Not for profit Organizations NPO Class 12 MCQ with Answers are covered in this Article. Not for profit Organizations NPO Class 12 MCQ Test contains 35 questions. Answers to MCQ on Not for profit Organizations NPO Class 12 Accountancy are available at the end of the last question. These MCQ have been made for Class 12 students to help check the concept you have learnt from detailed classroom sessions and application of your knowledge.

Not for profit Organizations NPO Class 12 MCQ with Answers

1.What will be effect of Audit Fee Paid in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (b) Shown in Credit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Audit Fee Paid is shown in the Credit Side of Receipts And Payments Account.

2.What will be effect of Depreciation on furniture in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (c) No Effect in Receipts and Payments Account

Explanation: Expenses or incomes which do not involve any cash flow are not shown in Receipts and Payments Account.

3.What will be effect of Entertainment Expenses in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (b) Shown in Credit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Entertainment Expenses is shown in the Credit Side of Receipts And Payments Account.

4.What will be effect of General Donation in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (a) Shown in Debit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, General Donation is shown in the Debit Side of Receipts And Payments Account.

5.What will be effect of Hall Rent Received for Previous and Current Year in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (a) Shown in Debit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Hall Rent Received is shown in the Debit Side of Receipts And Payments Account.

6.What will be effect of Insurance in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (b) Shown in Credit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Insurance is shown in the Credit Side of Receipts And Payments Account.

7.What will be effect of Interest on Investment in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (a) Shown in Debit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Interest on Investment is shown in the Debit Side of Receipts And Payments Account.

8.What will be effect of Lecturer’s Honorarium in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (b) Shown in Credit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Lecturer’s Honorarium is shown in the Credit Side of Receipts And Payments Account.

9.What will be effect of Life Membership Fees in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (a) Shown in Debit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Life Membership Fees is shown in the Debit Side of Receipts And Payments Account.

10.What will be effect of Locker’s Rent received in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (a) Shown in Debit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Locker’s Rent received is shown in the Debit Side of Receipts And Payments Account.

Not for profit Organizations NPO Class 12 MCQ with Answers

11.What will be effect of Miscellaneous Payments in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (b) Shown in Credit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Miscellaneous Payments is shown in the Credit Side of Receipts And Payments Account.

12.What will be effect of Municipal Taxes paid in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (b) Shown in Credit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Municipal Taxes paid is shown in the Credit Side of Receipts And Payments Account.

13.What will be effect of Rent Paid for Current Year in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (b) Shown in Credit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Rent Paid is shown in the Credit Side of Receipts And Payments Account.

14.What will be effect of Repairs in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (b) Shown in Credit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Repairs is shown in the Credit Side of Receipts And Payments Account.

15.What will be effect of Sale of Fixed Assets in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (a) Shown in Debit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Sale of Fixed Assets is shown in the Debit Side of Receipts And Payments Account.

16.What will be effect of Sale of old Newspapers in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (a) Shown in Debit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Sale of old Newspapers 0 is shown in the Debit Side of Receipts And Payments Account.

17.What will be effect of Sale of Old Used Sports Material in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (a) Shown in Debit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Sale of Old Used Sports Material is shown in the Debit Side of Receipts And Payments Account.

18.What will be effect of Sports Equipment purchased in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (b) Shown in Credit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Sports Equipment purchased is shown in the Credit Side of Receipts And Payments Account.

Not for profit Organizations NPO Class 12 MCQ with Answers

19.What will be effect of Subscription Received for Previous Year in Receipts and Payments Account ?

(a) Shown in Debit Side of Receipts and Payments Account

(b) Shown in Credit Side of Receipts and Payments Account

(c) No Effect in Receipts and Payments Account

Answer

Answer: (a) Shown in Debit Side of Receipts and Payments Account

Explanation: All cash inflows will be shown in the Receipts side i.e. on the Debit side and all cash outflows will be shown in the Payments side i.e. on the Credit Side of Receipts and Payments Account. Hence, Subscription Received is shown in the Debit Side of Receipts And Payments Account.

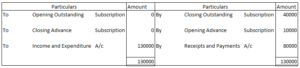

20. From the following account, calculate the amount to be shown in Receipts and Payments Account as on 31-12-2020:

Total subscription receivable during the year = Rs. 130000

Subscription outstanding as on 31-12-2020 = Rs. 40000

Subscription received in advance as on 31-12-2019 = Rs. 10000

(a)Rs. 160000

(b) Rs. 130000

(c) Rs. 80000

(d) None of the above

Answer

Answer: (c) Rs. 80000

Explanation:

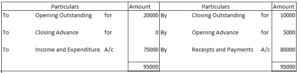

21.From the following account, calculate the amount to be shown in Income and Expenditure Account as on 31-12-2020:

Subscription received during the year = Rs. 80000

Subscription outstanding as on 31-12-2019 = Rs. 2000

Subscription outstanding as on 31-12-2020 = Rs. 10000

Subscription received in advance as on 31-12-2019 = Rs. 5000

(a) Rs. 80000

(b) Rs. 75000

(c) Rs. 60000

(d) None of the above

Answer

Answer: (b) Rs. 75000

Explanation:

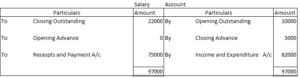

22.From the following account, calculate the amount to be shown in Receipts and Payments Account as on 31-12-2020

Salary payable for the year = Rs. 82000

Salary outstanding as on 31-12-2019 = Rs. 22000

Salary outstanding as on 31-12-2020 = Rs. 10000

Salary paid in advance as on 31-12-2019= Rs. 5000

(a) Rs. 82000

(b) Rs. 75000

(c) Rs. 58000

(d) None of the above

Answer

Answer: (b) Rs. 75000

Explanation:

