Liquidity means the firm’s ability to meet its current liabilities. In other words, the ability of a business to pay its short-term debts is frequently referred to as the liquidity position of the business. Short-term creditors of the firm are generally interested to know about the liquidity position of the firm. The liquidity ratio is further categorized into two parts: (i) Current Ratio & (ii) Liquid Ratio

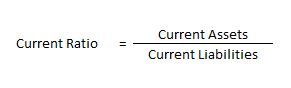

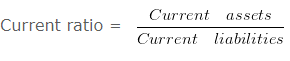

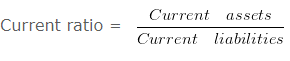

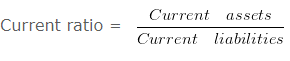

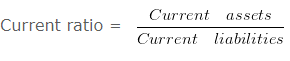

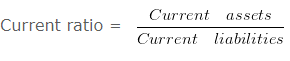

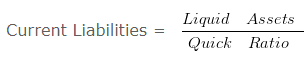

a. Current Ratio: It shows the relationship between current assets and current liabilities. It is also known as the working capital ratio. The ideal current ratio is 2:1. The term current assets mean the assets which are easily convertible into cash or cash equivalents within 12 months & the term current liabilities means the liabilities which are payable within a period of 12 months.

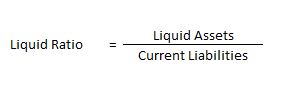

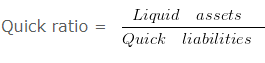

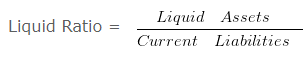

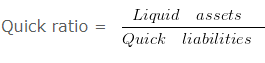

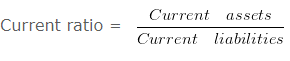

b. Liquid Ratio: It shows the relationship between liquid assets and current liabilities. It is also known as acid test ratio or quick ratio. The ideal liquid ratio is 1:1. The term liquid assets mean the assets which are easily convertible into cash or cash equivalents very shortly. All current assets except inventories and prepaid expenses are included in liquid assets.

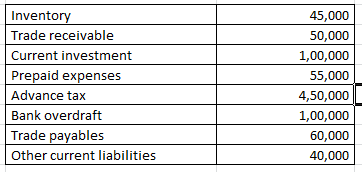

How to compute current ratio – Liquidity Ratio – Question 1: –

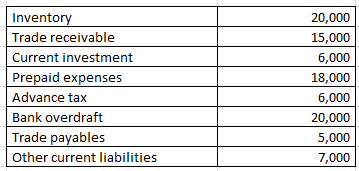

On the basis of the following information calculate the current ratio:

Explanation: –

Current ratio = 700000/200000

Current ratio = 3.5 :1

Working note 1 : Current assets = Inventory + Trade receivable + Current investment + Prepaid expenses + Advance tax

Current assets = 45000 + 50000 + 100000 + 55000 + 450000

Current assets = 700000

Working note 2: Current liabilities = Bank overdraft + Trade payables + Other current liabilities

Current liabilities = 100000 + 60000 + 40000

200000

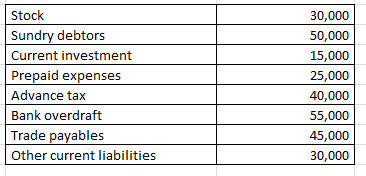

How to compute liquidity ratio – Question 2

On the basis of the following information calculate the liquidity ratio:

Explanation : –

![]()

Liquidity ratio = 65000/130000

Liquidity ratio = 0.5 :1

Working note 1 : Liquid assets = Current assets (-) ( Stock + Prepaid expenses + Advance tax )

Liquid assets = 160000 (-) 30000 + 25000 + 40000

Liquid assets = 65000

Working note 2 : Current assets = Stock + Sundry debtors + Current investment + Prepaid expenses + Advance tax

Current assets = 30000 + 50000 + 15000 + 25000 + 40000

Current assets = 160000

Working note 3: Current liabilities = Bank overdraft + Trade payables + Other current liabilities

Current liabilities = 55000 + 45000 + 30000

130000

How to compute quick ratio – Liquidity Ratio – Question 3

On the basis of the following information calculate the Quick ratio:

Explanation : –

Quick ratio = 21000/12000

Quick ratio = 1.75 :1

Working note 1 : Liquid assets = Current assets (-) ( Inventory + Prepaid expenses + Advance tax )

