Retirement/Death of a Partner implies that the original structure of the partnership firm is discontinued from the happening of either of the two events. This implies that the agreement between the partners comes to an end because of the change in the partners of the firm.

This change in the partnership deed due to retirement/death of a partner leads to reconstitution of a partnership firm. In such a scenario, there is a requirement of drafting a new partnership deed so as to continue the business of the firm.

Thus, the following steps are to be taken during retirement/death of a partner-

- Formation of a new partnership deed to accommodate the changed circumstances,

- Ascertain the amount due to the retiring partner after carrying out appropriate adjustments in respect of goodwill, capital amount, drawings, interest, any revaluation of assets or liabilities and accumulated profits or losses.

- Ascertain the amount due to the legal representative of the deceased partner after carrying out appropriate adjustments in respect of goodwill, capital amount, drawings, interest, any revaluation of assets or liabilities and accumulated profits or losses.

- Computation of new profit sharing ratio among the partners,

- Calculation of any gaining ratio.

The retirement/death of a partner leads to alteration in the structure of the firm. This leads to reconstitution of the partnership firm and in the process a few activities are undertaken to ascertain the amount due, the new profit sharing ratio, etc.

Retirement of Partners Accounts Problems – Adjustment of Capital Account of Partners

Question 1 : –

D , E and F are partners sharing profits and losses in the ratio of 1 , 2 and 1 respectively. After all adjustments on E s retirement from with respect to General Reserve , Goodwill and Revaluation etc. the balances in their capital accounts stood at Rs. 80000 , 40000 and 10000 respectively.It was decided that the amount payable to E will be brought by D and F in such a way as to make their capital proportionate to their profit sharing ratio. What will be the amount to be brought in by D and F ?

Explanation : –

Adjusted old capitals of continuing partners i.e D and F = 80000 and 40000

Calculation of total capital of the new firm:

Adjusted capital of D = 80000

Adjusted capital of F = 40000

Amount payable to E = 10000

Total capital of new firm = 130000

New profit sharing ratio between D and F after retirement of E = 1 : 1

Calculation of new capitals of the continuing partners:

D s new capital = 130000 X 1/2 = 65000

F s new capital = 130000 X 1/2 = 65000

Amount to be brought in or withdrawn by A

New capital = 65000

Adjusted capital (given) = 80000

Cash brought in/paid off = -15000

Amount to be brought in or withdrawn by C

New capital = 65000

Adjusted capital (given) = 40000

Cash brought in/paid off = 25000

D will withdraw Rs. 15000 and F will bring Rs. 25000

Retirement of Partners Accounts Problems – Adjustment of Capital when total capital of the new firm is given

Question 2 : –

D , E and F are partners sharing profits and losses in the ratio of 2 , 1 and 1 respectively. E retired from the firm and adjusted capitals of D and F on the date of retirement was Rs. 120000 and 80000 respectively.The entire capital of the new firm is fixed at Rs. 300000 .What will be the necessary entry for cash to be paid off or to be brought in by D and F to make their total capital equal to new capital of the firm.

Explanation : –

New ratio between D and F after the retirement of E = 2/3 : 1/3

Total capital of the new firm = 300000

New capital of D = 200000 ( 300000 X 2/3 )

Less: Adjusted capital of D = 120000

Deficiency = 80000

New capital of F = 100000 ( 300000 X 1/3 )

Less: Adjusted capital of F = 80000

Deficiency = 20000

Cash/Bank A/c Dr 80000

To D s Capital A/c 80000

Cash/Bank A/c Dr 20000

To F s Capital A/c 20000

Retirement of Partners Accounts Problems – Adjustment of capital when total capital of new firm is not given

Question 3 : –

D , E and F are partners sharing profits and losses in the ratio of 2 , 2 and 1 respectively. E retired from the firm and adjusted capitals of D and F on the date of retirement was Rs. 50000 and Rs. 70000 .It was decided to adjust the capitals of D and F in there profit sharing ratio. What will be the necessary journal entry to record cash brought or withdrawal by remaining partners?

Explanation : –

New ratio between D and F after the retirement of E = 2/3 : 1/3

Total capital of the new firm = Adjusted capital of D + Adjusted capital of F

= 50000 + 70000

= 120000

New capital of continuing partners and Surplus/ Deficiency:

New Capital of D = 50000 ( 120000 X 2/3 )

Less: Adjusted capital of D = 50000

Deficiency = 30000

F = 70000 ( 120000 X 1/3 )

Less: Adjusted capital of F = 70000

Surplus = -30000

Cash/Bank A/c Dr 30000

To D s Capital A/c 30000

F s Capital A/c Dr 30000

To Cash/Bank A/c 30000

Retirement of Partners Accounts Problems – Calculate the Amount Due to Retiring Partner

Question 4 : –

A , B and C are partners sharing profits and losses in the ratio of 1/5 : 2/5 : 2/5. A retired from the firm and on the date of retirement his capital was Rs. 300000 Balance of General Reserve- Rs. 400000 .Profit on Revaluation of assets and liabilities-Rs. 30000 what is the amount due to A on his retirement.

