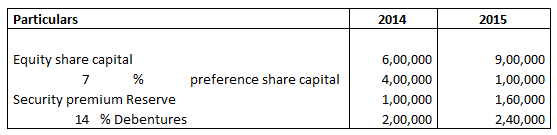

Calculation of amount in case of shares redeem at a premium – Cash Flow Statement Example 2 :

Following particulars are provided by Akash Ltd. The total amount paid to preference shares holders will be:

Additional information:

a Preference dividend on preference shares and an interim dividend on equity shares @ 15 % were paid on 30th September 2014.

b Preference shares were redeemed on 31st March 2015 at a premium of 12 %. Such premium has been provided out of profits. New shares and debentures were issued on 1st October 2014

Explanation: –

Redemption of preference shares = Opening balance of preference shares (-) Closing balance of preference shares

= 400000 (-) 100000

= 300000

Premium on redemption of preference shares = 300000 X 12/100 = 36000

Preference dividend = 400000 X 7%

= 28000

Total amount paid = 300000 + 36000 + 28000

= 364000

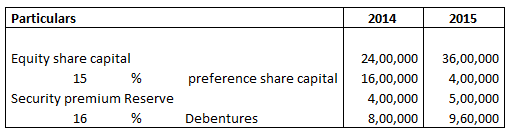

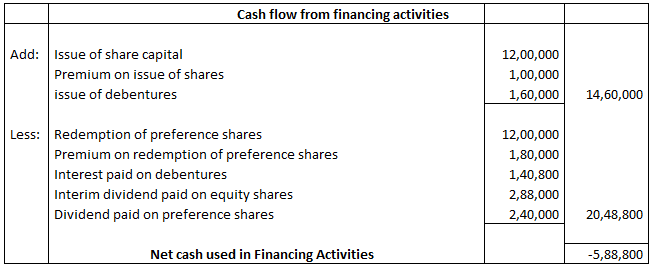

Cash flow from financing activities – Cash Flow Statement Example 3:

Following particulars are provided by Amit Ltd . Net cash flow from financing activities will be:

Additional information:

a Preference dividend on preference shares and an interim dividend on equity shares @ 12 % were paid on 30th September 2014.

b Preference shares were redeemed on 31st March 2015 at a premium of 15 %. Such premium has been provided out of profits. New shares and debentures were issued on 1st October 2014

Explanation: –

Issue of share capital = Closing balance of share capital (-) Opening balance of share capital

Equity share capital = 3600000 (-) 2400000

= 1200000

Premium on issue of shares = Closing balance of security premium (-) opening balance of security premium

= 500000 (-) 400000

= 100000

Issue of debentures = Closing balance of debentures (-) Opening balance of debentures

= 960000 (-) 800000

= 160000

Redemption of preference shares = Opening balance of preference shares (-) Closing balance of preference shares

= 1600000 (-) 400000

= 1200000

Premium on redemption of preference shares = 1200000 X 15/100 = 180000

Interest paid on debentures = 800000 X 16% = 128000

Add: Interest on new debentures issued = 160000 X 16% X 6/12 = 12800

Total interest on debentures = 128000 + 12800

= 140800

Dividend paid on equity shares = 2400000 X 12/100 = 288000

Dividend paid on preference shares = 1600000 X 15/100

= 240000

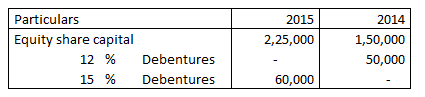

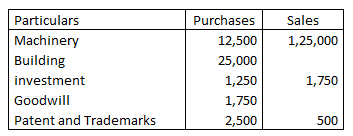

Cash Flow Statement Example 4:

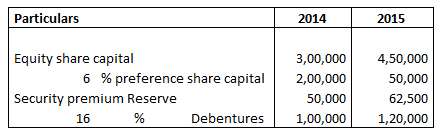

Akash Ltd provides the following information. Cash flow from financing activities will be:

Additional information:

1 Interest paid on debentures Rs 7000.

2 Dividend paid Rs 12000.

Explanation: –

Issue of equity share capital Closing balance of debentures (-) opening balance of debentures

