Economic Reforms Since 1991 Class 12 Notes Economics

Introduction of Economic Reforms Since 1991

Before the start of the phase of economic reforms since 1991, India followed a mixed economic framework from the start of the post-independence era which hailed from the start of planning.

Economists and intellectuals argue that this system led to the introduction of various rules and laws which aimed at controlling and regulating the economy ended up ultimately in hampering the process of growth and development.

Other groups of economists say that this phase saw a huge development in the industrial sector and expansion of agricultural output, this also ensured food security.

By the end of 80s and the start of the 90s, India met with an economic crisis relating to its external debt, foreign exchange reserves which we generally maintain to import petroleum dropped to extreme levels. The rising prices of essential goods further compounded the crisis.

This made the government adopt a new set of policy measures that led to a number of changes in our developmental strategies. These policies were termed as the ‘New Economic Policy’.

Background

The origin of the crisis is directly attributable to the cavalier micromanagement of the economy during the 1980 is which led to large and persistent macroeconomic imbalances.

The widening gap between the revenue and the expenditure of the government for managing the various policies and the administration resulted in growing fiscal deficits which had to be met by borrowing at home.

The Gulf crisis in the 1990 sharply accentuated macroeconomic problems. However, the government had to overshoot its revenue to meet the challenges like unemployment, poverty and population explosion.

There were no ways of generating additional revenues, also the internal revenue source like taxation was of no help. The income from public sector undertakings was also not very high to meet the growing expenditure. The foreign borrowings from other countries and International financial institutions were mostly spent on meeting consumption needs.

Further with the passage of time, government expenditure began to exceed its revenue by large margins and meeting the demand through foreign borrowings became increasingly unsustainable. The balance of payments (BOP) position was on the brink of disaster as in mid-January 1991 and again in late June 1991 the level of foreign exchange reserves dropped to levels which were not sufficient to finance imports for even 10 days.

To combat this crisis situation, India approached the World Bank (International Bank of Reconstruction and Development) and International Monetary Fund (IMF).

It is generally agreed in studies on Indian economy that the process of economic reforms was initiated in India by the government of PV Narasimha Rao in 1991 with the announcement of a number of measures for liberalising the economy by the then finance minister Manmohan Singh.

India received a $7 billion loan from the monetary agencies. The international agencies expected India to liberalize and open up the economy by removing restrictions on the private sector, reduce the role of the government in many areas and remove trade barriers between India and the other countries.

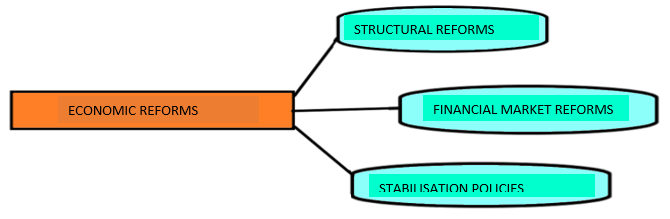

These conditionalities that India agreed to as given by the World Bank and IMF was announced as the ‘new economic policy 1991’ (NEP). The NEP aimed at creating a more competitive economic environment by introducing wide ranging economic reforms. The reforms were put under the broad heading of Liberalisation, Privatisation and Globalization (LPG).

Liberalization as a part of the Economic Reforms in India Since 1991

Liberalization was introduced to put an end to the restrictions that were imposed on the economy through the various rules and laws which were aimed at regulating the economic activities at the beginning. Liberalization measures like the abolition of industrial licensing policy, export-import policy, technology upgradation and fiscal policy, foreign investment policies were already introduced in the 80s.

However, the 1991 reform policies are more comprehensive.

The major reforms under Liberalization in 1991 includes:

- Removal of restrictions on the policies that were previously followed in the Industrial Sector like licensing policy, no permission of the private sector to enter many industries, production of some goods in the small-scale industries and controls on price fixation, this whole liberalization procedure here was known as ‘Industrial Deregulation.’

- Indian financial sector includes financial institutions such as commercial banks, investment banks, stock exchanges and foreign exchange markets. The Reserve Bank of India is the apex body, previously the RBI regulated the financial institutions through various norms, there prevailed a fixed exchange rate system, fixed interest rates and nature of lending to various sectors. The financial sector reforms mainly aimed at reducing the role of RBI from being a regulator of the financial institutions to a facilitator of the financial sector. An important outcome of financial sector reforms was that it contributed to greater flexibility in the factor and product markets. Two committees were set up to look after the financial sector, one was Committee on the Financial System 1991 and Committee on Banking Sector reforms in 1998 known as the Narasimham Committee.

- Tax reforms were the third major reforms under liberalization. There are mainly two types of taxes,

a) Direct taxes

b) Indirect taxes.

Direct taxes include disposable income tax and profits of business enterprises, it was felt back then that high rates of income tax were a major reason behind tax evasion and thus tax revenue generation was low. Efforts were made to revise high tax rates for both direct and indirect commodity taxes in order to increase demand and establish a common market for goods. - Last major reforms with an effort to liberalize the economy was the external sector Reforms. Under this segment the major reforms were,i. The Indian rupee was devalued in order to increase the inflow of foreign exchange. It also set a free tone for the determination of rupee value. Exchange rate is determined by the market. This fell under foreign exchange market reforms.ii. Liberalization of trade was introduced to increase international competitiveness of industrial production, foreign investments and technology into the economy. The objective was also to promote the efficiency of local industries and adoption of modern technologies. The trade policy reforms aimed at,a) dismantling of quantitative restrictions on imports and exports

b) reduction of tariff rates

c) removal of licensing procedures for imports.

