Provisions

The books of accounts of an organisation are generally based on accrual basis of accounting, which is also known as the mercantile system of bookkeeping. The accrual concept of accountancy specifies that all expenses and losses relating to the current year should be booked in this year itself and similarly all incomes and profits arising this year should be booked in the current year.

However, there are certain circumstances in which expenses/losses which are related to the current accounting period cannot be measured accurately as they have not been incurred yet and therefore their amount is not known with certainty. These expenses/losses point towards the need to make provision of such amounts so that true net profit for the year can be ascertained.

For example, a trader of goods who makes credit sales as a normal course of business is very well aware of the fact that some of his debtors of the current period would not pay the amount either in full or partially, i.e., make a default.

Since such cases arise during the regular business operations, it becomes mandatory to take into account this loss so as to calculate true profit/loss according to the principle of Prudence or Conservatism. Therefore, to meet the expected loss that might arise at the time of realisation from debtors, the trader creates a Provision for Doubtful Debts.

Similarly, other provisions that are created by a business organisation are –

- Provision for depreciation to charge depreciation cost evenly;

- Provision for bad and doubtful debts to meet any loss at the time of realisation;

- Provision for taxation to meet the tax related obligations;

- Provision for discount on debtors to provide for any discount that might be given to debtors for making early payment;

- Provision for repairs and renewals to provide for any future expected repairs of the fixed assets.

- Provisions are recorded on the debit side of the profit and loss account as they are a charge against the current period revenue. In the balance sheet, the provision can be shown either:

- By showing the assets at the net amount i.e., by way of deducting from the concerned asset For example, provision for depreciation is shown by deducting from the fixed assets;

- By showing under the current liabilities i.e., directly as provision for depreciation.

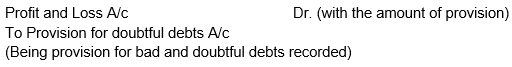

Journal entry for creating provision for bad and doubtful debt –

Thus, to ensure proper matching of revenue and expenses and fair/ true calculation of profit and loss following the principle of prudence or conservatism, it is necessary to make provisions for expenses that are not yet incurred. Provisions are based on estimated figures.

Chapter 7 – Depreciation, Provisions and Reserves – CBSE Class 11 Accountancy

- Depreciation and other Similar Terms

- Causes of Depreciation

- Need for Depreciation

- Factors Affecting the Amount of Depreciation

- Methods of Calculating Depreciation Amount

- Comparative Analysis

- Methods of Recording Depreciation

- Disposal of Asset

- Effect of any Addition or Extension to the Existing Asset

- Provisions

- Reserves