Money and Banking class 12 Notes covers various concepts about (a) Money used in the Indian economy (b) Role of commercial and central banks in supply of money and credit creation.

Money is the basic requirement of all economies . Prior to invention of money, world trade was conducted under the barter system of exchange, wherein one commodity was exchanged for another commodity. You can understand more about this aspect here : –

Money and Banking Class 12 Notes Economics: Overview

What is MONEY ?

Money is anything which is generally used as a medium of exchange, measure of value, store of value and means of standard deferred payment. In other words, money has the following characterstics : –

- It can be used as a medium of exchange ;

- It can be used as a measure of value ;

- It can be used as a store of value ; and

- It can be used as a means of standard deferred payment

Money covers all types of money: coins, paper notes, cheques, digital money, plastic money etc…. Money can be used to buy any product, services or other things. Where a particular form of money is legalised by the Government, it has to be accepted by everyone. The existence of money, removes the problem of double coincidence of wants , since a person can use money to buy another commodity, as the seller does not need to have a specific need, which can be fulfilled by buyer.

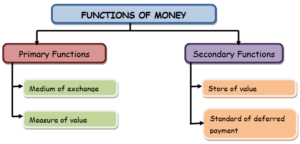

FUNCTIONS OF MONEY

The functions of money are broadly classified as:

- Primary Functions

- Secondary Functions

TYPES OF MONEY

- Legal Tender Money: Money which can be legally used to make payments for some obliged debt is known as legal tender money. It is of two types-

-

- Limited legal tender money: It is that form of legal money which is used to make payments for the debts up to a certain amount. For example; coins.

- Unlimited legal tender money: It is that form of legal money which can be used to make payment of debts up to any amount. There is no limit fixed. For example; paper/ currency notes.

- Full Bodied Money: It is that form of money in which face value is equal to intrinsic value of money. It means commodity value= money value. For example: gold and silver coins.

- Representative Full Bodied Money: It is that form of full bodied money in which intrinsic value is less than face value of money. It means commodity value< money value. For example: paper notes.

- Credit Money: It is that form of money whose intrinsic value is lower than its face value. It means that money value> commodity value. For example: credit cards, bank deposits etc….

MONETARY SYSTEM IN INDIA

- In India, monetary authority is ‘Reserve Bank of India’.

- Paper currency standard is followed in India.

- Coins are regarded as limited legal tender money.

- RBI has sole monopoly to issue currency in India.

- Ministry of Finance issues 1 rupee coins and notes in India.

- India follows Minimum Reserve System for issuing notes. It means that RBI has to keep a minimum of Rs. 200 crores as gold and foreign exchange with the World Bank for issuing coins and notes.

MONEY SUPPLY

Money supply refers to the total money held by public at a particular point of time in an economy.

It includes money only held by the “public” not the government or banking system. Money supply is a “Stock” concept.

There are 4 measures of money supply. As per money and banking class 12 we need to cover only M1 measure of money supply.

MEASURES OF MONEY SUPPLY

(i) M1: It is the first and basic measure of money supply. It includes currency held by the public, demand deposits of commercial banks and other deposits with the RBI.

M1= Currency and coins with public+ Demand deposits with commercial banks+ Other deposits with RBI

(ii) M2: It is a broader concept of money supply as compared to M1. It also includes savings deposits with the post office saving bank.

M2 = M1 + Savings deposit with Post office saving bank

(iii) M3: It also includes net time deposits in addition to M1 measure of money supply.

M3 = M1 + Net time deposits with banks

(iv) M4: It includes total deposits with post office savings bank in addition to M3 measure of money supply.

M4 = M3 + Total deposits with post office saving bank

- M1 is the most liquid form of money supply while M4 is the least liquid.

- M1 and M2 are considered the narrow concept of money supply while M3 and M4 are the broader concept of money supply.

HIGH POWERED MONEY

- High powered money is the money produced by RBI and the government.

- It includes currency held by the public and the cash reserves held by the banks.

- It is denoted by symbol (H).

- It is different from money because money consists of demand deposits while it includes cash reserves which act as a base for generating demand deposits.

BANKING

There are mainly 2 types of banks, Commercial Banks and Central Banks. In money and banking class 12 we will study about the functions of both banks and the credit creation process of commercial banks.

COMMERCIAL BANKS

A commercial bank is a bank which accepts deposits and advance loans for the purpose of earning profits. For example: SBI, PNB, Canara Bank, Kotak Mahindra Bank etc….

CREDIT CREATION PROCESS

This is an important activity of commercial bank. Through this process, commercial banks create credit, which is created through excess reserves of the initial deposits.

There are two main assumptions

1. The entire banking system is one unit known as “BANK”.

2. All the receipts and payments in the economy is done through the Banks.

For the credit creation, commercial banks are legally required to keep a certain fraction of deposits with RBI and themselves. This fraction is called Legal Reserve Ratio (LRR).

The bank knows that all the customers will not come in one go to withdraw their money and that there is a constant flow of money with the bank. That’s why only a fraction of deposits are kept as reserve.

- Money creation is an important aspect of money and banking class 12. Let us take a hypothetical example to understand this concept.

- Let us assume that LRR= 10% and Initial deposits= Rs. 100.

- Now, the banks will keep 10% of Rs. 100 as reserve and give the rest Rs.90 as loan to the public in round 1.

- In round 2, banks will keep 10% of Rs. 90 as reserve and give Rs. 81 as loan to public.

- This process goes on and on till the reserves are exhausted. In this way, commercial banks create multiple credits with just the initial deposit.

- This gives rise to the concept of “Money Multiplier”.

- “Money Multiplier” or deposit multiplier measures the amount of deposits the commercial banks are able to create through the deposits of public kept with them as reserves.