225000 (-) 150000

75000

Cash proceeds from 15 % Debentures = Closing balance of debentures (-) opening balance of debentures

= 60000 (-) 0

= 60000

Redemption of 12 % Debentures = opening balance of debentures (-) Closing balance of debentures

= 50000 (-) 0

= 50000

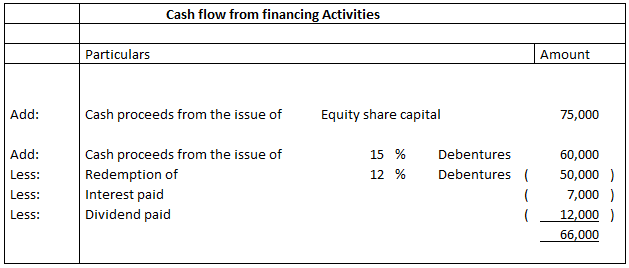

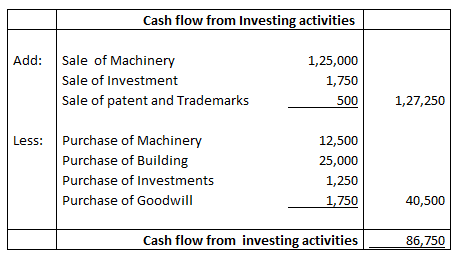

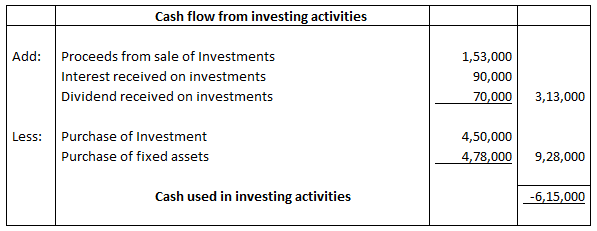

Cash flow from Investing activities – Cash Flow Statement Example 5:

Following is the information available from the books of Akash Ltd.

Cash flow from investing activities will be:

Explanation: –

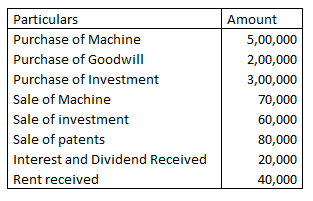

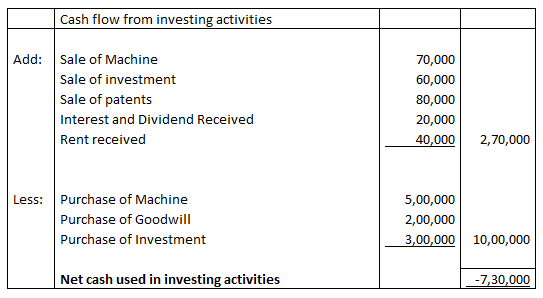

Cash Flow Statement Example 6:

Cash flow from investing activities from the following information will be:

Explanation: –

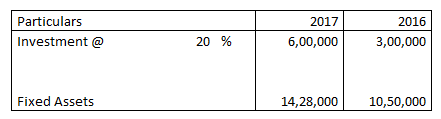

Cash Flow Statement Example 7:

Following is the information available from ABC Ltd

Additional information:

1 Half of the investment held at the beginning of the year was sold at a profit of 2 %.

2 Depreciation on Fixed Assets was Rs 100000 for the year

3 Interest received on investment was Rs 90000

4 Dividend received on investment Rs 70000

Cash flow from Investing activities will be:

Explanation: –

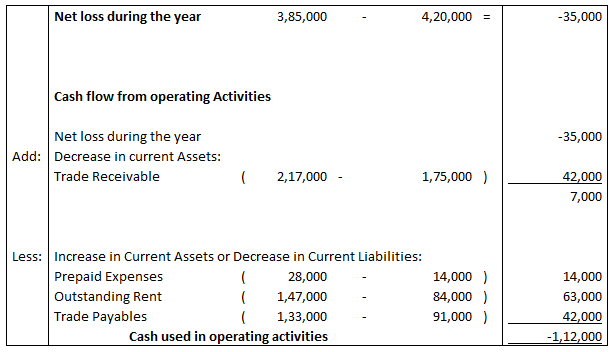

Cash flow from operating activities – Cash Flow Statement Example 8:

Question 8: –

Cash flow from operating activities from the following information will be:

Explanation: –

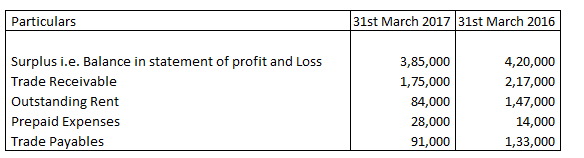

Cash Flow Statement Example 9:

Cash flow from operating activities from the following information will be:

Explanation: –

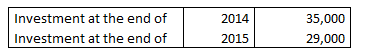

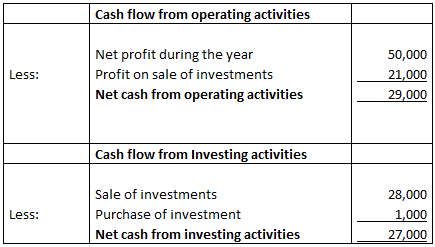

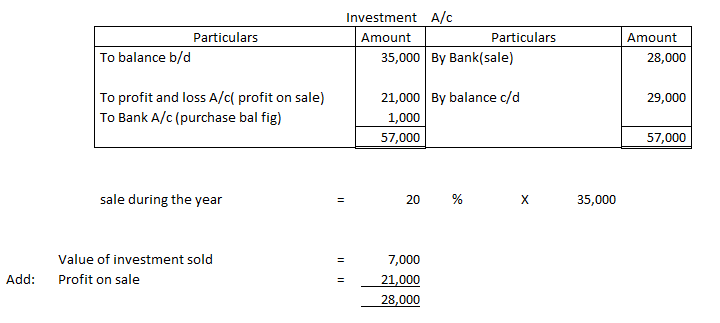

Cash Flow Statement Example 10:

AB Ltd had the following balances

During the year, the company had sold 20 % of its investment at a profit of Rs 21000 . Calculate cash flow from the operating activity and cash flow from investing activity if a company earned a profit of Rs 50000 during the year will be:

Explanation: –

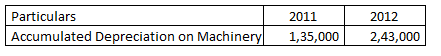

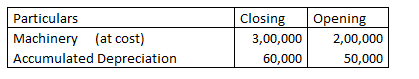

Depreciation on the asset when accumulated depreciation is given – Cash Flow Statement Example 11:

Following is the information relating to Akash Ltd

During the year a Machine sold for Rs 45000 On which Accumulated depreciation was Rs 67500.

Depreciation charged on machinery during the year is:

Explanation: –

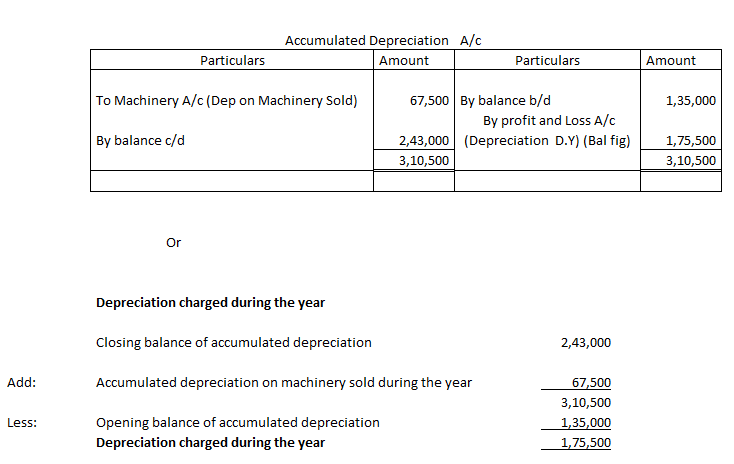

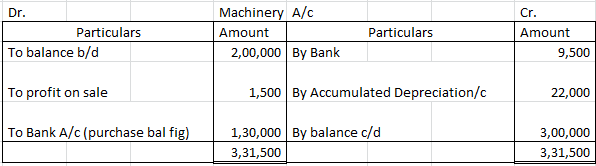

Cash Flow Statement Example 12:

From the following information what will be the amount of assets purchased during the year

Additional information

1 During the year a machine costing Rs 30000 accumulated deprecation Rs 22000 was sold for Rs 9500

Explanation: –

Dividend paid during the year – Cash Flow Statement Example 13:

Following particulars are provided by Amrita Ltd dividend paid on preference shares will be:

Additional information:

a Preference dividend on preference shares and an interim dividend on equity shares @ 20 % were paid on 30th September 2014.

b Preference shares were redeemed on 31st March 2015 at a premium of 5 %. Such premium has been provided out of profits. New shares and debentures were issued on 1st October 2014

Explanation: –

Rate of dividend on preference shares = 15%

Dividend paid on preference shares = 1600000 X 15%

= 240000

Interest paid to debenture holders – Cash Flow Statement Example 14:

Following particulars are provided by Best Ltd .interest paid on debenture during the year will be:

Additional information:

a Preference dividend on preference shares and an interim dividend on equity shares @ 7 % were paid on 30th September 2014.

b Preference shares were redeemed on 31st March 2015 at a premium of 3 %. Such premium has been provided out of profits. New shares and debentures were issued on 1st October 2014

Explanation: –

Issue of debentures = Closing balance of debentures (-) Opening balance of debentures

= 120000 (-) 100000

= 20000

New debenture issued = 1st October 2014

Month up to 31st March = 6

Total month in a year = 12

Interest paid on debentures = 100000 X 16% = 16000

Add: Interest on new debentures issued = 20000 X 16% X 6/12 = 1600

Total interest on debentures = 16000 + 1600

= 17600

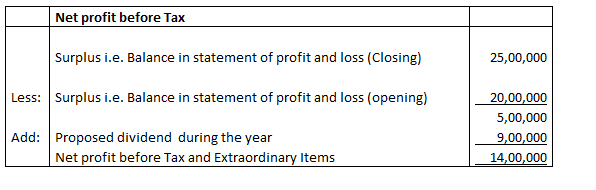

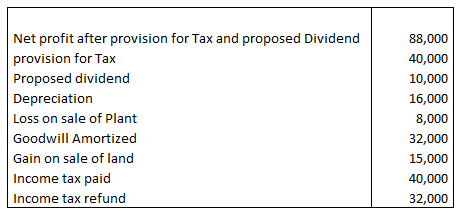

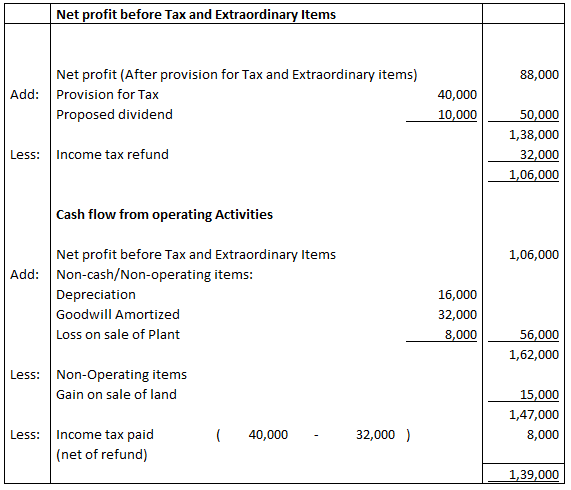

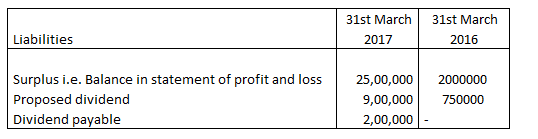

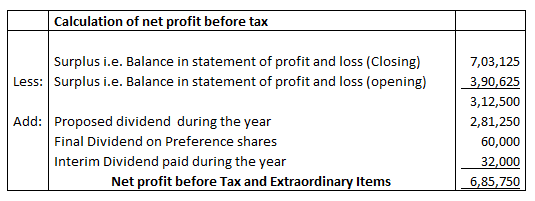

Net profit before tax and extraordinary items – Cash Flow Statement Example 15:

Following is the extract from the Balance sheets of Better LTD

Net profit before Tax and Extraordinary items will be:

Explanation: –

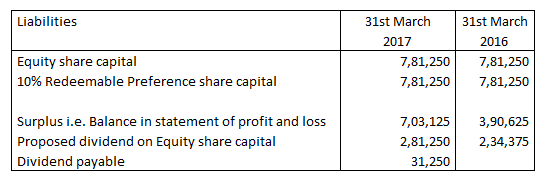

Cash Flow Statement Example 16:

Following is the extract from the Balance sheets of Akash Ltd

Additional Information: final dividend on preference share of Rs 60000 and the Interim dividend of Rs 32000 on Equity share was paid on 31st March 2017.

Net profit before Tax and Extraordinary items will be:

Explanation: –

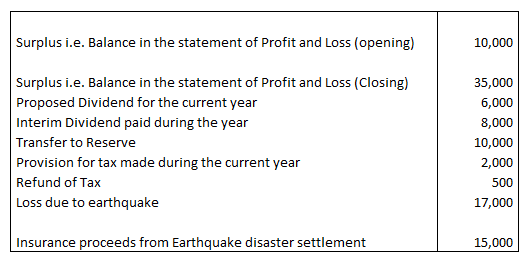

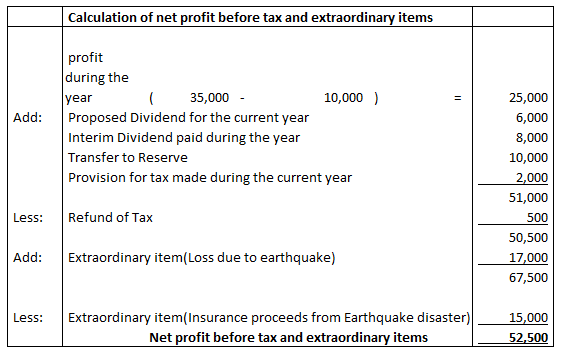

Cash Flow Statement Example 17:

Following is the information available from the records of DP LTD

Net profit before Tax and Extraordinary Items will be:

Explanation: –

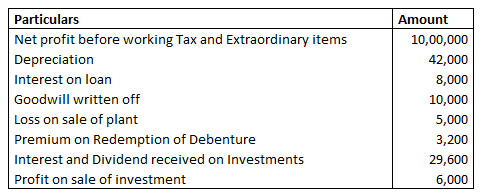

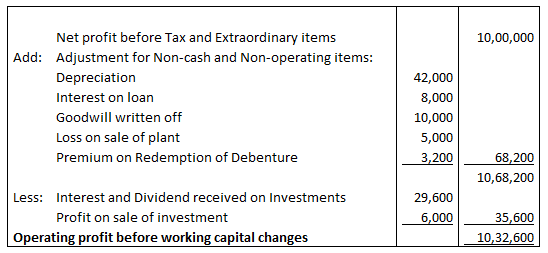

Operating profit before working capital changes – Cash Flow Statement Example 18:

From the following information, Calculate operating profit before working capital changes

Explanation: –

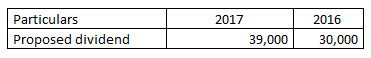

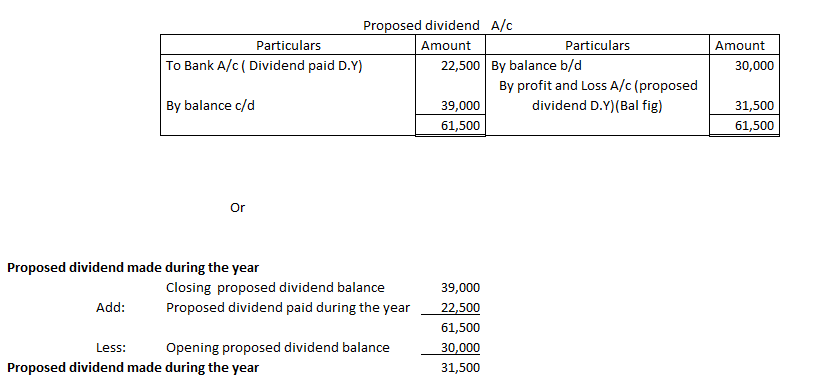

Proposed dividend made during the year – Cash Flow Statement Example 19:

Following is the information relating to Amit Ltd.

If the Dividend paid during the year is 22500 Proposed dividend during the year is:

Explanation: –

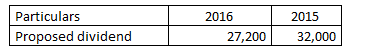

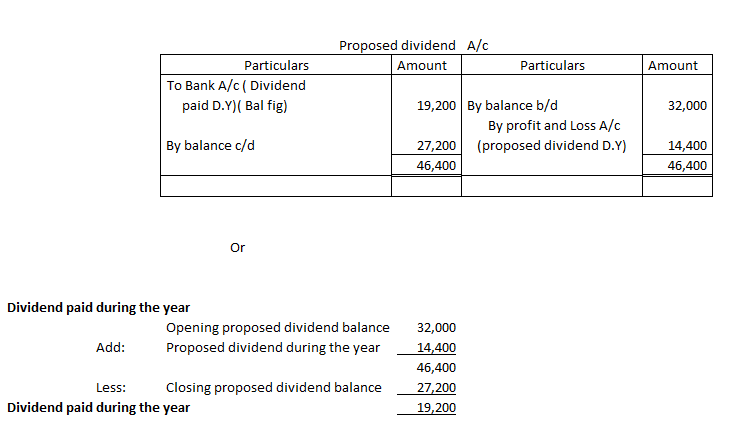

Cash Flow Statement Example 20:

Following is the information relating to Balaji Ltd

If the proposed dividend during the year is 14400 dividend paid during the year is:

Explanation: –

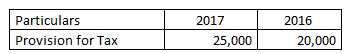

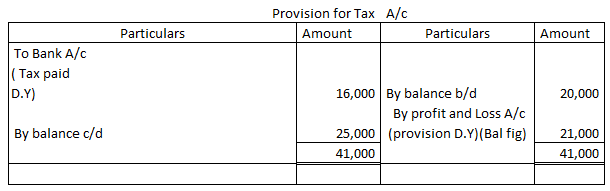

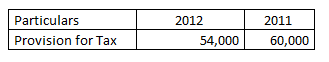

Provision for tax made during the year – Cash Flow Statement Example 21:

Following is the information relating to DK Ltd.

If the tax paid during the year is 16000 provision for tax during the year is :

Explanation: –

Calculation of Provision for tax during the year

OR

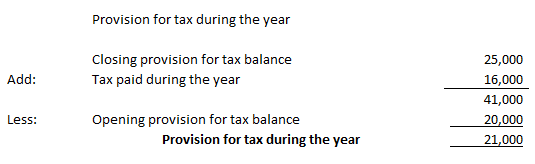

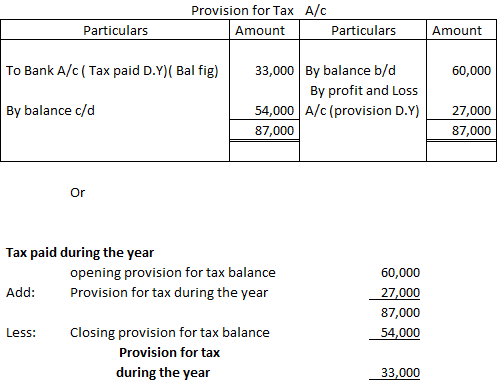

Tax paid during the year – Cash Flow Statement Example 22:

Following is the information relating to ABC Ltd

if provision for tax made during the year is 27000 tax paid during the year is :

Explanation: –

Chapter 6 – Cash Flow Statement