Dissolution of Partnership Firm Class 12 MCQ with Answer are covered in this Article. Dissolution of Partnership Firm Class 12 MCQ Test contains 20 questions. Answers to MCQ on Dissolution of Partnership Firm Class 12 MCQ Accountancy are available at the end of the last question. These MCQ have been made for Class 12 students to help check the concept you have learnt from detailed classroom sessions and application of your knowledge.

Dissolution of Partnership Firm Class 12 MCQ

1.In case of dissolution of a firm, which item on the liabilities side is to be paid last?

(a) Partners capital

(b) External liabilities

(c) Long term debt

(d) None of the above

Answer

Answer: (a) Partners capital

Explanation: In dissolution of a firm after the payment of all the external liabilities, partner’s capital is paid at last, after adjusting all profits and losses.

2.X Ltd was dissolved on 31st March 2016. Mohan, a partner wants that his loan of Rs. 15000 should be paid off before the payment of capitals of the partners. But Rakesh, another partner wants that capitals must be paid before the payment of Mohan’s loan. Who is correct?

(a) Rakesh is correct

(b) Mohan is correct

(c) Both are wrong

(d) None of the above

Answer

Answer: (b) Mohan is correct

Explanation: As per section 48 of The Partnership Act, 1932, partner’s loan is paid before the payment of partner’s capitals.

3.A and B were partners in a firm which was dissolved.

No goodwill appeared in the books. What will be the journal entry if Goodwill realised Rs. 80000 ?

(a) Cash A/c Dr 80000′

To Realisation A/c 80000

(b)Realisation A/c Dr 80000

To Cash A/c 80000

(c) No entry will be passed

(d) None of the above

Answer

Answer: (a) Cash A/c Dr 80000′

To Realisation A/c 80000

Explanation: On dissolution every asset and liability of the firm is transferred to realisation account and if any amount is realised for goodwill then bank / cash account is debited and the realisation account is credited.

4.G and H were partners. They decided to dissolve their firm due to heavy losses.

No goodwill appeared in the books. What will be the journal entry if Goodwill is taken over by G at and agreed value of Rs. 80000 ?

(a) G’s capital A/c Dr 80000

To Realisation A/c 80000

(b) Realisation A/c Dr 80000

To G’s capital A/c 80000

(c) G’s capital A/c Dr 80000

To Revaluation A/c 80000

(d) None of the above

Answer

Answer: (a) G’s capital A/c Dr 80000

To Realisation A/c 80000

Explanation: On dissolution of firm every asset and liability of the firm is transferred to realisation account and if any asset is taken over by any partner then concerned partner’s capital account is debited and the realisation account is credited.

5.E and F were partners. They decided to dissolve their firm on 31st March 2015. Creditors worth Rs. 90000, accepted Rs. 55000 on dissolution. The Journal entry to record the settlement of creditors will be:

(a) Cash A/c Dr 55000

To Realisation A/c 55000

(b) Realisation A/c Dr 55000

To Cash A/c 55000

(c) Creditors A/c Dr 90000

To Cash A/c 55000

To P & L A/c 35000

(d) None of the above

Answer

Answer: (b) Realisation A/c Dr 55000

To Cash A/c 55000

Explanation: On dissolution of a firm every asset and liability of the firm is transferred to realisation account and if any amount is realised for goodwill then bank / cash account is debited and the realisation account is credited and if any liability is paid off then realisation account is debited and cash/Bank account is credited.

Dissolution of Partnership Firm Class 12 MCQ

6.E and F were partners. They decided to dissolve their firm on 31st March 2015. Creditors worth Rs. 90000 accepted Land & Building valued at Rs. 80000 in full settlement of their claim. The journal entry in the books of the firm to record the settlement of creditors will be:

(a) Realisation A/c Dr 80000

To Cash A/c 80000

(b) Cash A/c Dr 80000

To Realisation A/c 80000

(c) No entry required

(d) None of the above

Answer

Answer: (c) No entry required

Explanation: No entry will be passed as liability is settled against asset without any cash/bank transaction.