Money Multiplier = 1/LRR - In this case, money multiplier is 1/10% = 10.

| Deposits (Rs) | Loans (Rs) | Cash Reserves (LRR = 10%) (Rs.) | |

| Initial Deposits | 100 | 90 | 10 |

| Round 1 | 90 | 81 | 9 |

| Round 2 | – | – | – |

| – | – | – | – |

| – | – | – | – |

| Total | 1000 | 900 | 100 |

Total Deposits= = 100*10= Rs. 1000

CENTRAL BANKS

Central bank is the ‘apex’ body that controls, regulates and operates the entire banking system in the country. In India, the central bank is RBI.

FUNCTIONS OF CENTRAL BANK

- Bank of issue: Central bank has the sole authority to issue currency notes and coins (except one rupee notes and coins). The central bank is obliged to keep the reserves in terms of gold equal to the amount of currency issued with the World Bank. It leads to uniformity in note circulation. It gives the power to Central Bank to enhance the money supply. It also helps in maintaining stability in value of money.

- Bankers to Government: The RBI acts as a banker, agent and a financial advisor to the central and state government. As a banker, it carries out all the banking business of the government. As an agent, it manages the public debt. As a financial advisor, it advices the government from time to time in financial and monetary matters.

- Banker’s Bank: Being the apex bank, central bank acts as a banker to all other banks. Other banks in the economy keep their reserves with the RBI. It has same relationship with other banks as the commercial banks have with the public. It obliges the commercial banks to keep CRR with them during the credit creation process.

- Custodian of Foreign Exchange: Central banks keep the reserves of foreign currency with themselves so that there is no excess increase or decrease in price of foreign currency. Central bank does this so that foreign reserves are available to the public.

- Lender of Last Resort: When commercial banks fail to meet the needs of the public, then RBI helps the commercial banks and the public by advancing loans to them and acts as a lender of last resort.

- Clearing House: Central bank has the reserves of commercial banks with themselves. All commercial banks have their accounts with the RBI. Therefore, RBI can make settlement of claims of various banks against each other by editing the entries in their accounts.

- Supervisor: Central bank regulates and controls the commercial banks. It exercises regular inspection and of banks and entries passed by them.

CONTROL OF CREDIT AND MONEY SUPPLY

There are TWO ways of controlling the credit creation in the market: Quantitative measure and Qualitative measures.

QUANTITATIVE MEASURES

- Repo Rate: It is the rate at which central bank gives money to commercial banks for short- term purpose without any collateral. An increase in repo rate reduces the capability of commercial banks to lend money and thus decreases money supply in the economy. A decrease in repo rate increases the money supply in the economy.

- Bank Rate: It is the rate at which central bank lends money to commercial banks for long- term purpose by keeping something as collateral. An increase in bank rate will decrease the lending capacity of commercial banks and thus reduces money supply in the economy. A decrease in bank rate increases the money supply in the economy.

- Reverse Repo Rate: It is the rate at which commercial banks keep their reserves with central bank in order to earn interest willfully. An increase in reverse repo rate induces commercial banks to keep reserves with central bank rather than giving to public. So, money supply decreases in the economy. A decrease in reverse repo rate increases the money supply in the economy.

- Legal Reserve Ratio (LRR): It is the amount of deposits which the commercial banks are obliged to keep with themselves and the central bank for credit creation process. There are two parts of LRR: CRR and SLR.

-

- Cash Reserve Ratio (CRR): It is the amount of deposits which the commercial banks are obliged to keep with the central bank for creating credit in the economy. An increase in CRR decreases money supply in economy and decrease in CRR increases money supply in the economy.

- Statutory Liquidity Ratio (SLR): It is the amount of deposits which the commercial banks are obliged to keep with themselves for the credit creation process. An increase in SLR decreases money supply in economy and decrease in SLR increases money supply in the economy.

QUALITATIVE MEASURES

- Open Market Operations: It refers to the sale and purchase of securities in the open market by the central bank to/from commercial banks or public. Purchase of securities by central bank increases the bank capacity to give credit as it receives money and thus it increases the money supply in the economy. Sale of securities by commercial banks soaks the excess money from the economy and thus reduces the money supply in the market.

- Margin Requirement: It refers to the difference between the amount of loan and the market value of the securities offered against the loan. An increase in margin reduces the borrowing capacity and reduces the money supply in the economy. A decrease in margin increases the borrowing capacity and increases the money supply in the economy.

DIFFERENCE BETWEEN COMMERCIAL BANK AND CENTRAL BANK

| Basis | Central Bank | Commercial Bank |

| Meaning | Central Bank is the ‘apex’ body that controls, regulates and operates the entiresbanking system in the country. | A commercial bank is a bank which accepts deposits and advance loans for the purpose of earning profits. |

| Ownership | Owned and governed by government | Owned and governed by private sector. |

| Objective | Operates in public interest. | Operates to maximize profits. |

| Issue of Currency | Sole monopoly to issue currency. | No powers to issue currency. |

| Public Dealing | Does not deal directly with public | Deals directly with public. |

| Number of Banks | There is only one central bank in every country. | There are multiple commercial banks in a country. |

| Examples | Reserve Bank of India (RBI) | PNB, SBI, Kotak Mahindra, ICICI etc…. |

CBSE Economics Class 12 Notes Term I Syllabus

Part A: Introductory Macroeconomics

- Money and Banking Class 12 Notes

- Government Budget and the Economy Notes

- Balance of Payments Class 12 Notes

- Foreign Exchange Rate Notes

Part B: Indian Economic Development

Development Experience (1947-90) and Economic Reforms since 1991:- 12 Marks

- Indian Economy on the eve of Independence Notes

- Indian Economy (1950-90) Notes

- Economic Reforms since 1991 Notes

Current challenges facing Indian Economy – 10 Marks