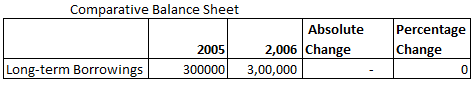

Comparative Balance Sheet

A comparative balance sheet presents side-by-side information about an entity’s assets, liabilities, and shareholder’s equity as of multiple points in time. It shows increases and decreases in the various assets, liabilities, and capital. A comparative balance sheet usually has two columns of amounts that appear to the right of the descriptions. The first column of amounts contains the amounts as of a recent moment or point of time i.e. current year and the column to the right contains corresponding amounts from a previous year.

Advantages of a comparative balance sheet are:

- The emphasis of the comparative balance sheet is on change.

- It acts as a connection between Statement of Profit and Loss and Balance Sheet.

- A comparative balance sheet is helpful in comparison to a single year’s balance sheet.

Comparative Balance Sheet Example

Comparative Balance Sheet: Example 1

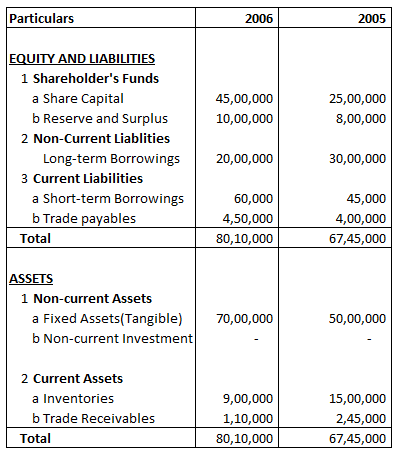

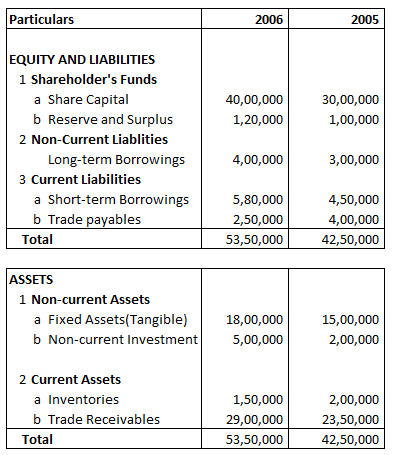

Following is the information provided by A LTD

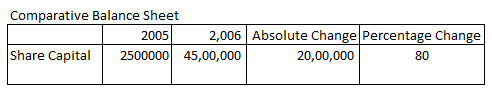

Absolute Change and Percentage Change in share capital is

Explanation: –

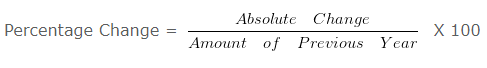

Absolute Change = Current year’s figure – Previous year’s figure

= 4500000 – 2500000

= 2000000

= 2000000/2500000 X 100

= 80 %

Comparative Balance Sheet: Example 2

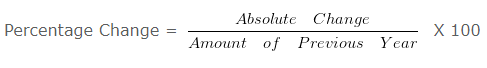

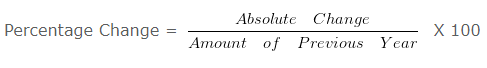

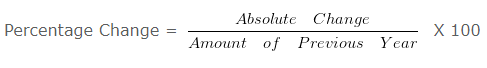

Following is the Balance sheet of AA Ltd

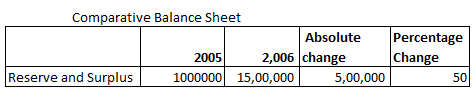

Absolute Change and Percentage Change in Reserve and Surplus is:

Explanation: –

Absolute change = Current year’s figure – Previous year’s figure

= 1500000 – 1000000

= 500000

= 500000/1000000 X 100

= 50

Comparative Balance Sheet: Example 3

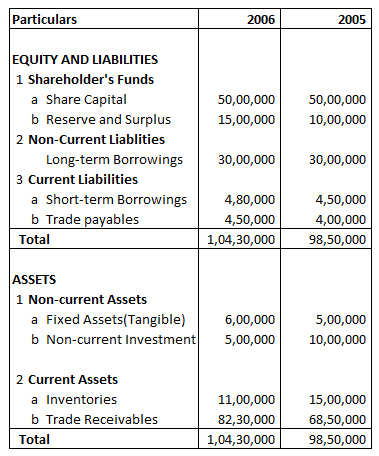

Following is the Balance sheet of B Ltd

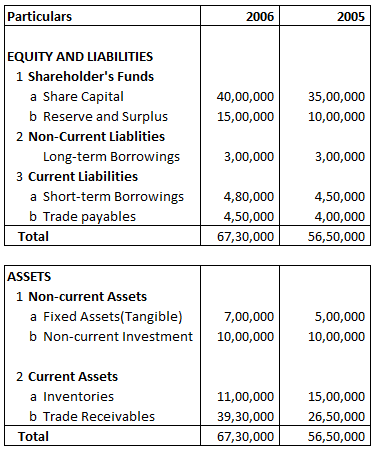

Absolute Change and Percentage Change in Long-term Borrowings is:

Explanation: –

Absolute Change = Current year’s figure – Previous year’s figure

= 300000 – 300000

= 0

= 0/300000 X 100

= 0

Comparative Balance Sheet: Example 4

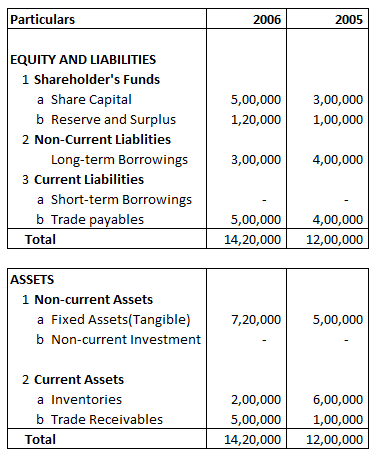

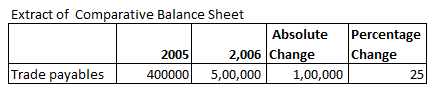

Following is the Balance sheet of A Ltd

Absolute Change and Percentage Change in Trade payable is:

Explanation: –

Absolute Change = Current year’s figure – Previous year’s figure

= 500000 – 400000

= 100000

= 100000/400000 X 100

= 25

Comparative Balance Sheet: Example 5

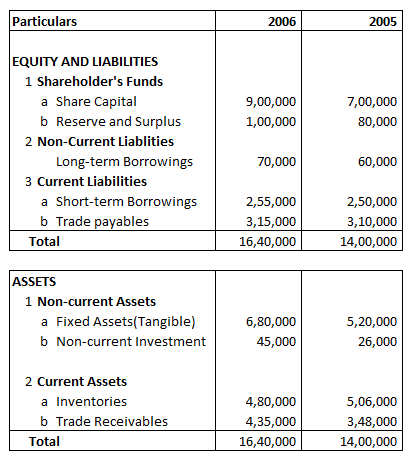

Following is the Balance sheet of A Ltd

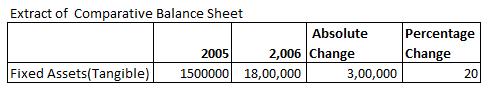

Absolute Change and Percentage Change in Fixed Assets(Tangible) is:

Explanation: –

Absolute Change = Current year’s figure – Previous year’s figure

= 1800000 – 1500000

= 300000

= 300000/1500000 X 100

= 20

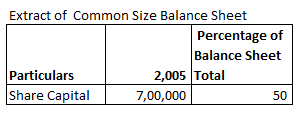

Example 6

Following is the Balance Sheet of AX Ltd

Share Capital Percentage of Balance Sheet total for 2005 will be:

Explanation: –

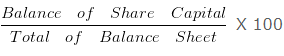

Share Capital Percentage of Balance Sheet Total 2005 =

= 700000/1400000 X 100

= 50

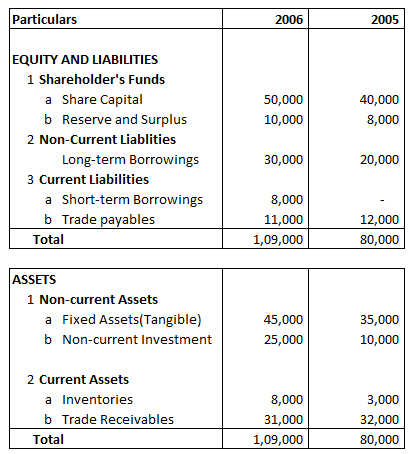

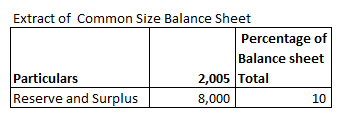

Comparative Balance Sheet: Example 7

Following is the Balance Sheet of A Ltd

Reserve and Surplus Percentage of Balance Sheet total for 2005 will be:

Explanation: –

Reserve and Surplus Percentage of Balance Sheet Total 2005 =

= 8000/80000 X 100

= 10

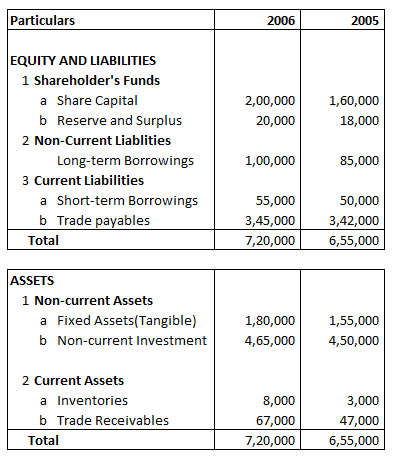

Comparative Balance Sheet: Example 8

Following is the balance sheet of A Ltd

Fixed Assets(Tangible) Percentage of Balance Sheet Total for 2006 will be:

Explanation: –

Fixed Assets(Tangible) Percentage of Balance Sheet Total 2006

= 180000/720000 X 100

= 25

Example 9

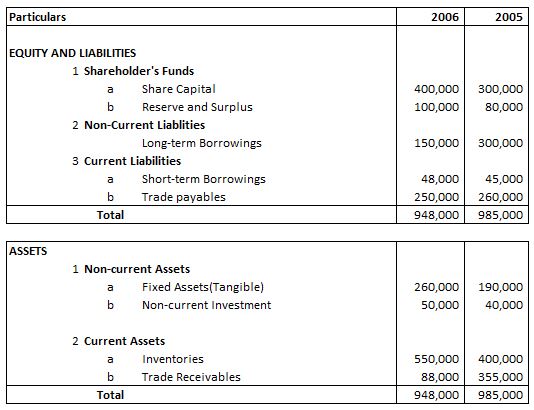

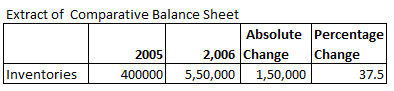

Following is the Balance sheet of AB Ltd

Absolute Change and Percentage Change in Inventories is:

Explanation: –

Absolute Change = Current year’s figure – Previous year’s figure

= 550000 – 400000

= 150000

= 150000/400000 X 100

= 37.5

Chapter 4 – Analysis of Financial Statements