Explanation : –

Amount due to A

Balance of his Capital Account = 300000

Share in General Reserve- Rs. = 400000 X 1/5 = 80000

Share in Revaluation = 30000 X 1/5 = 6000

Total = 386000

Retirement of Partners Accounts Problems – Amount due to retiring partner transferred to his loan account

Question 5 : –

A , B and C are partners sharing profits and losses in the ratio of 2 , 2 and 1 respectively. B retired from the firm and his capital on the date of retirement was Rs. 100000 Profit on Revaluation of assets and liabilities was Rs. 5000 and General Reserve was Rs . 7000 . What will be the journal entry for transferring the amount due to B in his loan account?

Explanation : –

Calculation of total amount due to B :

Balance of capital on retirement = 100000

Share in General Reserve = 7000 X 2/5 = 2800

Share in Revaluation = 5000 X 2/5 = 2000

Total amount due = 104800

B s Capital A/c Dr 104800

To B s Loan A/c 104800

Retirement of Partners Accounts Problems – Entire partnership profit share of retiring partner taken by one partner

Question 6 : –

D , E and F are partners sharing profits and losses in the ratio of 3 : 2 : 2 . B has retired from the firm and his share is taken by C . What will be the new profit sharing ratio between partners?

Explanation : –

C s new share of profit = Old share + Share taken from B

= 3/7 + 2/7

= (3+2)/7

= 5/7

D s new share of profit = 3/7 Same as before

New ratio of D and C = 3/7 : 5/7

= 3 : 5

Retirement of Partners Accounts Problems – Calculating Gaining Ratio

Question 7 : –

A , B and C are partners sharing profits and losses in the ratio of 3/6 : 2/6 : 1/6 B retired from the firm. What will be the gaining ratio between remaining partners?

Explanation : –

New Ratio between A and C after retirement of B = 3/4 : 1/4

Gaining Ratio = New Ratio – Old Ratio

A s Gaining Ratio = 3/4 – 3/6 = (9-6)/12 = 3/12

N s Gaining Ratio = 1/4 – 1/6 = (3-2)/12 = 1/12

Gaining Ratio = 3 : 1

Retirement of Partners Accounts Problems – Calculate Gaining Ratio of Existing partners

Question 8 : –

D , E and F are partners sharing profits and losses in the ratio of 2 : 3 : 2 F retired from the firm and surrendered 2/9th of his share of profit to D and remaining in favour of E . What will be the gaining ratio between D and E ?

Explanation : –

Old ratio between D, E and F = 2 : 3 : 2

Share surrendered by F in favour of D =2/7 X 2/9 = 4/63

Share surrendered by F in favour of E = 2/7 – 4/63 = (18- 4)/63 = 14

Gaining ratio = The ratio in which the continuing partners acquire the outgoing (retired ) partner share

New share – Old share

Gaining ratio between D and E =4/63 : 14/63

= 4 : 14

Retirement of Partners Accounts Problems – Calculate Gaining ratio when old profit sharing ratio and new profit sharing ratio given

Question 9 : –

D, E and F are partners sharing profits and losses in the ratio of 1 : 2 : 1 F retired from the firm and D and E decide to share future profits and losses in the ratio of 1 : 2 . What will be the gaining ratio between partners?

Explanation : –

Old ratio between D , E and F = 1/4 : 2/4 : 1/4

New ratio between D and E = 1/3 : 2/3

Gaining ratio = New ratio – Old ratio

For D = 1/3 – 1/4 = (4-3)/12 = 1/12

For E = 2/3 – 2/4 = (8-6)/12 = 2/12

= 1 : 2

Retirement of Partners Accounts Problems – Gaining share of existing partner

Question 10 : –

A , B and C are partners sharing profits and losses in the ratio of 2/7 : 3/7 : 2/7 B retired from the firm. What will be the gaining share of A ?

Explanation : –

New Ratio between A and C after retirement of B = 2/4 : 2/4

A s Gaining Share = 2/4 – 2/7 = (14 – 8)/28 = 6/28

Retirement of Partners Accounts Problems – Gaining share of existing partner – I

Question 11 : –

A , B and C are partners sharing profits and losses in the ratio of 2/4 : 1/4 : 1/4 B retired from the firm. What will be the gaining share of C ?

Explanation : –

New Ratio between A and C after retirement of B = 2/3 : 1/3

C s Gaining Share = 1/3 – 1/4 = (4 – 3)/12 = 1/12

Gaining share of existing partner-II

Question 12 : –

C, D and E are partners sharing profits and losses in the ratio of 2 : 1 : 1 E retired from the firm and surrendered 1/3th of his share of profit to C and remaining in favour of D .Calculate the gaining share of D .

