Ledger Accounts Class 11

Ledger- “Book or register which contains, in a summarized and classified form, a permanent record of all transactions.”

When the journal entries are passed after that to classify them, different accounts are prepared of individual nature. These are called ledger.

SIGNIFICANCE OF A LEDGER

- Classifies the transaction under individual heads

- Helps in the preparation of trial balance, through which financial statements are prepared to ascertain the profit or loss of the organization.

- Personal account depicts the money owed to creditors and amount to be recovered from debtors.

- Real account shows the value of assets and value of stock.

- Nominal account reflects the sources of income and expenses of the firm.

FORMAT OF LEDGER ACCOUNT

POSTING THE ENTRIES

The process of transferring the information contained in a journal to a ledger is called posting.

Posting of account in a journal entry:

- Identification of the debit and credit accounts.

- Entering the date of transaction into the date column.

- Name of the account is written in the particulars column. If on debit side it will be written as “To( name of account credited)” and if on credit side it will be written as “By (name of account debited)”.

- In the Journal Folio column page number where the entry exists in the journal will be written.

- Relevant amount will be recorded in “Amount Column”.

- A ledger account is prepared from

- Trial balance

- Cash book

BALANCING OF ACCOUNTS

In the balancing of accounts total of both debit and credit side is done. After totalling their difference is find out and is written on the side whose total is short. For example: if the total of the debit side is more than the credit side then the difference amount will be written on the credit side as balance c/d (carried down) and vice versa. On debit side the balance will be written as “To balance b/d (brought down)” and on credit side it will be written as “By balance b/d”. These balances will be used as opening balance for the new period.

Usually, the personal and the real accounts are balanced. Nominal accounts are not balanced but are closed by transferring to trading or profit and loss account at the end of the accounting year.

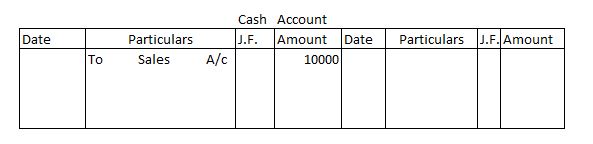

Question 1:

From the following ledger, the effect of the below given transaction will be _____.

Explanation:

Cash Account is debited because amount is received for goods sold.

And Sales Account is credited because goods are sold on cash basis.

Hence, Cash Increases and Goods Decreases

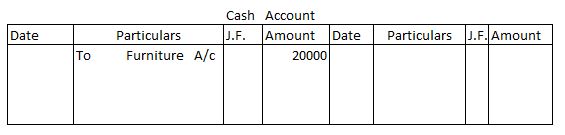

Question 2:

From the following ledger, the effect of the below given transaction will be _____.

Explanation:

Cash Account is debited because amount is received for sale of furniture, hence it increases the cash balance.

And Furniture Account is credited which decreases the balance of furniture.

Hence, Cash Increases and Furniture Decreases

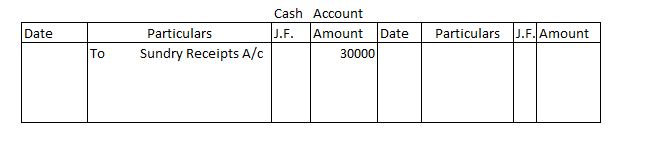

Question 3:

From the following ledger, the effect of the below given transaction will be _____.

Explanation:

Cash Account is debited hence it increases the cash balance.

And Sundry Receipts Account is credited which increases the balance of sundry receipts.

Hence, Cash Increases and Sundry Receipts Increases

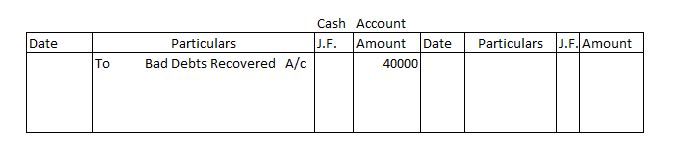

Question 4:

From the following ledger, the effect of the below given transaction will be _____.

Explanation:

Cash Account is debited because amount is received against bad debts, hence it increases the cash balance.

