Dissolution of Partnership Accounting is required when the relationship between the partners come to an end, this termination of agreement of partnership is known as dissolution of partnership. On dissolution of a firm, all the books of accounts of a firm are closed, all assets are sold and all liabilities are paid off. There are two criteria in case of dissolution, one is dissolution of firm and the other is dissolution of partnership. Dissolution of partnership includes change in relationship of partners whereas dissolution of firm includes complete closure of business.

Dissolution of partnership

Dissolution of partnership does not lead to closure of the business conducted by the firm. It simply means change in the relationship between partners.

Dissolution of partnership could be due to any of these reasons –

- Alteration in existing profit sharing ratio among partners;

- Admission of a new partner;

- Retirement of a partner;

- Death of a partner;

- Insolvency of a partner;

- Completion of the objective for which partnership was entered into; and

- Expiry of the agreed period of partnership, if any defined time period of partnership was decided.

Dissolution of Partnership Accounting – Types of Dissolution of Firm

Dissolution can be either with the intervention of court of by the order of court.

Dissolution of Partnership Accounting – Modes of dissolution without the intervention of court:

- On the Basis of Mutual Agreement : A partnership firm is being setup on the basis of mutual agreement between partners. In the similar way, a partnership firm can be dissolved on the basis of mutual agreement between partners.

- On the Happening of an Event : A partnership firm can be dissolved on the basis of happening of any of the below mentioned events: a) Due to the fulfillment of the objective of business b) Due to insolvency of partners c) On the expiry of period for which the firm was formed.

- Compulsory Dissolution : A firm is compulsorily dissolved either if the business is unlawful or any or all of the partners have become insolvent.

- By Notice : When the duration of the partnership firm is not fixed and it is at will then any partner can dissolve the business by giving a notice.

Dissolution of Partnership Accounting – Dissolution by the Order of Court

The partner may give an application to the court for dissolution of firm. The court, on receipt of application may order the dissolution of the partnership firm under the following circumstances:

- On satisfaction of the court that the decision of dissolution is equitable and just

- When a partner has become unsound mind

- When a partner, other than the partner filing the suit is guilty of misconduct or he willfully commits breach of contract

- When a partner, other than the partner filing the suit has become permanently incapable of performing the duties as a partner

- When the court is satisfied that the firm cannot be carried out except on a loss

Settlement of Accounts on Dissolution

The partnership account, at the time of dissolution, is settled as per the following:

- The amount of loss shall be paid out of profits first, if remaining then out of capital and lastly, if necessary will be realized from the partners in their profit sharing ratio.

- Amount realized from sale of assets of the firm shall be applied in the following order and manner and order:

- First of all, outside debts of the firm will be paid

- Out of the remaining amount, the loans advanced by partners will be paid off

- Thereafter the balance of partners capital accounts will be returned

- If some amount remains, it will be divided among the partners in their profit sharing ratio.

Accounting Procedure on Dissolution of Firm

In order to dissolve the firm and close the books of accounts, the below given accounts are opened:

- Realisation Account

- Partner’s Loan Accounts

- Partner’s Capital Accounts

- Cash or Bank Account

Dissolution of Partnership Accounting – Asset credited to realisation account when realisation %given

Question 1 : –

If on the dissolution of the firm A Ltd. Sundry assets transferred to realisation account is Rs. 50000 .Asset realised 50 % of their book value. What amount should be credited to realisation account ?

Explanation : –

Realised value of asset = 50000 X 50% = 25000

Cash/Bank A/c Dr 25000

To Realisation A/c 25000

Dissolution of Partnership Accounting – Calculation of amount realised from sale of asset

Question 2 : –

The amount of sundry assets trasferred to realisation account was Rs. 100000 . 70 % of them have been sold at a profit of Rs. 10000 . 20 % of the remaining were sold at a discount of 15 % .The amount realised from the sale is:

Explanation : –

Calculation of amount realised from sale

1. Sale ( 50% of 60000 ) = 30000 Rs.

Add: Profit on sale = 4000 Rs.

A = 34000 Rs.