Liquid assets = 65000 (-) 20000 + 18000 + 6000

Liquid assets = 21000

Working note 2: Quick liabilities = Current liabilities (-) Bank overdraft

Quick liabilities 32000 (-) 20000

Quick liabilities 12000

Working note 3 : Current assets = Inventory + Trade receivable + Current investment + Prepaid expenses + Advance tax

Current assets = 20000 + 15000 + 6000 + 18000 + 6000

Current assets = 65000

Working note 4: Current liabilities = Bank overdraft + Trade payables + Other current liabilities

Current liabilities = 20000 + 5000 + 7000

32000

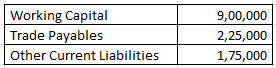

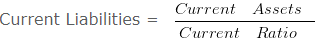

When current liabilities are given – Question 4

From the following information compute the current ratio.

Explanation : –

Current Ratio = 1300000/400000

Current Ratio = 3.25 :1

Workings:

Working Capital = Current assets (-) current liabilities

900000 = Current assets (-) 400000

Current assets = 1300000

Workings:

current liabilities = Trade Payables (+) Other Current Liabilities

current liabilities = 225000 (+) 175000

current liabilities = 400000

Determination of working capital – Liquidity Ratio – Question 5

From the following given information:

A firm had current assets of RS. 140000

it then paid a current liability of RS. 20000

After this payment, the current ratio was 3: 2

Determine the current liabilities and working capital after the payment.

Explanation: –

Working capital = Current assets (-) Current liabilities

= 120000 (-) 80000

= 40000

Workings:

Current Assets = 140000

Current Assets After the payment of RS. 20000 would be 140000 (-) 20000 = 120000

As the current ratio is 3: 2 and current assets are RS. 120000

3/2 = 120000/Current liabilities

Current liabilities = 240000/3

Current liabilities = 80000

Determination of working capital when current ratio is given – Question 6

From the following information:

A firm had current assets of RS. 225000

it then paid a current liability of RS. 45000

After this payment, the current ratio was 9: 7

Determine the current liabilities and working capital Before the payment.

Explanation: –

(i) Working capital = Current assets (-) Current liabilities

= 180000 (-) 140000

= 40000

Workings:

Current Assets = 225000

Current Assets After the payment of RS. 45000 would be 225000 (-) 45000 = 180000

As the current ratio is 9: 7 and current assets are RS. 180000

9/7 = 180000/Current liabilities

Current liabilities = 1260000/9

Current liabilities = 140000

Before the payment of liabilities of RS. 45000 total amount of

Current liabilities = 45000 + 140000

Current liabilities = 185000

Working capital = 40000

The liquid ratio on the basis of working capital – Liquidity Ratio – Question 7

Current Assets = Rs. 80000 . Inventory = Rs. 15000 . Prepaid Expenses = Rs. 50000 . Working Capital = Rs. 50000 Calculate Liquid Ratio.

Explanation : –

Liquid Assets = Current Assets (-) Inventory (-) Prepaid Expenses

Liquid Assets = 80000 (-) 15000 (-) 50000

Liquid Assets = 15000

Current Liabilities = 30000

Liquid Ratio = 15000/30000

Liquid Ratio = 0.5

Working Note 1 :

Current Liabilities = Current Assets (-) Working Capital

= 80000 (-) 50000

= 30000

Calculation of Liquid Ratio – Question 8

Current Assets of ABC Ltd. are Rs. 72000 and the current ratio is 1.2. The value of inventories is Rs. 27000. Calculate liquid ratio.

Explanation : –

OR

Current Liabilities = 72000/1.2

Current Liabilities = 60000

Quick Ratio = 45000/60000

Quick Ratio = 0.75

Working Notes:

Liquid Assets = Current Assets (-) Inventory

Liquid Assets = 72000 (-) 27000

Liquid Assets = 45000

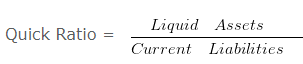

Current Ratio on the basis of Quick Ratio – Liquidity Ratio – Question 9

The value of the Inventory of HRD & Co. is Rs. 240000. Liquid Assets are Rs. 120000

Quick Ratio is 0.5. Calculate the current ratio.

Explanation: –

OR

Current Liabilities = 120000/0.5

Current Liabilities = 240000

Current Ratio = 360000/240000

Current Ratio = 1.5 :1

Working Notes:

Current Assets = Liquid Assets + Inventory

= 120000 + 240000

= 360000

Chapter 5 – Accounting Ratios