Dissolution of a firm: Dissolving a partnership firm means stopping the business under the name of said partnership firm. For this situation, all liabilities are at last settled by selling off assets or transferring them to a specific partner, settling all accounts that existed with the partnership firm. Any profit/loss is transferred to partners in their profit sharing ratio as concurred by them in the partnership deed.

Dissolving a partnership firm is not the same as dissolving a partnership. In the previous case, the firm finishes its name and hence can’t do business in the future. In any case, if there should arise an occurrence of dissolving a partnership, the existing partnership is dissolved by consent or on occurring of a specific event, yet the firm can hold its existence if remaining partners go into another partnership agreement.

Dissolution of a firm takes place due to any of the following ways:

- Mutual Agreement between partners: It is the most straightforward approach to dissolve a partnership firm since all partners have commonly agreed upon shutting the partnership firm. Partners can give a mutual consent or may go into an agreement for the dissolution.

- Compulsory dissolution: A firm may need to be disintegrated compulsory if all partners or all but one partner are declared insolvent or the firm is involved in unlawful activities like dealing in drugs or other illicit items or working with outsider countries that may harm the interest of India or doing other such unlawful activities.

- Happening of certain contingent events: A firm may be required to get dissolved, when the fixed term of the partnership gets over, when the task or objective is completed or on the death of the partner if there are two people in a firm. If there are more than two partners in the firm then other partners may choose to run the firm. In such a case only the partnership will get dissolved and other partners will enter into a new agreement.

- Dissolution by notice: A firm is dissolved when a partner issues a notice of his intention to dissolve the partnership firm. The notice so issued shall be in writing.

- Dissolution by court: A court generally issues an order for dissolution of a partnership firm when there is no other option than to discontinue the firm. This happens when a partner is unable to perform his duties, or is guilty of any misconduct, or he is guilty of committing breach of the agreement, etc.

Dissolution of firm is not the same as dissolution of partnership. In the former case the firm’s name is discontinued, i.e., no activities can be carried in its name. Also, dissolution of a firm compulsorily means dissolution of partnership, although the vice versa is not true. Dissolution of a firm can be by order of a court or because of a mutual agreement between the partners or through any notice

Dissolution of partnership firm Problem 1 – Asset credited to realisation account when realisation %given

Question 1 : –

If on the dissolution of the firm A Ltd. Sundry assets transferred to realisation account is Rs. 50000 .Asset realised 50 % of their book value. What amount should be credited to realisation account ?

Explanation : –

Realised value of asset = 50000 X 50% = 25000

Cash/Bank A/c Dr 25000

To Realisation A/c 25000

Dissolution of partnership firm Problem 2 – Calculation of amount realised from sale of asset

Question 2 : –

The amount of sundry assets trasferred to realisation account was Rs. 100000 . 70 % of them have been sold at a profit of Rs. 10000 . 20 % of the remaining were sold at a discount of 15 % .The amount realised from the sale is:

Explanation : –

Calculation of amount realised from sale

1. Sale ( 50% of 60000 ) = 30000 Rs.

Add: Profit on sale = 4000 Rs.

A = 34000 Rs.

Remaining goods at book value = 60000 – 30000 = 30000 Rs.

2. Sale ( 40% of 30000 ) = 12000 Rs.

Less: Discount on sale 25% of 12000 = 3000 Rs.

B = 9000 Rs.

Total amount realised from assets A + B

= 34000 9000

= 43000 Rs.

Dissolution of partnership firm Problem 3 – Calculation of realised value of assets

Question 3 : –

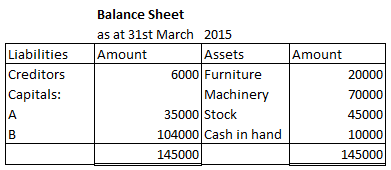

A and B were partners.They decided to dissolve their firm on 31st March 2015 .Balance sheet of the firm on dissolution given below. A was appointed to realise the assets. A was to receive 6% commission on the sale of assets(except cash) and was to bear all expenses of realisation . A realised the assets as: Furniture 50%, Machinery 40% , Stock 80% of the book value.The amount realised from assets is:

Explanation : –

Total value of assets realised :

Furniture = 20000 X 50% = 10000

Machinery = 70000 X 40% = 28000

Stock = 45000 X 80% = 36000

= 74000

Dissolution of partnership firm Problem 4 – Calculation of value of asset taken over by a partner

Question 4 : –

The amount of sundry assets trasferred to realisation account was Rs. 100000 . 30 % of them have been sold at a profit of Rs. 10000 . 10 % of the remaining assets were sold at a discount of 15 % and remaining were taken over by D (a partner) at 20 % above book value .At what value were the assets taken over by D ?

Explanation : –

Calculation of value of asset taken over by D

Total value of assets transferred to realisation account = 100000 Rs.

Less: Sale 30% of 100000 = 30000 Rs.

=70000 Rs.

Less: Sale 10% of 70000 = 7000 Rs.

Book value of remaining goods = 63000 Rs.

Add: 20% of 63000 = 12600 Rs.

Goods taken over by D at Rs. = 75600 Rs.