And Bad Debts Recovered Account is credited because old debts has been recovered.

Hence, Cash Increases and Bad Debts Decreases

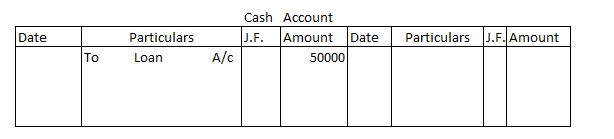

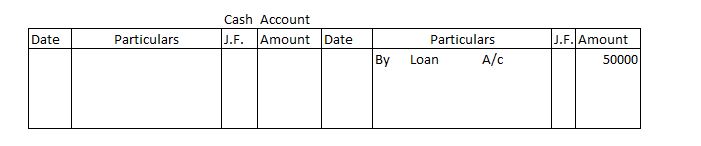

Question 5:

From the following ledger, the effect of the below given transaction will be _____.

Explanation:

Cash Account is debited as amount is received against loan, hence it increases the cash balance.

And Loan Account is debited which means liability is increased.

Hence, Cash Increases and Loan Increases

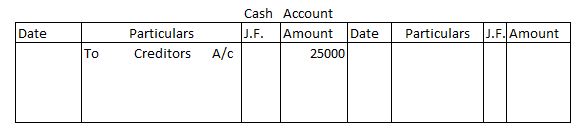

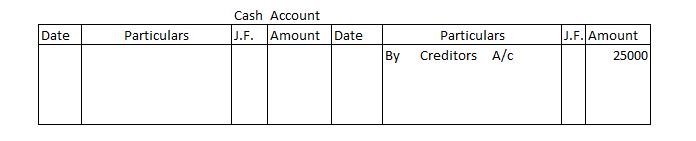

Question 6:

From the following ledger, the effect of the below given transaction will be ____.

Explanation:

Cash Account is debited because amount is received from creditors, hence it increases the cash balance.

And Creditors Account is creditors which means liability is increased.

Hence, Cash Decreases and Creditors Increases

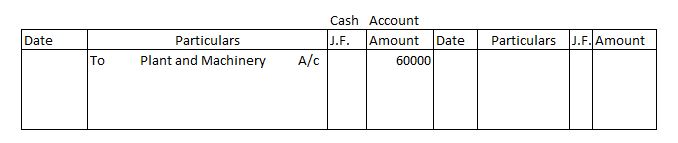

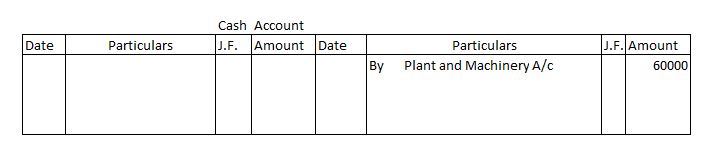

Question 7:

From the following ledger, the effect of the below given transaction will be ______.

Explanation:

Cash Account is debited because amount is received for sale of furniture, hence it increases the cash balance.

And Plant and Machinery Account is credited which decreases the balance of the same.

Hence, Cash Increases and Plant and Machinery Decreases

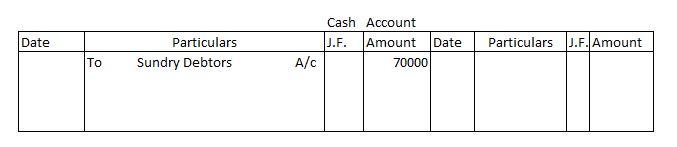

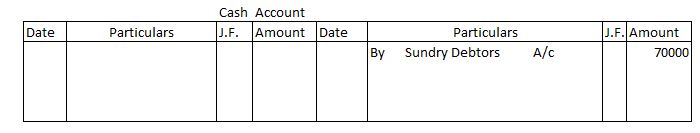

Question 8:

From the following ledger, the effect of the below given transaction will be ______.

Explanation:

Cash Account is debited because amount is received from debtors, hence it increases the cash balance.

And Sundry Debtors Account is credited which decreases the balance of debtors.