Remaining goods at book value = 60000 – 30000 = 30000 Rs.

2. Sale ( 40% of 30000 ) = 12000 Rs.

Less: Discount on sale 25% of 12000 = 3000 Rs.

B = 9000 Rs.

Total amount realised from assets A + B

= 34000 9000

= 43000 Rs.

Dissolution of Partnership Accounting – Calculation of realised value of assets

Question 3 : –

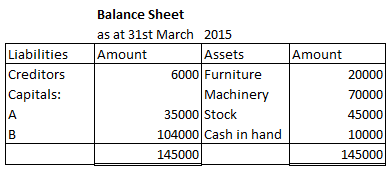

A and B were partners.They decided to dissolve their firm on 31st March 2015 .Balance sheet of the firm on dissolution given below. A was appointed to realise the assets. A was to receive 6% commission on the sale of assets(except cash) and was to bear all expenses of realisation . A realised the assets as: Furniture 50% , Machinery 40% , Stock 80% of the book value.The amount realised from assets is:

Explanation : –

Total value of assets realised :

Furniture = 20000 X 50% = 10000

Machinery = 70000 X 40% = 28000

Stock = 45000 X 80% = 36000

= 74000

Dissolution of Partnership Accounting – Calculation of value of asset taken over by a partner

Question 4 : –

The amount of sundry assets trasferred to realisation account was Rs. 100000 . 30 % of them have been sold at a profit of Rs. 10000 . 10 % of the remaining assets were sold at a discount of 15 % and remaining were taken over by D (a partner) at 20 % above book value .At what value were the assets taken over by D ?

Explanation : –

Calculation of value of asset taken over by D

Total value of assets transferred to realisation account = 100000 Rs.

Less: Sale 30% of 100000 = 30000 Rs.

=70000 Rs.

Less: Sale 10% of 70000 = 7000 Rs.

Book value of remaining goods = 63000 Rs.

Add: 20% of 63000 = 12600 Rs.

Goods taken over by D at Rs. = 75600 Rs.

Dissolution of Partnership Accounting – Commission payable to partner as per realised value of asset

Question 5 : –

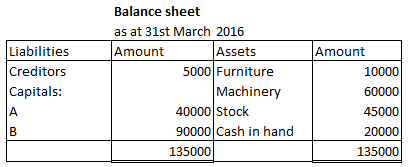

A and B were partners.They decided to dissolve their firm on 31st march 2016. Balance sheet of the firm given below A was appointed to realise the assets. A was to receive 6 % commission on the sale of assets(except cash) and was to bear all expenses of realisation . A realised the assets as: Furniture 50 % , Machinery 40 % , Stock 80% of the book value. The amount of commission credited to A s capital A/c is:

Explanation : –

Total value of assets realised :

Furniture = 10000 X 50% = 5000

Machinery = 60000 X 40% = 24000

Stock = 45000 X 80% = 36000

= 65000

Commision payable to A = Realised value of assets X Rate of commission

65000 X 6% = 3900

Dissolution of Partnership Accounting – Commission payable to a partner for realising assets

Question 6 : –

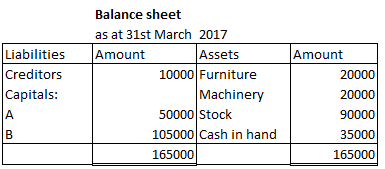

A and B were partners.They decided to dissolve their firm on 31st march 2017. Balance sheet of the firm given below. A was appointed to realise the assets. A was to receive 9 % commission on the sale of assets(except cash) and was to bear all expenses of realisation . A realised the assets as: Furniture 60 % , Machinery 50 % , Stock 80 % of the book value. The journal entry for commission to A is:

Explanation : –

Total value of assets realised :

Furniture = 20000 X 60% = 12000

Machinery = 20000 X 50% = 10000

Stock = 90000 X 80% = 72000

= 94000

Commision payable to A = Realised value of assets X Rate of commission

= 94000 X 9% = 8460

Realisation A/c Dr 8460

To A s capital A/c 8460

Dissolution of Partnership Accounting – Creditor accepted any asset in settlement of their claim

Question 7 : –

A and B were partners.They decided to dissolve their firm on 31st March 2017 . Creditors worth Rs. 100000 accepted Land valued at Rs. 60000 in full settlement of their claim. The journal entry in the books of the firm to record the settlement of creditors will be:

Explanation : –

No entry will be passed as liability is settled against asset without any cash/bank transaction.

