Change in Profit Sharing Ratio MCQ with Answer are covered in this Article. Change in Profit Sharing Ratio MCQs Test contains 8 questions. Answers to MCQ on Change in Profit Sharing Ratio Class 12 Accountancy are available at the end of the last question. These MCQ have been made for Class 12 students to help check the concept you have learnt from detailed classroom sessions and application of your knowledge. For more MCQ’s, subscribe to our email list.

Change in Profit Sharing Ratio MCQ – Question 1:-

D , E and F are partners sharing profits and losses in the ratio of 1:2:1 respectively. F acquires 1/5th share from E .New profit sharing ratio among partners will be:

[A] 5 : 6 : 9

[B] 1 : 2 : 1

[C] 6 : 9 : 5

[D] None of the above

Question 2:-

E , F and G are partners sharing profits and losses in the ratio of 2 : 3 : 2 respectively. G acquires 1/7th share from E and F equally. New profit sharing ratio among partners will be:

[A] 3 : 5 : 6

[B] 1 : 3 : 4

[C] 3 : 2 : 2

[D] None of the above

Question 3:-

D , E and F are partners sharing profits and losses in the ratio of 1 : 2 : 1 respectively. D sacrifices 1/5th of his share and E sacrifices 1/4th of his share in favour of F .What will be the new profit sharing ratio between partners.

[A] 1 : 2 : 2

[B] 16 : 30 : 34

[C] 5 : 2 : 34

[D] None of the above

Question 4:-

G , H and I are partners sharing profits and losses in the ratio of 3 : 1 : 1 respectively. G sacrifices 1/3 of his share and H sacrifices 1/2 of his share in favour of I .What will be the sacrificing ratio between partners.

[A] 6 : 3

[B] 3 : 0

[C] 1 : 2

[D] None of the above

Question 5:-

D , E and F are partners sharing profits and losses in the ratio of 3 : 3 : 2 respectively. From 1st April 2015 they decided to share the profits equally. For this purpose, the goodwill of the firm was valued at Rs. 240000 .The necessary journal entry for the treatment of goodwill on change in the profit sharing ratio will be:

[A] D ‘s Capital Account Dr. 40000

To E’s Capital Account 20000

To F’s Capital Account 20000

[B] F ‘s Capital Account Dr 20000

To D ‘s Capital Account 10000

To E ‘s Capital Account 10000

[C] F ‘s Capital Account Dr 18000

To D ‘s Capital Account 18000

[D] None of the above

Question 6:-

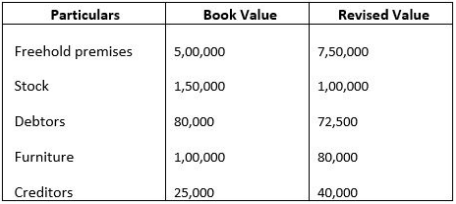

A , D and K are partners sharing profits and losses equally. From 1st April 2015 they decide to share profits in the ratio of 3 : 1 : 1 .At the time of reconstitution, the following assets and liabilities are revalued and reassessed.

Partners decided to record the above adjustments without affecting the book value of assets and liabilities The single entry to record adjustment will be:

[A] A s capital A/c Dr 41000

To D s capital A/c 20500

To K s capital A/c 20500

[B] A s capital A/c Dr 42000

To D s capital A/c 21000

To K s capital A/c 21000

[C] A s capital A/c Dr 41600

To D s capital A/c 20800

To K s capital A/c 20800

[D] None of the above

Question 7:-

A , D and K are partners sharing profits and losses in the ratio of 3 : 2 : 4 .They decide to share future profits in the ratio of 4 : 2 : 3 .They also decided to record the effect of the following without affecting their book values.

General reserve = 100000 Rs.

Profit and loss A/c(cr) = 90000 Rs.

Advertisement Suspense(Dr) = 10000 Rs.

The single adjusting entry will be:

[A] A s capital A/c Dr 18000

To K s capital A/c 18000

[B] A s capital A/c Dr 17500

To K s capital A/c 17500

[C] A s capital A/c Dr 20000

To K s capital A/c 20000

[D] None of the above

Question 8:-

P , Q and R are partners sharing profits and losses in the ratio of 4 : 3 : 2 .They decide to share future profits in the ratio of 2 : 3 : 4 .They also decided to record the effect of the following without affecting their book values.

Profit and loss A/c(cr) = 72000 Rs.

Advertisement Suspense(Dr) = 18000 Rs.

The single adjusting entry will be:

[A] R s capital A/c Dr 10000

To P s capital A/c 10000

[B] R s capital A/c Dr 9500

To P s capital A/c 9500

[C] R s capital A/c Dr 12000

To P s capital A/c 12000

[D] None of the above

Change in Profit Sharing Ratio MCQ – Answers and Explanations

Explanation 1:-

D s new share = 1/4

E s new share = 2/4 – 1/5 = (10-4)/20 = 6/20

F s new share = 1/4 + 1/5 = (5+4)/20 = 9/20

New profit sharing ratio among partners = 1/4 : 6/20 : 9/20

= (5:6:9)/6

= 5 : 6 : 9

Answer – [A] 5 : 6 : 9

Change in Profit Sharing Ratio MCQ – Explanation 2:-

G will take = 1/2 of 1/7 = 1/14 from E

G will take = 1/2 of 1/7 = 1/14 from F

E’s new share = 2/7 – 1/14 = (4-1)/14 = 3/14

F’s new share = 3/7 – 1/14 = (6-1)/14 = 5/14

G’s new share = 2/7 + 1/7 = (2+1)/7 = 3/7

New profit sharing ratio among partners = 3/14 : 5/14 : 3/7

= (3 : 5: 6)/14

= 3 : 5 : 6

Answer – [A] 3 : 5 : 6

Explanation 3:-

D sacrifices 1/5 of 1/4 = 1/20

E sacrifices 1/4 of 2/4 = 2/16

now F’s share in profit of the firm = 1/4+ 1/20 + 2/16

= (20+4+10)/80

= 34/80

D’s remaining portion of share = 1/4 – 1/20 = (5-1)/20 = 4/20

E’s remaining portion of share = 2/4 – 2/16 = (8-2)/16 = 6/16

New profit sharing between partners = 4/20 : 6/16 : 34/80

= (16:30:34)/80

= 16 : 30 : 34

Answer – [B] 16 : 30 : 34

Change in Profit Sharing Ratio MCQ – Explanation 4:-

G sacrifices 1/3 of 3/5 = 3/15

H sacrifices 1/2 of 1/5 = 1/10

now I s share in profit of the firm = 1/5 + 3/15 + 1/10

= (6+6+3)/30

= 15/30

G’s remaining portion of share = 3/5 – 3/15 = (9-3)/15 = 6/15

H’s remaining portion of share =1/5 – 1/10 = (2-1)/10 = 1/10

New profit sharing between partners = 6/15 : 1/10 : 15/30

= (12 : 3 : 15)/30

= 12 : 3 : 15

Sacrificing ratio = Old ratio – New ratio

G = 3/5 – 12/30

= (18-12)/30

= 6/30

H = 1/5 – 3/30

= (6-3)/30

= 3/30

6 : 3

Answer – [A] 6 : 3

Change in Profit Sharing Ratio MCQ – Explanation 5:-

New profit sharing ratio = 1 : 1 : 1

Sacrificing ratio = Old share – New share

D sacrifice/Gain = 3/8 – 1/3 = (9-8)/24 = 1/24

E sacrifice/Gain = 3/8 – 1/3 = (9-8/24) = 1/24

F sacrifice/Gain =2/8 – 1/3 = (6-8)/24 = -2/24

Share of goodwill :

D = 240000 x 1/24 = 10000 (Cr)

E = 240000 x 1/24 = 10000 (Cr)

F = 240000 x (-2/24) = -20000 (Dr)

Answer – (B)F ‘s Capital Account Dr 20000

To D ‘s Capital Account 10000

To E ‘s Capital Account 10000

Explanation 6:-

Net effect of revaluation:

Profit/Loss

Freehold premises = 250000

Stock = -50000

Debtors = -7500

Furniture = -20000

Creditors = -15000

= 157500

Profit on Revaluation 157500

Old profit sharing ratio = 1 : 1 : 1

New profit sharing ratio = 3 : 1 : 1

Sacrificing ratio = Old share – New share

A sacrifice/Gain = 1/3 – 3/5 = (5-9)/15 = -4/15

D sacrifice/Gain = 1/3 – 1/5 = (5-3)/15 = 2/15

K sacrifice/Gain = 1/3 – 1/5 = (5-3)/15 = 2/15

Proportionate amount gained by A = 157500 x (-4/15) = -42000 (Dr)

Proportionate amount sacrificed by D = 157500 x 2/15 = 21000 (Cr)

Proportionate amount sacrificed by K = 157500 x 2/15 = 21000 (Cr)

Answer (B) A s capital A/c Dr 42000

To D s capital A/c 21000

To K s capital A/c 21000

Change in Profit Sharing Ratio MCQ – Explanation 7:-

Calculation of net effect of reserves and accumulated profits/losses

General reserve = 100000 Rs.

(+) Profit and loss A/c(cr) = 90000 Rs.

(-) Advertisement Suspense(Dr) = -10000 Rs.

Net effect = 180000 Rs.

Calculation of sacrificing/gaining share of partners:

Sacrificing ratio = Old share – New share

A = 3/9 – 4/9 = (3-4)/9 = -1/9

D = 2/9 – 2/9 = (2-2)/9 = 0

K = 4/9 – 3/9 = (4-3)/9 = 1/9

Proportionate share of gaining partner A = 180000 x -1/9 = -20000 (Dr)

Proportionate share of sacrificing partner K = 180000 x 1/9 = 20000 (Cr)

Answer (c)A s capital A/c Dr 20000

To K s capital A/c 20000

Change in Profit Sharing Ratio MCQ – Explanation 8:-

Calculation of net effect of reserves and accumulated profits/losses

Profit and loss A/c(cr) = 72000 Rs.

Less: Advertisement Suspense(Dr) = 18000 Rs.

Net effect = 54000 Rs.

Calculation of sacrificing/gaining share of partners

Sacrificing ratio = Old share – New share

P = 4/9 – 2/9 = (4-2)/9 = 2/9

Q = 3/9 – 3/9 = (3-3)/9 = 0

R = 2/9 – 4/9 = (2-4)/9 = -2/9

Proportionate share of gaining partner R = 54000 x -2/9 = -12000 (Dr)

Proportionate share of sacrificing partner P = 54000 x 2/9 = 12000 (Cr)

Answer (C) – R s capital A/c Dr 12000

To P s capital A/c 12000