Dissolution of partnership firm Problem 5 – Commission payable to partner as per realised value of asset

Question 5 : –

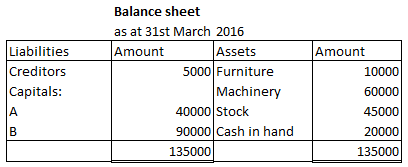

A and B were partners.They decided to dissolve their firm on 31st march 2016. Balance sheet of the firm given below A was appointed to realise the assets. A was to receive 6 % commission on the sale of assets(except cash) and was to bear all expenses of realisation . A realised the assets as: Furniture 50 % , Machinery 40 % , Stock 80% of the book value. The amount of commission credited to A s capital A/c is:

Explanation : –

Total value of assets realised :

Furniture = 10000 X 50% = 5000

Machinery = 60000 X 40% = 24000

Stock = 45000 X 80% = 36000

= 65000

Commision payable to A = Realised value of assets X Rate of commission

65000 X 6% = 3900

Dissolution of partnership firm Problem 6 – Commission payable to a partner for realising assets

Question 6 : –

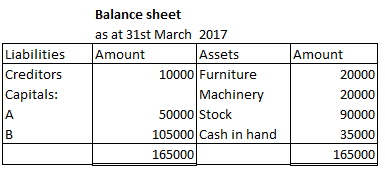

A and B were partners.They decided to dissolve their firm on 31st march 2017. Balance sheet of the firm given below. A was appointed to realise the assets. A was to receive 9 % commission on the sale of assets(except cash) and was to bear all expenses of realisation . A realised the assets as: Furniture 60 % , Machinery 50 % , Stock 80 % of the book value. The journal entry for commission to A is:

Explanation : –

Total value of assets realised :

Furniture = 20000 X 60% = 12000

Machinery = 20000 X 50% = 10000

Stock = 90000 X 80% = 72000

= 94000

Commision payable to A = Realised value of assets X Rate of commission

= 94000 X 9% = 8460

Realisation A/c Dr 8460

To A s capital A/c 8460

Dissolution of partnership firm Problem 7 – Creditor accepted any asset in settlement of their claim

Question 7 : –

A and B were partners.They decided to dissolve their firm on 31st March 2017 . Creditors worth Rs. 100000 accepted Land valued at Rs. 60000 in full settlement of their claim. The journal entry in the books of the firm to record the settlement of creditors will be:

Explanation : –

No entry will be passed as liability is settled against asset without any cash/bank transaction.

Dissolution of partnership firm Problem 8 – Creditor accepted cash in full and final settlement

Question 8 : –

A and B were partners.They decided to dissolve their firm on 31st March 2016 . Creditors worth Rs. 100000 ,accepted Rs. 60000 on dissolution. The Journal entry to record the settlement of creditors will be:

Explanation : –

On dissolution of a firm every asset and liability of the firm is transferred to realisation account and if any amount is realised for goodwill then bank / cash account is debited and the realisation account is credited and if any liability is paid off then realisation account is debited and cash/Bank account is credited.

Dissolution of partnership firm Problem 9 – Debtors taken over by a partner & sold to debt collector

Question 9 : –

On dissolution of a firm amount of sundry debtors were of Rs. 100000 . K (a partner)took over debtors amounted to Rs. 95000 at Rs. 95000 and the remaining debtors were sold to a debt collecting agency at 25 % of the value. What will be the entries for the transactions ?

Explanation : –

Amount realised from sale of debtors to debt collecting agency:

Total value of debtors = 100000

Less: Debtors taken over by K = 95000

Book value of remaining debtors = 5000

Amount received from sale to debt collecting agency:

Book value of debtors remaining = 5000

Less: Discount given 5000 X 25% = 1250

= 3750

Dissolution of partnership firm Problem 10 – Journal Entry for asset realised

Question 10 : –

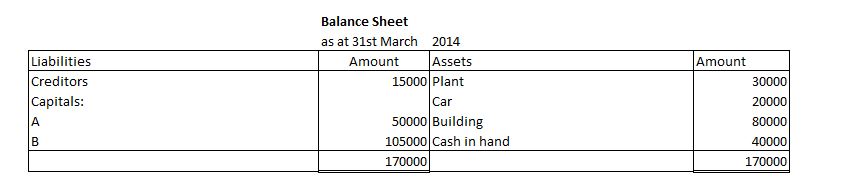

A and B were partners.They decided to dissolve their firm on 31st March 2014 .Balance sheet of the firm given below. A was appointed to realise the assets. A was to receive 12 % commission on the sale of assets(except cash) and was to bear all expenses of realisation . A realised the assets as: Plant 55 % , Car 45 % , Building 80 % of the book value. The journal entry for asset realised will be:

Explanation : –

Total value of assets realised :

Plant = 30000 X 55% = 16500

Car = 20000 X 45% = 9000

Building = 80000 X 80% = 64000

= 89500

Cash/Bank A/c Dr 89500

To Realisation A/c 89500

Dissolution of partnership firm Problem 11 – Journal Entry for the payment of unrecorded liabilities

Question 11 : –

On dissolution of A Ltd .It was found that an unrecorded Trade Payable of Rs. 50000 settled at Rs. 32000 . What will be the journal entry of the transaction?

