Goodwill Meaning – Goodwill Meaning, in general terms is the positive reputation of the firm, which enables it to achieve higher profitability, against its competitors, by helping it to attract a larger number of customers.

The definition of Goodwill given by various authorities are as under:

Lord Lindley

“The term goodwill is generally used to denote the benefit arising from connections and reputation.”

Lord Eldon

“Goodwill is nothing more than the probability that the old customers will resort to the old place”.

Spicer and Pegler

“Goodwill may be said to be that element arising from the reputation, connections or other advantages possessed by a business which enables it to earn greater profits than the return normally to be expected on the capital represented by the net tangible assets employed in the business.”

Characteristics of Goodwill

- Goodwill is an intangible asset. It cannot be seen our touched.

- Goodwill is not a fictitious asset as it has a value .

- Goodwill is an attractive force, which attracts more number of customers to old place of business.

- Goodwill increases profitability level of the firm;

- The value of goodwill constantly fluctuates.

The need for Valuation of Goodwill may arise under the following cases : –

(i) Change in profit sharing ratio amongst existing partners.

(ii) Admission of a new partner in a partnership firm.

(iii) Death or retirement of an existing partner in a partnership firm.

(iv) When two firms are amalgamated.

( v) When the business of a firm is sold to outsiders, valuation of goodwill of business.

Factors affecting Goodwill

Factors affecting Goodwill can be internal factors, which are within the company, or external factors, which are a part of the economic environment in which the company operates. All these factors are discussed as under : –

- Efficient Management: Efficient management, manages the resources in the company in a manner which leads to higher profits in business . This is achieved by fulfilling the needs of customers, which increases the goodwill of the firm.

- Location: If the business is located at a favorable location, then it has a higher value of goodwill as compared to a business which is located at an unfavorable location.

- Quality of goods and services: If the firm provides best quality of goods and services to its customers then it has a higher goodwill than other firms.

- Contracts: If the firm has favourable contracts for the sale of its products and purchase of its raw material, then the firm enjoys a higher goodwill.

- Access to supplies: In case where the supplies of raw materials are difficult to secure, there will be a higher goodwill of the firm which has easy access to raw material.

- After-sale services to the customers – customers tend to purchase from the company which provides better after Sales Service. The quality of service increasing the Goodwill of the company thereby increasing the number of customers who purchased from the company.

- Patents owned by the firm – If the company goes certain patents, it is able to exclude competition, and provide Certain exclusive products/services to the customers which increases the Goodwill of the company.

- Effective advertisement – It creates brand awareness, Increases the Goodwill of the company

- Good Customer relation- A company which has good relationships with its customers, tend to bring the customers back to them/ generates referrals, which increases the value of goodwill of the company

TYPES OF GOODWILL

There are two types of goodwill, purchase goodwill and self generated goodwill. The definition of these two are discussed as under : –

(i) Purchased Goodwill: Purchased goodwill arises, when one business is taken over by another business, and the price paid by acquirer i.e., purchase consideration, is more than the net assets (value) acquired in the business purchased. Such excess of purchase consideration over the net assets value is known as purchased goodwill.

(ii) Self Generated Goodwill: Self Generated Goodwill arises from business attributes like efficient management, favourable location, quality etc. of the company or firm. It is internally generated and no payment is made to any external party.

Methods of Valuation of Goodwill

The following methods are most commonly used methods of Valuation of Goodwill:

(i) Average profit method of valuation of goodwill

(ii) Super profit method of valuation of goodwill

(iii) Capitalisation method of valuation of goodwill

(a) Capitalisation of Average Profit

(b) Capitalisation of Super Profit

Number of Year’s Purchase_ Meaning

Generally, the goodwill represents the ability of a company to earn certain excess profits over the normal profits earned by competitors for certain number of years. Number of Year’s Purchase, implies that the firm is expected to earn the same amount of profits , as they are earning, after the admission (or retirement/death) of a new partner for the given number of years .

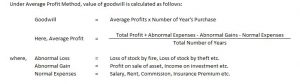

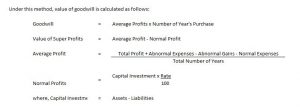

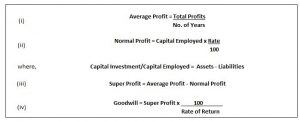

IMPORTANT FORMULAS:

- Average Profit Method

Goodwill – Average Profit Method

Question : –

Aaroh and Avroh were partners in a firm. They admit Anant for 3/4 the share in partnership, on 1st April 2016. Calculate the value of Goodwill on the basis of 4 year’s purchases of normal average profits of the last 5 years. The Profit and Loss Account showed the profit as follows: ”

2012-60,000 , 2013-75,000 , 2014-90,000 , 2015-75,000 , 2016-1,05,000

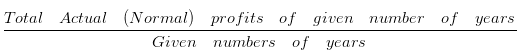

Explanation : –

Goodwill = Average profit X Numbers of year’s purchase

Total number of years = 5

Number of year purchase = 4

= 81,000

Goodwill = Average profit X Numbers of year’s purchase

= 81,000 X 4

= 3,24,000 Rs.