Hence, Cash Increases and Sundry Debtors Decreases

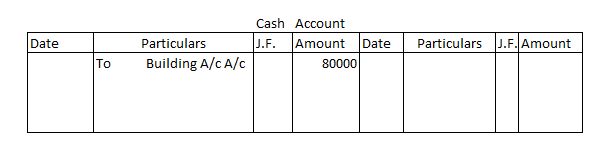

Question 9:

From the following ledger, the effect of the below given transaction will be ______.

Explanation:

Cash Account is debited, so it increases the cash balance.

And Building Account is credited which reduces the balance of Building.

Hence, Cash Increases and Building A/c Decreases

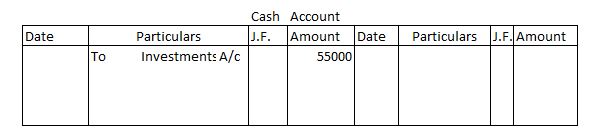

Question 10:

From the following ledger, the effect of the below given transaction will be _________.

Explanation:

Cash Account is debited, hence it increases the cash balance.

And Investment Account is credited which reduces the balance of Investments.

Hence, Cash Increases and Investments Decreases

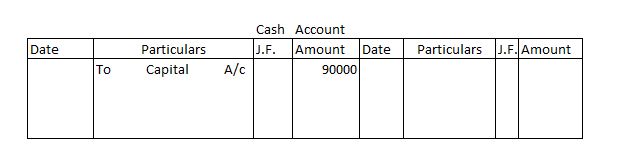

Question 11:

From the following ledger, the effect of the below given transaction will be ________.

Explanation:

Cash Account is debited, it increases the cash balance.

And Capital Account is credited, it increases the capital balance.

Hence, Cash Increases and Capital Decreases

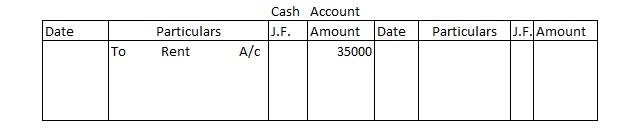

Question 12:

From the following ledger, the effect of the below given transaction will be ______.

Explanation:

Cash Account is debited, so it increases the cash balance.

And Rent Account is credited which reduces the balance of Rent Account.

Hence, Cash Increases and Rent Decreases

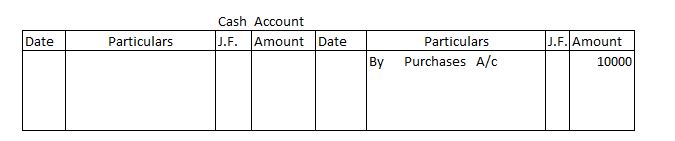

Question 13:

From the following ledger, the effect of the below given transaction will be ______.

Explanation:

Purchases A/c is debited, which increases the goods.

And Cash A/c is credited, which decreases the cash balance.

Hence, Cash Decreases and Goods Increases

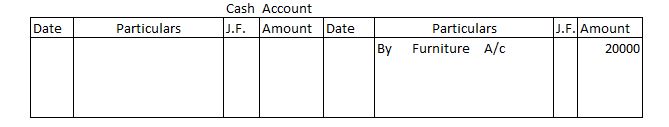

Question 14:

From the following ledger, the effect of the below given transaction will be _______.

Explanation:

Cash Account is credited, it decreases the cash balance.

And Furniture A/c is debited, which increases the balance of furnitures.

Hence, Cash Decreases and Furniture Increases

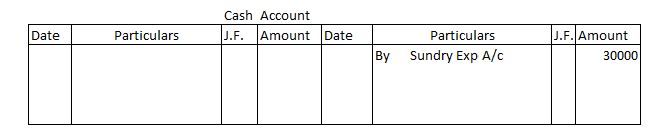

Question 15:

From the following ledger, the effect of the below given transaction will be _________.

Explanation:

Sundry Expense A/c is debited, so it increases the balance of sundry expenses.

And Cash A/c is credited, hence it decreases the cash balance.

