Profitability

The profitability or financial performance is mostly summed up in the statement of profit and loss. Profitability ratios are determined to analyze the earning capacity of the business which is the result of the utilization of assets employed in the business. There is a close connection between the profit and the productivity with which the assets are utilized in the business are used.

The different ratios which are generally used to analyze the profitability of the business are:

- Gross Profit Ratio

- Operating Ratio

- Net Profit Ratio

- Operating Profit Ratio

- Earning Per Share

- Return on Investment (ROI) or Return on Capital Employed (ROCE)

- Return on Shareholders’ Funds

- Book Value per Share

- Dividend Payout Ratio

- Price / Earnings Ratio:

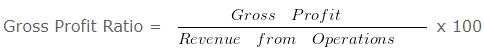

Profitability Ratios – Gross Profit Ratio

This ratio establishes a relationship between Gross profit and revenue from Operations i.e. Net Sales.

Gross Profit = Revenue from Operations – Cost of Revenue from Operations

Cost of Revenue from Operations = Opening Inventory + Purchases + Carriage Inward + Wages + Other Direct Charges – Closing Inventory

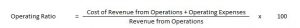

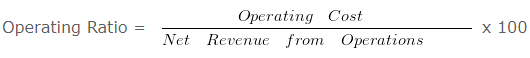

Profitability Ratios – Operating Ratio

This ratio compares an enterprise’s cost of revenue from operations and operating expenses to its revenue from operations.

Cost of Revenue from Operations = Opening Inventory + Purchases + Carriage Inward + Wages + Other Direct Charges – Closing Inventory

Operating Expenses = Employee Benefits Expense + Depreciation Expense + Other Expense

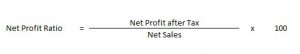

Profitability Ratios – Net Profit Ratio

This ratio establishes a relationship between Net profit and revenue from Operations i.e. Net Sales.

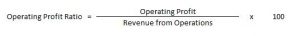

Profitability Ratios – Operating Profit Ratio

Operating Profit = Gross Profit – Other Operating Expenses + Other Operating Incomes

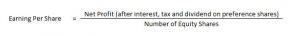

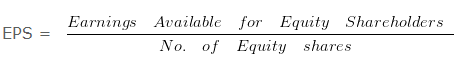

Profitability Ratios – Earning Per Share

Earning per share helps in calculating the profitability of the company.

Return on Investment (ROI) or Return on Capital Employed (ROCE):

It signifies how much return is generated by using the assets of an enterprise. Capital employed implies the funds invested in the business for the long term like share capital, debentures, and long-term loans. Then again, capital employed might be calculated by taking the aggregate of the assets side, i.e., non-current assets and working capital.

Along these lines, it is computed as follows:

Return on Investment (or Capital Employed) = (Profit before Interest and Tax)/(Capital Employed × 100)

Return on Shareholders’ Funds:

Shareholders are interested in knowing whether the investment made by them in the company is generating returns or not.

Also, only generation of returns is not sufficient, it is supposed to be higher than the return on investment else it would suggest that the organization’s assets have not been utilized gainfully.

Return on Shareholders’ Fund = (Profit after Tax/Shareholders’ Funds) x 100

Book Value per Share:

To calculate the value of shares as per the books, this ratio is used.

Book Value per share = Equity shareholders’ funds/Number of Equity Shares

Equity shareholder fund can be calculated as Shareholders’ Funds – Preference Share Capital. This ratio signifies the value of shareholders’ holding in the company and its effect on the market prices.

Dividend Payout Ratio:

This refers to the proportion of earnings that are distributed to the owners of the company, i.e., the shareholders. It is determined as:

Dividend Payout Ratio = Dividend per share/Earnings per share

Price / Earnings Ratio:

The ratio is computed as –

P/E Ratio = Market Price of a share/Earnings per share

It evaluates the growth of the company with respect to the industry it is a part of. It highlights the expectations of the investors and the movement of share price in the stock market.

Calculation of Earning Per Share

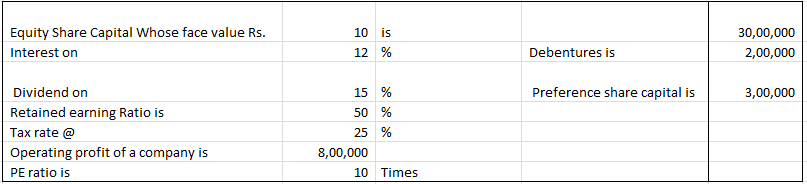

Profitability Ratios – Questions 1: –

On the basis of the following data calculate earning per share

Explanation: –

EBIT = 800000

Less: Interest on Debentures = 200000

EBT = 600000

Less: Tax = 150000

EAT = 450000

Less: Preference Dividend = 300000

Earnings for Equity Shareholders = 150000

Less: Retained Earnings = 75000

Dividend Paid = 75000

= 150000/300000

= 0.5 Per share

Gross Profit Ratio, Operating Ratio & Operating Profit Ratio

Profitability Ratios – Question 2: –

The following information is given

If Revenue from Operations of XYZ Ltd is Rs. 1000000 Cost of Revenue from Operations is Rs. 450000 Selling Expense is Rs. 80000 Administrative Expenses is Rs. 60000

Calculate- Gross Profit Ratio ,Operating Ratio , Operating Profit Ratio

Explanation : –

Gross Profit Ratio= 550000/1000000 x 100 = 55%

Operating Ratio = 590000/1000000 x 100

Operating Ratio = 59 %

= 100 (-) Operating Ratio

= 100 (-) 59

Operating Profit Ratio = 41 %

Working Notes:

Gross Profit = Revenue from Operations (-) Cost of Revenue from Operations

Gross Profit = 1000000 (-) 450000

Gross Profit = 550000

Operating Cost = Cost of Revenue from Operations + Selling Expenses + Administrative Expenses

Operating Cost = 450000 + 80000 + 60000

Operating Cost = 590000

Chapter 5 – Accounting Ratios