Goodwill – Average Profit Method(Abnormal Gain & Abnormal Losses)

Question : –

A and B were partners in a firm .They admit C for 1/3rd share in profit on 1st January 2015 .Value of the Goodwill is to be calculated based on the basis of 2 year’s purchases of normal average profits of last 5 years. The Profit and Loss Account showed the profit as follows:

2010-Rs.5,000 Including an abnormal gain of Rs 1,000

2011-Rs.10,000 Excluding Rs 4,000 as insurance premium

2012-Rs.4,000 After charging an abnormal loss of Rs 3,000

2013-Rs.8,000

2014-Rs.2,000 Loss

The value of goodwill will be:

Explanation : –

Goodwill = Average profit X Numbers of year’s purchase

Total number of years = 5

Number of year purchase = 2

Average Maintainable profits

Years

2010 = 5,000 – 1,000 = 4,000

2011 = 10,000 – 4,000 = 6,000

2012 = 4,000 + 3,000 = 7,000

2013 = 8,000

2014 = -2,000

Rs. 23,000

Average profit = 23000/5

= 4,600

Goodwill = Average profit X Numbers of year’s purchase

= 4,600 X 2

= 9,200 Rs.

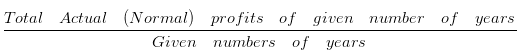

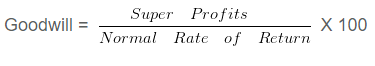

- Valuation of Goodwill- Super Profit Method

Goodwill – Super Profit Method

Question : –

A and B who were partners in a firm admitted C for 1/4 share of profits on 1st April 2015. The capital investment of the firm was Rs. 1,00,000. A fair return on the capital, having regard to the risk involved is 10 %. If the profits for the last 2 years were 2013 = 40,000 Rs. , 2014 = 50,000 Rs. Find the value of goodwill on the basis of 2 year purchase of super profit?

Explanation : –

Goodwill = Super profit X Numbers of year’s purchase

Super Profit = Average Profit – Normal profit

Average profit =

Given numbers of years

Total number of years = 2

Number of year purchase = 2

Average profit = (40000+50000+0)/2

= 90000/2

= 45,000

Normal profit = Capital investment X Normal rate of return

= 1,00,000 X 10/100

= 10,000

Super Profit = 45,000 – 10,000

= 35,000

Goodwill = 35,000 x 2

= Rs. 70,000

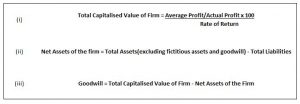

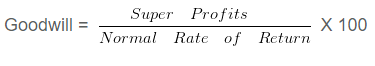

- Valuation of Goodwill – Capitalisation Method :- Under this method, valuation of goodwill can be calculated by capitalisation of average profit or capitalisation of super profit.

A. Capitalisation of Average Profit Method

Goodwill – Capitalisation of Average Profit

Question : –

A firm earns Rs. 1,00,000 as its annual profit, the normal rate of profit being 5 %.Assets of the firm are Rs. 15,00,000 excluding goodwill and liabilities are Rs. 5,00,000 .The value of goodwill by capitalisation method will be:

Explanation : –

![]()

= 100000/5 X 100

= 20,00,000

Net asset of the firm = Total Assets – Liabilities

= 15,00,000 – 5,00,000

= 10,00,000

Goodwill = Total capitalised value of business – Net assets

= 20,00,000 – 10,00,000

= Rs. 10,00,000

B. Capitalisation of Super Profit

Goodwill – Capitalisation of Super Profit

Question : –

A firm having assets of Rs. 1,00,000 and liabilities of Rs. 1,50,000 earns the annual profits of Rs. 45,000 .The rate of normal profit being 10 %.The amount of goodwill by capitalisation of super profits will be:

Explanation : –

Average profits = 45,000

Capital employed (Net assets) = 1,00,000 – 1,50,000

= -50,000

![]()

= -50,000 X 10/100

= -5,000

Super profits = Average profits – Normal profits

= 45,000 – (-5,000)

= 50,000

= 50000/10 X 100

= Rs. 5,00,000

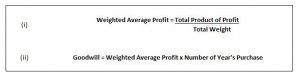

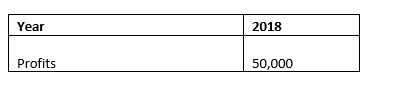

Weighted Average Profit Method

Goodwill – Weighted Average Profit Method

Question : –

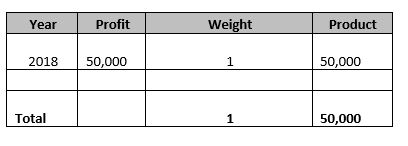

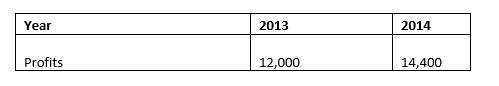

The profits of a firm for the year ended 31st March for the last 1 year were as under :