7.A and B were partners. They decided to dissolve their firm on 31st March 2015. A agrees to pay off his wife’s loan of Rs. 40000 at and agreed value of Rs. 40000. The journal entry to record the case will be:

(a) Realisation A/c Dr 40000

To A’s capital A/c 40000

(b) Realisation A/c Dr 40000

To Cash A/c 40000

(c) A’s capital A/c Dr 40000

To Realisation A/c 40000

(d) None of the above

Answer

Answer: (a) Realisation A/c Dr 40000

To A’s capital A/c 40000

Explanation: When any partner agrees to pay of any loan appearing on the date of dissolution then dissolution a/c is debited and concerned partners capital account is credited.

8.The amount of sundry assets transferred to Realisation account was Rs. 120000, 50 % of them have been sold at a profit of Rs. 25000. 30 % of the remaining assets were sold at a discount of 12 % and remaining were taken over by X (a partner) at 25 % above book value. At what value were the assets taken over by X ?

(a) Rs. 52500

(b) Rs. 42000

(c) Rs. 60000

(d) None of the above

Answer

Answer: (a) Rs. 52500

Explanation: Calculation of value of asset taken over by X

Total value of assets transferred to Realisation account = Rs. 120000

Less: Sale 50% of 120000 = Rs. 60000

= Rs. 60000

Less: Sale 30% of 60000 = Rs. 18000

Book value of remaining goods = Rs. 42000

Add: 25% of 42000 = Rs. 10500

Goods taken over by X at Rs. = Rs. 52500 (42000 + 10500)

9.The amount of sundry assets transferred to Realisation account was Rs. 110000, 60 % of them have been sold at a profit of Rs. 10000. 40 % of the remaining were sold at a discount of 20 % .The amount realised from the sale is:

(a) Rs. 44000

(b) Rs. 76000

(c) Rs. 90080

(d) None of the above

Answer

Answer: (c) Rs. 90080

Explanation: Calculation of amount realised from sale

1. Sale ( 50% of 60000 ) = Rs. 30000

Add: Profit on sale = Rs. 4000

= Rs. 34000 – (A)

Remaining goods at book value = 60000 – 30000 = Rs. 30000

2. Sale ( 40% of 30000 ) = Rs. 12000

Less: Discount on sale 25% of 12000 = Rs. 3000

= Rs.9000 – (B)

Total amount realised from assets A + B

= 34000 + 9000

= Rs. 43000

10.The amount of sundry assets transferred to Realisation account was Rs. 130000, 30 % of them have been sold at a profit of Rs. 12000. 20 % of the remaining were sold at a discount of 15 % and remaining were taken over by J (a partner) at 20 % above book value. What will be the journal entry of assets taken over by J ?

(a) J’s capital A/c Dr. 72800

To Realisation A/c 72800

(b) Realisation A/c Dr. 87360

To J’s capital A/c 87360

(c) J’s capital A/c Dr. 87360

To Realisation A/c 87360

(d) None of the above

Answer

Answer:

(c) J’s capital A/c Dr. 87360

To Realisation A/c 87360

Explanation: Calculation of value of asset taken over by X :

Total value of assets transferred to Realisation Account = Rs. 60000

Less: Sale ( 50% of 60000 ) = Rs. – 30000

= Rs. 30000

Less: Sale 20% of 30000 = Rs. – 6000

Book value of remaining goods = Rs. 24000

Add: 10% of 24000 = Rs. 2400

Goods taken over by X at Rs. = Rs. 26400

Journal Entry :

X’s capital A/c Dr. 26400

To Realisation A/c 26400

Dissolution of Partnership Firm Class 12 MCQ

11.On dissolution of a firm amount of sundry debtors were of Rs. 180000. B (a partner) took over debtors amounted to Rs. 90000 at Rs. 85000 and the remaining debtors were sold to a debt collecting agency at 15 % of the value. What will be the entries for the transactions ?