Hence, Cash Decreases and Sundry Expenses Increases

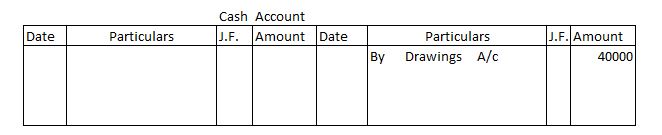

Question 16:

From the following ledger, the effect of the below given transaction will be ______.

Explanation:

Drawings A/c is debited, hence it increases the balance of drawings.

And Cash A/c is credited, hence it reduces the cash balance.

Hence, Cash Decreases and Drawings Increases

Question 17:

From the following ledger, the effect of the below given transaction will be _________.

Explanation:

Loan A/c is debited, it reduces the balance of Loan A/c.

And Cash A/c is credited, hence it reduces Cash Balance as well.

Hence, Cash Decreases and Loan Decreases

Question 18:

From the following ledger, the effect of the below given transaction will be _______.

Explanation:

Creditors A/c is debited, hence it reduces the balance of creditors.

And, Cash A/c is credited, hence it reduces the cash balance.

Hence, Cash Decreases and Creditors Decreases

Question 19:

From the following ledger, the effect of the below given transaction will be __________.

Explanation:

Plant & Machinery A/c is debited, hence it reduces the Cash Balance.

And Cash A/c is credited, which decreases the cash balance.

Hence, Cash Decreases and Plant and Machinery Increases

Question 20:

From the following ledger, the effect of the below given transaction will be ________.

Explanation:

Sundry Debtors A/c is debited, so balance of debtors is increased.

And Cash A/c is credited, hence it decreases

Hence, Cash Decreases and Sundry Debtors Increases

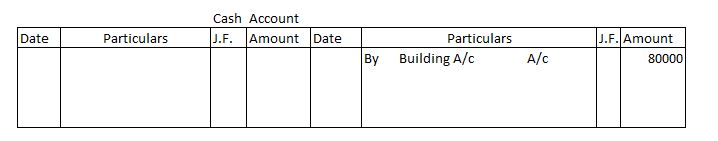

Question 21:

From the following ledger, the effect of the below given transaction will be _________.

Explanation:

Building A/c is debited, so it increases the balance of Building A/c.

And Cash A/c is credited, hence it reduces cash balance.

Hence, Cash Decreases and Building A/c Increases

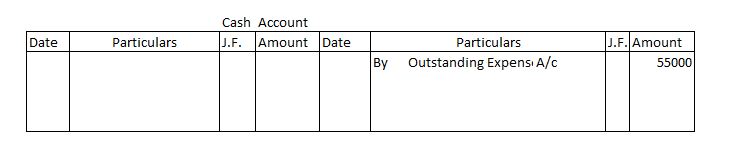

Question 22:

From the following ledger, the effect of the below given transaction will be _______.

Explanation:

Outstanding Expenses A/c is debited, hence it reduces the balance of the same.

And Cash A/c is credited, hence cash balance is reduced.

Hence, Cash Decreases and Outstanding Expenses Decreases

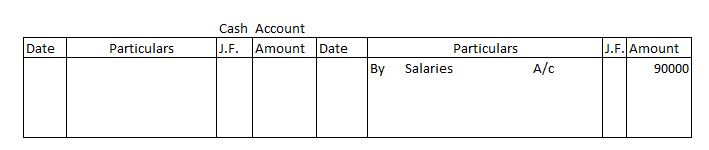

Question 23:

From the following ledger, the effect of the below given transaction will be ________.

Explanation:

Salaries A/c is debited and Cash A/c is credited, it implies that Salaries has been paid and cash balance is reduced.

Hence, Cash Decreases and Salaries Increases

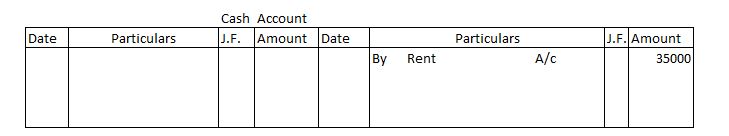

Question 24:

From the following ledger, the effect of the below given transaction will be _________.

Explanation:

Rent A/c is debited and Cash A/c is credited which implies that rent has been paid.

Hence, Cash Decreases and Rent Increases

Chapter 3 – Recording of Transactions