Dissolution of Partnership Accounting – Creditor accepted cash in full and final settlement

Question 8 : –

A and B were partners.They decided to dissolve their firm on 31st March 2016 . Creditors worth Rs. 100000 ,accepted Rs. 60000 on dissolution. The Journal entry to record the settlement of creditors will be:

Explanation : –

On dissolution of a firm every asset and liability of the firm is transferred to realisation account and if any amount is realised for goodwill then bank / cash account is debited and the realisation account is credited and if any liability is paid off then realisation account is debited and cash/Bank account is credited.

Dissolution of Partnership Accounting – Debtors taken over by a partner & sold to debt collector

Question 9 : –

On dissolution of a firm amount of sundry debtors were of Rs. 100000 . K (a partner)took over debtors amounted to Rs. 95000 at Rs. 95000 and the remaining debtors were sold to a debt collecting agency at 25 % of the value. What will be the entries for the transactions ?

Explanation : –

Amount realised from sale of debtors to debt collecting agency:

Total value of debtors = 100000

Less: Debtors taken over by K = 95000

Book value of remaining debtors = 5000

Amount received from sale to debt collecting agency:

Book value of debtors remaining = 5000

Less: Discount given 5000 X 25% = 1250

= 3750

Dissolution of Partnership Accounting – Journal Entry for asset realised

Question 10 : –

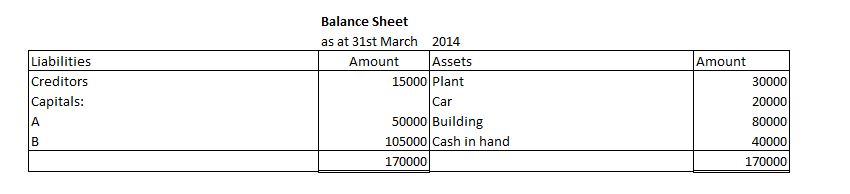

A and B were partners.They decided to dissolve their firm on 31st March 2014 .Balance sheet of the firm given below. A was appointed to realise the assets. A was to receive 12 % commission on the sale of assets(except cash) and was to bear all expenses of realisation . A realised the assets as: Plant 55 % , Car 45 % , Building 80 % of the book value. The journal entry for asset realised will be:

Explanation : –

Total value of assets realised :

Plant = 30000 X 55% = 16500

Car = 20000 X 45% = 9000

Building = 80000 X 80% = 64000

= 89500

Cash/Bank A/c Dr 89500

To Realisation A/c 89500

Dissolution of Partnership Accounting – Journal Entry for the payment of unrecorded liabilities

Question 11 : –

On dissolution of A Ltd .It was found that an unrecorded Trade Payable of Rs. 50000 settled at Rs. 32000 . What will be the journal entry of the transaction?

Explanation : –

Unrecorded liabitlities are those liabilties which are not appeared in the balance sheet of the firm but remain payable . When these liabilities are paid off realisation account is debited and cash/bank account is credited.

Dissolution of Partnership Accounting – Journal Entry for value of goods taken over by partner

Question 12 : –

The amount of sundry assets transferred to realisation account was Rs. 100000 . 45 % of them have been sold at a profit of Rs. 10000 . 10 % of the remaining were sold at a discount of 20 % and remaining were taken over by B (a partner) at 15 % above book value .what will be the journal entry of assets taken over by B ?

Explanation : –

Calculation of value of asset taken over by X :

Total value of assets transferred to Realisation Account = 60000 Rs.

Less: Sale ( 50% of 60000 ) = – 30000 Rs.

= 30000 Rs.

Less: Sale 20% of 30000 = – 6000 Rs.

Book value of remaining goods = 24000 Rs.