(a) B’s capital A/c Dr 180000

To Realisation A/c 180000

Cash/Bank A/c Dr 76500

To Realisation A/c 76500

(b) B’s capital A/c Dr 85000

To Realisation A/c 85000

Cash/Bank A/c Dr 13500

To Realisation A/c 13500

(c) B’s capital A/c Dr 85000

To Realisation A/c 85000

Cash/Bank A/c Dr 76500

To Realisation A/c 76500

(d) None of the above

Answer

Answer:

(c) B’s capital A/c Dr 85000

To Realisation A/c 85000

Cash/Bank A/c Dr 76500

To Realisation A/c 76500

Explanation:Amount realised from sale of debtors to debt collecting agency:

Total value of debtors = Rs. 180000

Less: Debtors taken over by B = Rs. 90000

Book value of remaining debtors = Rs. 90000

Amount received from sale to debt collecting agency:

Book value of debtors remaining = Rs. 90000

Less: Discount given 90000 X 15% = Rs. 13500

= Rs. 76500

12.On dissolution of B Ltd. It was found that an unrecorded Plant of Rs. 50000 realised at Rs. 35000. What will be the journal entry of the transaction?

(a) Cash/Bank A/c Dr 35000

To Plant A/c 35000

(b) Cash/Bank A/c Dr 35000

To Realisation A/c 35000

(c) Cash/Bank A/c Dr 35000

Profit and Loss A/c Dr 15000

To Plant A/c 50000

(d) None of the above

Answer

Answer: (b) Cash/Bank A/c Dr 35000

To Realisation A/c 35000

Explanation: Unrecorded assets are those assets which are owned by the firm but not appeared in the balance sheet of the firm. These assets may have market value and can be realised. When any amount received from the sale of these assets then realisation account is credited and Cash/Bank account is debited.

13.On dissolution of B Ltd. It was found that an unrecorded Bills Payable of Rs. 30000 settled at Rs. 7000. What will be the journal entry of the transaction?

(a) Cash/Bank A/c Dr 7000

To Realisation A/c 7000

(b) Realisation A/c Dr 7000

To Cash/Bank A/c 7000

(c) Bills Payable A/c Dr 30000

To Cash/Bank A/c 7000

To Profit and Loss A/c 23000

(d) None of the above

Answer

Answer: (b) Realisation A/c Dr 7000

To Cash/Bank A/c 7000

Explanation: Unrecorded liabilities are those liabilities which are not appeared in the balance sheet of the firm but remain payable . When these liabilities are paid off realisation account is debited and cash/bank account is credited.

14.On dissolution of C & Co., C (a partner) paid realisation expenses of Rs. 22000 out of his private funds, who was to get remuneration of Rs. 18000 for completing the dissolution process and was responsible to bear all the realisation expenses. What will be the journal entry of the transaction?

(a) Realisation A/c Dr 22000

To C’s Capital A/c 22000

(b) C’s Capital A/c Dr 22000

To Realisation A/c 4000

To Cash/Bank A/c 18000

(c) Realisation A/c Dr 18000

To C’s capital A/c 18000

(d) None of the above

Answer

Answer:

(c) Realisation A/c Dr 18000

To C’s capital A/c 18000

Explanation: When a partner was responsible for all the dissolution process then he can only receive the remuneration decided by the firm. If the amount of realization expenses paid by the partner is more than the remuneration decided then partner have to pay the excess from his personal funds.

15.If on the dissolution of the firm B Ltd. Sundry assets transferred to realisation account is Rs. 45000. Asset realised 20 % of their book value. What amount should be credited to realisation account ?

(a) Rs. 9000

(b) Rs. 45000

(c) Rs. 54000

(d) None of the above

Answer

Answer: (a) Rs. 9000

Explanation: Realised value of asset = 45000 X 20% = Rs. 9000

Dissolution of Partnership Firm Class 12 MCQ

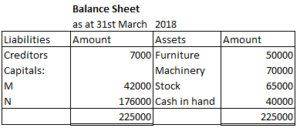

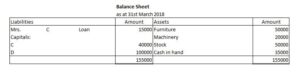

16.M and N were partners. They decided to dissolve their firm on 31st March 2018. Balance sheet of the firm on dissolution given below. M was appointed to realise the assets. M was to receive 6% commission on the sale of assets (except cash) and was to bear all expenses of realisation. M realised the assets as: Furniture 80% , Machinery 50% , Stock 80% of the book value. The amount realised from assets is:

(a) Rs.75000

(b) Rs. 87000

(c) Rs. 127000

(d) None of the above

Answer

Answer: (c) Rs. 127000

Explanation: Total value of assets realised :