The value of goodwill on the basis of 1 years purchase of the weighted average profit will be:

Explanation : –

Weighted Average profit = 50000/1

= 50,000

Goodwill = Weighted Average Profit X Number of year’s purchase

= 50,000 X 1

= Rs. 50,000

Some examples of methods of valuation of goodwill are as given below:

Goodwill – Average profit method-Insurance Premium

Question : –

A and B were partners in a firm .They admit C for 1/2 share in profit on 1st January 2016 Compute Average maintainable profit, for the Year 2017, if there was an insurance premium of Rs. 6000 excluded from profit of Rs. 17,000 . The value of goodwill will be:

Explanation : –

Average Maintainable profits = Profit for the Year – Insurance premium

= 17,000 – 6,000

= 11,000

Goodwill – Average Profit Method(Type 4)

Question : –

A and B were partners in a firm .They admit C for 2/3 share in profit on 1st January 2016 .Compute Average maintainable profit, for the Year 2017, if there was an abnormal loss of Rs. 3,000 included in the total profit of Rs. 10,000 . The value of goodwill will be:

Explanation : –

Average Maintainable profits = Profit for the Year + Abnormal Loss

= 10,000 + 3,000

= 13,000 Rs.

Goodwill – Capitalisation of Super Profit(Type 2)

Question : –

Average profit of the firm are Rs. 2,00,000 .Total tangible assets in the firm are Rs . 25,00,000 and Outside Liabilities are Rs. 10,00,000 .In the same type of business , the normal rate of return is 10 % of the capital employed.The value of goodwill by capitalisation of super profit method will be:

Explanation : –

Capital Employed = Total Tangible Assets – Outside Liabilities

= 25,00,000 – 10,00,000

= 15,00,000

= 15,00,000 X 10/100

= 1,50,000

Super Profit = Average Profit – Normal Profit

= 2,00,000 – 1,50,000

= 50,000

= 50000/10 X 100

= Rs. 5,00,000

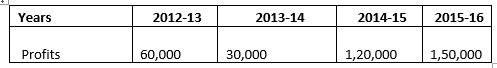

Goodwill – Normal Average Profit Method

Question : –

B , C and D are partners sharing profits and losses in the ratio of 2 : 1 : 3 . They admit E for 1/3 share. For the purpose of admission of E ,the goodwill of the firm is to be valued on the basis of 1 years purchase of last 3 or 4 years profits,whichever is higher. The profits were:

The value of goodwill will be:

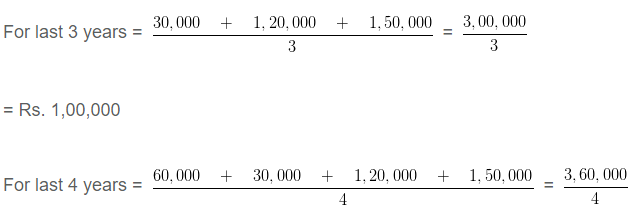

Explanation : –

Calculation of Average profits

=Rs. 90,000

Since the profit of Year 3 are higher, goodwill shall be calcualted based on the profit of 3 th Year

Goodwill = Average proft of 3 years X Number of year purchase

= 1,00,000 X 1

= Rs. 1,00,000

Goodwill – Super profit Method(Type 3)

Question : –

Average net profit of A Ltd expected in the future is Rs . 100000 per year.The average capital employed in the business is Rs 500000 .Normal profit expected from capital invested in this class of business is 10 %.The Remuneration of the partners is estimated to be Rs 20000 per annum. The value of goodwill on the basis of 3 year’s purchase of super profit will be :

Explanation : –

Average Annual Profit = 1,00,000 Rs.

Less : Remuneration = -20,000 Rs.

Actual Profit = 80,000 Rs.

Normal profit on capital employed = 5,00,000 X 10/100 = 50,000

Annual super profit = 80,000 – 50,000

= 30,000

Goodwill = 30,000 X 3

= Rs. 90,000

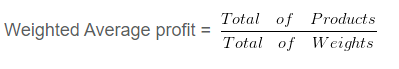

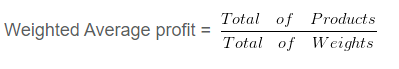

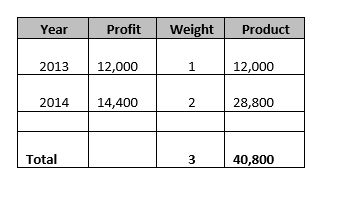

Goodwill – Weighted Average Profit Method(Type 2)

Question : –

The profits of a firm for the year ended 31st March for the last 2 years were as under :

The value of goodwill on the basis of 1 years purchase of the weighted average profit will be:

Explanation : –

Weighted Average profit = 40800/3

= 13,600

Goodwill = Weighted Average Profit X Number of year’s purchase

= 13,600 X 1

= Rs. 13,600

Chapter 3 Reconstitution of a Partnership Firm – Admission of a Partner