Explanation : –

Unrecorded liabitlities are those liabilties which are not appeared in the balance sheet of the firm but remain payable . When these liabilities are paid off realisation account is debited and cash/bank account is credited.

Dissolution of partnership firm Problem 12 – Journal Entry for value of goods taken over by partner

Question 12 : –

The amount of sundry assets transferred to realisation account was Rs. 100000 . 45 % of them have been sold at a profit of Rs. 10000 . 10 % of the remaining were sold at a discount of 20 % and remaining were taken over by B (a partner) at 15 % above book value .what will be the journal entry of assets taken over by B ?

Explanation : –

Calculation of value of asset taken over by X :

Total value of assets transferred to Realisation Account = 60000 Rs.

Less: Sale ( 50% of 60000 ) = – 30000 Rs.

= 30000 Rs.

Less: Sale 20% of 30000 = – 6000 Rs.

Book value of remaining goods = 24000 Rs.

Add: 10% of 24000 = + 2400 Rs.

Goods taken over by X at Rs. = 26400 Rs.

Journal Entry :

X s capital A/c Dr. 26400

To Realisation A/c 26400

Dissolution of partnership firm Problem 13 – Partner discharge realisation expense & receive remuneration

Question 13 : –

On dissolution of A Ltd , A (a partner) paid realisation expenses of Rs. 20000 out of his private funds, who was to get remuneration of Rs. 10000 for completing the dissolution process and was responsible to bear all the realisation expenses. What will be the journal entry of the transaction?

Explanation : –

When a partner was responsible for all the dissolution process then he can only receive the remuneration decided by the firm. If the amount of realisation expenses paid by the partner is more than the remuneration decided then partner have to pay the excess from his personal funds.

Dissolution of partnership firm Problem 14 – Treatment of Goodwill on Dissolution

Question 14 : –

A and B were partners in a firm which was dissolved.

No goodwill appeared in the books. What will be the journal entry if Goodwill realised Rs. 80000 ?

Explanation : –

On dissolution every asset and liability of the firm is transferred to realisation account and if any amount is realised for goodwill then bank / cash account is debited and the realisation account is credited.

Dissolution of partnership firm Problem 15 – Treatment of Goodwill on Dissolution (Type 2)

Question 15 : –

A and B were partners.They decided to dissolve their firm due to heavy losses .

No goodwill appeared in the books. What will be the journal entry if Goodwill is taken over by A at and agreed value of Rs 60000 ?

Explanation : –

On dissolution of firm every asset and liability of the firm is transferred to realisation account and if any asset is taken over by any partner then concerned partner’s capital account is debited and the realisation account is credited.

Dissolution of partnership firm Problem 16 – Value of asset taken over by partner at discount

Question 16 : –

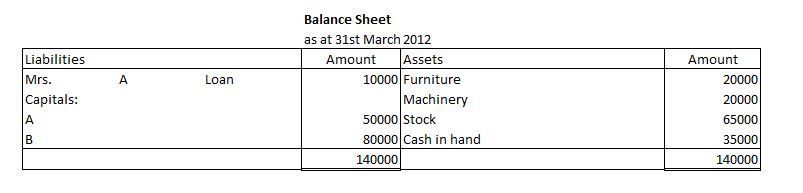

A and B were partners.They decided to dissolve their firm on 31st March 2012 .Balance sheet of the firm given below. A undertook to pay Mrs. A Loan and took over 50 % of the Stock and 20 % of Machinery at a discount of 5 % .The value at which asset taken over by A will be:

Explanation : –

(A) Value of Stock taken over by A = 65000 X 50% = 32500

Less: Amount of discount = 32500 X 5% = 1625

(A) = 30875

(B) Value of Machinery taken over by A = 20000 X 20% = 4000

Less: Amount of discount = 4000 X 5% = = 200

(B) = 3800

Total value of asset taken over by A = (A) + (B)

= 30875 + 3800

= 34675

Dissolution of partnership firm Problem 17 – Value realised from sale of unrecorded asset

Question 17 : –

On dissolution of M Ltd .It was found that an unrecorded Furniture of Rs. 120000 realised at Rs. 100000 . What will be the journal entry of the transaction?

Explanation : –

Unrecorded assets are those assets which are owned by the firm but not appeared in the balance sheet of the firm.These assets may have market value and can be realised. When any amount received from the sale of these assets then realisation account is credited and Cash/Bank account is debited.

Dissolution of partnership firm Problem 18 – When a partner agrees to pay of his wife’s loan

Question 18 : –

A and B were partners.They decided to dissolve their firm on 31st March 2015 . A agrees to pay off his wife’s loan of Rs. 40000 at and agreed value of Rs. 40000 The journal entry to record the case will be:

Explanation : –

When any partner agrees to pay of any loan appearing on the date of dissolution then dissolution a/c is debited and concerned partners capital account is credited.

Chapter 5 Dissolution of Partnership Firm

- Dissolution of Partnership

- Dissolution of a Firm

- Settlement of Accounts

- Accounting Treatment