Furniture = 50000 X 80% = Rs. 40000

Machinery = 70000 X 50% = Rs. 35000

Stock = 65000 X 80% = Rs. 52000

= Rs. 127000

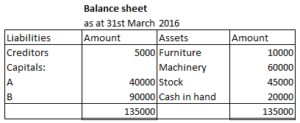

17.A and B were partners. They decided to dissolve their firm on 31st march 2016. Balance sheet of the firm given below A was appointed to realise the assets. A was to receive 6 % commission on the sale of assets (except cash) and was to bear all expenses of realisation. A realised the assets as: Furniture 50 % , Machinery 40 % , Stock 80% of the book value. The amount of commission credited to A’s capital A/c is:

(a) Rs. 2160

(b) Rs. 1440

(c) Rs. 3900

(d) None of the above

Answer

Answer: (c) Rs. 3900

Explanation: Total value of assets realised :

Furniture = 10000 X 50% = Rs. 5000

Machinery = 60000 X 40% = Rs. 24000

Stock = 45000 X 80% = Rs. 36000

= Rs. 65000

Commission payable to A = Realised value of assets X Rate of commission

65000 X 6% = Rs. 3900

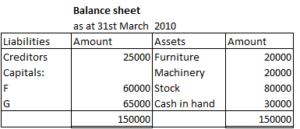

18. F and G were partners.They decided to dissolve their firm on 31st march 2010. Balance sheet of the firm given below. F was appointed to realise the assets. F was to receive 12 % commission on the sale of assets (except cash) and was to bear all expenses of realisation. F realised the assets as: Furniture 50 % , Machinery 50 % , Stock 70 % of the book value. The journal entry for commission to F is:

(a) Realisation A/c Dr 1200

To F’s capital A/c 1200

(b) Realisation A/c Dr 6720

To F’s capital A/c 6720

(c) Realisation A/c Dr 9120

To F’s capital A/c 9120

(d) None of the above

Answer

Answer:

(c) Realisation A/c Dr 9120

To F’s capital A/c 9120

Explanation: Total value of assets realised :

Furniture = 20000 X 50% = Rs. 10000

Machinery = 20000 X 50% = Rs. 10000

Stock = 80000 X 70% = Rs. 56000

= Rs. 76000

Commision payable to F = Realised value of assets X Rate of commission

= 76000 X 12% = Rs. 9120

Realisation A/c Dr 9120

To F’s capital A/c 9120

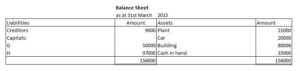

19.G and H were partners. They decided to dissolve their firm on 31st March 2015. Balance sheet of the firm given below. G was appointed to realise the assets. G was to receive 15 % commission on the sale of assets (except cash) and was to bear all expenses of realisation. G realised the assets as: Plant 50 % , Car 30 % , Building 50 % of the book value. The journal entry for asset realised will be:

(a) Cash/Bank A/c Dr 56500

To Realisation A/c 56500

(b) Cash/Bank A/c Dr 40000

To Realisation A/c 40000

(c) Cash/Bank A/c Dr 16500

To Realisation A/c 16500

(d) None of the above

Answer

Answer:

(a) Cash/Bank A/c Dr 56500

To Realisation A/c 56500

Explanation: Total value of assets realised :

Plant = 21000 X 50% = Rs. 10500

Car = 20000 X 30% = Rs. 6000

Building = 80000 X 50% = Rs. 40000

= Rs. 56500

Cash/Bank A/c Dr 56500

To Realisation A/c 56500

20. C and D were partners. They decided to dissolve their firm on 31st March 2018. Balance sheet of the firm given below. C undertook to pay Mrs. C Loan and took over 40 % of the Stock and 70 % of Machinery at a discount of 15 %. The value at which asset taken over by C will be:

(a) Rs. 17000

(b) Rs. 5100

(c) Rs. 28900

(d) None of the above

Answer

Answer: (c) Rs. 28900

Explanation: (A) Value of Stock taken over by C = 50000 X 40% = Rs. 20000

Less: Amount of discount = 20000 X 15% = Rs. 3000

(A) = Rs. 17000

(B) Value of Machinery taken over by C = 20000 X 70% = Rs. 14000

Less: Amount of discount = 14000 X 15% = Rs. 2100

(B) = 11900

Total value of asset taken over by C = (A) + (B)

= 17000 + 11900

= Rs. 28900