Import licensing was removed except for environmentally hazardous industries and export duties have also been removed.

Privatization as a part of economic reforms since 1991

Privatization is a process by which the government transfers the productive activity from the public sector to the private sector. Government companies are converted into private companies in two ways,

- By withdrawing of the government ownership and management of public sector undertakings.

- By outright sale of public sector companies.

Privatization of public sector enterprises by selling off part of equity of PSEs to the public is known as disinvestment. The purpose of sale according to the government was mainly to improve financial discipline and facilitate modernization. Also, private capital and managerial capabilities could be effectively utilised to improve the performance of the PSUs. To improve the efficiency of PSUs, special status of Maharatnas, Navaratnas and Miniratnas were granted to them.

Globalisation as a Part of Economic Reforms in India Since 1991 Notes

Globalisation is a complex phenomenon, though it generally means integration of the economy of the country with the world economy, it is actually an outcome of a set of various policies that are aimed at transforming the world towards greater Independence and integration.

- Outsourcing is one of the most important outcomes of the globalisation process that India achieved. In this a company hires regular services from external sources (foreign countries). In the recent years outsourcing has intensified because of the growth of fast modes of communication, particularly the growth of Information Technology. This has made record keeping, banking services, music recording, film editing and other works easier in developing countries such as India. Multinational corporations are outsourcing their services to India where they can be availed at a cheaper cost with reasonable degree of skill and accuracy.

- Another major step towards globalisation was the foundation of the World Trade organization (WTO) in 1995 as a successor to GATT (General Agreement on Trade and Tariff). The motive behind this was to establish a rule-based trading regime in which Nations will not be able to place arbitrary restrictions on trade. India’s membership of WTO has helped her in framing fair global rules, common regulations and safeguards and advocating the interests of the developing world.

Performance of Indian Economy after the Introduction of the economic reforms since 1991

Achievements

- GDP or Gross Domestic Product is a very important indicator of economic growth. The post-1991 India witnessed a rapid growth in GDP on a continuous basis for almost two decades.

- Growth of the Service sector was most important mainly after the 2000s. This sector witnessed a growth up to 9.8%.

- There was a rapid increase in foreign direct investment and foreign exchange reserves due to the opening up of the economy. This has made India one of the largest forex reserve holders in the world.

- India also became a successful exporter of automobile machineries and engineering goods, IT softwares and textiles.

- Inflation was also under control.

Criticisms

- Critics argue that reform-led growth was not able to generate sufficient employment opportunities in the country.

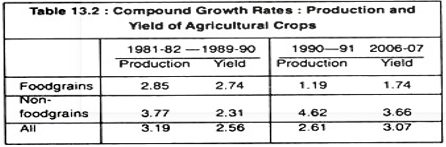

- Another important drawback was that the reforms were not much beneficial for the agricultural sector, especially in infrastructure such as irrigation, power, roads, market linkages, research and extension. Moreover because of the export-oriented policies, there was a major shift from production for the domestic markets towards production for the export markets.

- Industrial sector faced a demand crunch in the products which led to an industrial slow down because of various reasons such as cheaper imports, inadequate investment in infrastructure etc. The power industry also faced certain backwardness due to poor investment in its infrastructure.

- India has always maintained a target of disinvestment of the PSEs but has always achieved more than the target, critics argue that assets of PSEs have been undervalued and sold to the private sector resulting in a substantial loss to the government.

- Reform policies aimed at generating revenue for the government and curbing tax evasion such as tax reduction were not as helpful as they were expected to be. In order to increase foreign investment, tax incentives were provided to the foreign investors which further reduce the scope for raising tax revenue.

General Evaluation

Liberalisation, Privatisation and Globalization has both positive as well as negative impact on India’s growth. On the one hand, globalisation is to be seen as an opportunity for greater access to global markets, on the other hand, it is a mode through which developed countries open up their markets in the developing countries and gain themselves.

In the Indian context there were mixed views from economists, intellects and critics. It was seen as a way of reducing the deep-rooted inequalities and limitations, that was a part of the system during the post-independence period, a set of policies put forward by the international agencies helping India to recover from the crisis. \

On a positive note, it improved the quality of living by improving the income and consumption patterns of the people. Therefore, we can conclude that Liberalisation, Privatisation and Globalisation helped India increase its reach to the global world and helped Indians live a better life.

Development Experience (1947-90) and Economic Reforms since 1991:- 12 Marks

CBSE Economics Class 12 Notes Term I Syllabus

Part A: Introductory Macroeconomics

- Money and Banking Class 12 Notes

- Government Budget and the Economy Notes

- Balance of Payments Class 12 Notes

- Foreign Exchange Rate Notes

Part B: Indian Economic Development

Development Experience (1947-90) and Economic Reforms since 1991:- 12 Marks

- Indian Economy on the eve of Independence Notes

- Indian Economy (1950-90) Notes

- Economic Reforms since 1991 Notes

Current challenges facing Indian Economy – 10 Marks