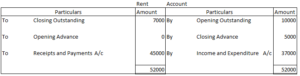

23.From the following account, calculate the amount to be shown in Income and Expenditure Account Account as on 31-12-2020:

Rent paid for the year = Rs. 45000

Rent outstanding as on 31-12-2019 = Rs. 7000

Rent outstanding as on 31-12-2020 = Rs. 10000

Rent received in advance as on 31-12-2019 = Rs. 5000

(a) Rs. 37000

(b) Rs. 43000

(c) Rs. 45000

(d) None of the above

Answer

Answer: (c) Rs. 45000

Explanation:

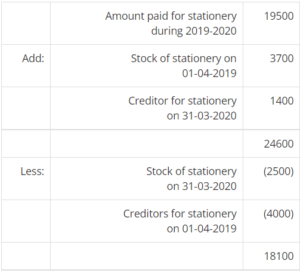

24.On the basis of below given information, calculate the amount of Stationery consumed during the year ending 31-03-2020 :

Stock of Stationery on 1-04-2019 = Rs. 3700

Creditors for Stationery on 1-04-2019 = Rs. 4000

Amount paid for Stationery during 2019 – 2020 = Rs. 19500

Stock of Stationery on 31-03-2020 = Rs. 2500

Creditors for Stationery on 31-03-2020 = Rs. 1400

(a) Rs. 18100

(b) Rs. 24600

(c) Rs. 26100

(d) None of the above

Answer

Answer: (a) Rs. 18100

Explanation:

Calculation of amount of stationery consumed during the year ending 31-3-2020:

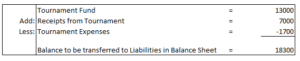

25.Based on the information given below, the amount that will be transferred to the Balance Sheet of Not-For-Profit Organization will be ________________.

Tournament Fund = Rs. 13000

Tournament Expenses = Rs. 1700

Receipts from Tournament = Rs. 7000

(a) Rs. 7700

(b) Rs. 18300

(c) Rs. 13000

(d) None of the above

Answer

Answer: (b) Rs. 18300

Explanation:

Not for profit Organizations NPO Class 12 MCQ with Answers

26.Advance Rent is a/an __________________.

(a) Capital

(b) Liability

(c) Asset

(d) None of the above

Answer

Answer: (c) Asset

Explanation: Rent paid in advance is the expense related to next year. Therefore, it is shown in the asset side of balance sheet.

27. Capital Fund is ___________________________.

(a) Excess of Assets over Liabilities

(b) Excess of Liabilities over Assets

(c) Equal to Assets and Liabilities

(d) None of the above

Answer

Answer: (a) Excess of Assets over Liabilities

Explanation: Assets = Liabilities + Capital Fund

28.Income and Expenditure Account is _________________ account.

(a) Personal

(b) Real

(c) Nominal

(d) None of the above

Answer

Answer: (c) Nominal

Explanation: Income and Expense account shows receipts and payments of the current year. Hence, it is a nominal account

29.Outstanding Rent is a/an ____________________.

(a) Capital

(b) Liability

(c) Asset

(d) None of the above

Answer

Answer: (b) Liability

Explanation: Outstanding rent is the expense for the current year which has not been paid. hence, it is shown in the liability side of balance sheet.

30.Outstanding Subscription is a/an ___________________.

(a) Capital

(b) Liability

(c) Asset

(d) None of the above

Answer

Answer: (c) Asset

Explanation: Outstanding subscription the income of the year which has not been received. Hence, it is shown in the asset side of balance sheet.

31.Prepaid Salary is a/an _________________.

(a) Capital

(b) Liability

(c) Asset

(d) None of the above

Answer

Answer: (c) Asset

Explanation: Prepaid salary is the expense related to next year which has been paid in the current year. Hence, it is shown in the asset side of the balance sheet.

Not for profit Organizations NPO Class 12 MCQ with Answers

32.Receipts and Payments Account is _______________ account.

(a) Personal

(b) Real

(c) Nominal

(d) None of the above

Answer

Answer: (b) Real

Explanation: Receipt and Payment Account is a real account as it follows the rule of real accounts, “Debit what comes in, Credit what goes out”.

33.The balance of Income and Expenditure Account is either _________________ or _________________.

(a) Net Profit, Net Loss

(b) Surplus, Deficit

(c) None of the above

Answer

Answer: (b) Surplus, Deficit

Explanation: When the revenue generated by a non-trading or non-profitable organisation exceeds total expenditure incurred in a financial year, Income & Expenditure account shows a surplus balance. It is usually termed as excess income over expenditure. And vice versa in case of deficit.

34.Which of the following is a category of fund for Not-For-Profit Organisation?

(a) Restricted Fund and Unrestricted Fund

(b) Expense Fund and Income Fund

(c) Limited Fund and Unlimited Fund

(d) All of the above

Answer

Answer: (a) Restricted Fund and Unrestricted Fund

Explanation: Since, the organizations restrict some funds for specific purposes and some for general purposes, there are two categories of fund- Restricted Fund and Unrestricted Fund.

35.Which of the following is not a part of financial statement of Not-for-Profit Organisations?

(a) Profit and Loss Account

(b) Receipts and Payments Account

(c) Income and Expenditure Account

(d) Balance Sheet

Answer

Answer: (a) Profit and Loss Account

Explanation: Since, not for profit organizations do not work with profit motive, they prepare Income and Expenditure Account instead of Profit and Loss Account.