Add: 10% of 24000 = + 2400 Rs.

Goods taken over by X at Rs. = 26400 Rs.

Journal Entry :

X s capital A/c Dr. 26400

To Realisation A/c 26400

Dissolution of Partnership Accounting – Partner discharge realisation expense & receive remuneration

Question 13 : –

On dissolution of A Ltd , A (a partner) paid realisation expenses of Rs. 20000 out of his private funds, who was to get remuneration of Rs. 10000 for completing the dissolution process and was responsible to bear all the realisation expenses. What will be the journal entry of the transaction?

Explanation : –

When a partner was responsible for all the dissolution process then he can only receive the remuneration decided by the firm. If the amount of realisation expenses paid by the partner is more than the remuneration decided then partner have to pay the excess from his personal funds.

Dissolution of Partnership Accounting – Treatment of Goodwill on Dissolution

Question 14 : –

A and B were partners in a firm which was dissolved.

No goodwill appeared in the books. What will be the journal entry if Goodwill realised Rs. 80000 ?

Explanation : –

On dissolution every asset and liability of the firm is transferred to realisation account and if any amount is realised for goodwill then bank / cash account is debited and the realisation account is credited.

Dissolution of Partnership Accounting – Treatment of Goodwill on Dissolution (Type 2)

Question 15 : –

A and B were partners.They decided to dissolve their firm due to heavy losses .

No goodwill appeared in the books. What will be the journal entry if Goodwill is taken over by A at and agreed value of Rs 60000 ?

Explanation : –

On dissolution of firm every asset and liability of the firm is transferred to realisation account and if any asset is taken over by any partner then concerned partner’s capital account is debited and the realisation account is credited.

Dissolution of Partnership Accounting – Value of asset taken over by partner at discount

Question 16 : –

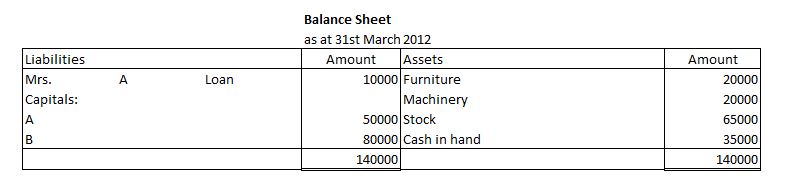

A and B were partners.They decided to dissolve their firm on 31st March 2012 .Balance sheet of the firm given below. A undertook to pay Mrs. A Loan and took over 50 % of the Stock and 20 % of Machinery at a discount of 5 % .The value at which asset taken over by A will be:

Explanation : –

(A) Value of Stock taken over by A = 65000 X 50% = 32500

Less: Amount of discount = 32500 X 5% = 1625

(A) = 30875

(B) Value of Machinery taken over by A = 20000 X 20% = 4000

Less: Amount of discount = 4000 X 5% = = 200

(B) = 3800

Total value of asset taken over by A = (A) + (B)

= 30875 + 3800

= 34675

Dissolution of Partnership Accounting – Value realised from sale of unrecorded asset

Question 17 : –

On dissolution of M Ltd .It was found that an unrecorded Furniture of Rs. 120000 realised at Rs. 100000 . What will be the journal entry of the transaction?

Explanation : –

Unrecorded assets are those assets which are owned by the firm but not appeared in the balance sheet of the firm.These assets may have market value and can be realised. When any amount received from the sale of these assets then realisation account is credited and Cash/Bank account is debited.

Dissolution of Partnership Accounting – When a partner agrees to pay of his wife’s loan

Question 18 : –

A and B were partners.They decided to dissolve their firm on 31st March 2015 . A agrees to pay off his wife’s loan of Rs. 40000 at and agreed value of Rs. 40000 The journal entry to record the case will be:

Explanation : –

When any partner agrees to pay of any loan appearing on the date of dissolution then dissolution a/c is debited and concerned partners capital account is credited.

Chapter 5 Dissolution of Partnership Firm

- Dissolution of Partnership

- Dissolution of a Firm

- Settlement of Accounts

- Accounting Treatment