Explanation : –

Old ratio between C , D and E = 2 : 1 : 1

Share surrendered by E in favour of C = 1/4 X 1/3 = 1/12

Share surrendered by E in favour of D = 1/4 – 1/12 = (3-1)/12= 2/12

Gaining share when old ratio and new ratio given

Question 13 : –

D, E and F are partners sharing profits and losses in the ratio of 3 : 2 : 1 . F retired from the firm and D and E decide to share future profits and losses in the ratio of 1 : 1 . What will be the gaining share of E ?

Explanation : –

Old ratio between D , E and F = 3/6 : 2/6 : 1/6

New ratio between D and E = 1/2 : 1/2

Gaining ratio = New ratio – Old ratio

Gaining Share of D = 1/2 – 2/6 = (3-2)/6 = 1/6

Gaining share when old ratio and new ratio given-I

Question 14 : –

D, E and F are partners sharing profits and losses in the ratio of 3 : 2 : 1 . F retired from the firm and D and E decide to share future profits and losses in the ratio of 2 : 1 . What will be the gaining share of D ?

Explanation : –

Old ratio between D , E and F = 3/6 : 2/6 : 1/6

New ratio between D and E = 2/3 : 1/3

Gaining ratio = New ratio – Old ratio

Gaining Share of D 2/3 – 3/6 = (4 – 3)/6 = 1/6

Retirement of Partners Accounts Problems – New Profit Sharing Ration – Gains of continuing partners are separately given

Question 15 : –

C, D and E are partners sharing profits and losses in the ratio of 2 : 1 : 1 E retired from the firm and surrendered 1/5th of his share of profit to C and remaining in favour of D . Calculate the new profit sharing ratio of C and D .

Explanation : –

Old ratio between C , D and E = 2 : 1 : 1

Share surrendered by E in favour of C = 1/4 X 1/5 = 1/20

Share surrendered by E in favour of D = 1/4 – 1/20 = (5 – 1)/20 = 4/20

New share of C = 2/4 + 1/20 = (10 + 1)/20 = 11/20

New share of D = 1/4 + 4/20 = (5 + 4)/20 = 9/20

New ratio = 11/20 : 9/20

= 11 : 9

Paid amount due to retiring partner-paid in installment

Question 16 : –

D , E and F are partners sharing profits and losses in the ratio of 2 , 2 and 1 respectively. E retired from the firm and his capital on the date of retirement was Rs. 50000 Profit on Revaluation of assets and liabilities was Rs. 10000 and General Reserve was Rs . 15000 .Amount due to E will be paid in 5 equal annual instalments.The journal entry for each instalment will be:

Explanation : –

Calculation of total amount due to E :

Balance of Capital on Retirement = 50000

Share in General Reserve = 15000 X 2/5 = 6000

Share in Revaluation = 10000 X 2/5 = 4000

Total amount due = 60000

Yearly instalment = 60000/5 = 12000

E s Loan A/c Dr 12000

To Bank A/c 12000

Payment of amount due to the retiring partner

Question 17 : –

D , E and F were partners sharing profits and losses in the ratio of 2 , 2 and 1 respectively. F is retired from the firm and his capital on the date of retirement was Rs. 70000 Profit on Revaluation of assets and liabilities was Rs. 20000 and General Reserve was Rs . 10000 . What will be the journal entry for the payment of amount due to F ?

Explanation : –

Calculation of total amount due to F :

Balance of Capital on Retirement = 70000

Share in General Reserve = 10000 X 1/5 = 2000

Share in Revaluation = 20000 X 1/5 = 4000

Total amount due = 76000

F s Capital A/c Dr 76000

To Bank A/c 76000

Payment of amount due to the retiring partner-II

Question 18 : –

D , E and F are partners sharing profits and losses in the ratio of 2 , 2 and 1 respectively. E retired from the firm and his capital on the date of retirement was Rs. 50000 Profit on Revaluation of assets and liabilities was Rs. 10000 and General Reserve was Rs . 9000 . What will be the journal entry for the payment of amount due to E ?

Explanation : –

Calculation of total amount due to E :

Balance of Capital on Retirement = 50000

Share in General Reserve = 9000 X 2/5 = 3600

Share in Revaluation = 10000 X 2/5 = 4000

Total amount due = 57600

E s capital A/c Dr 57600

To Bank A/c 57600

Remaining partners acquire share of the retiring partner

Question 19 : –

D, E and F are partners sharing profits and losses in the ratio of 2 : 2 : 1 F is retired from the firm and his share is taken by D and E in the ratio of 1 : 2 . What will be the new profit sharing ratio ?

Explanation : –

Old ratio between D , E and F = 2 : 2 : 1

F s share taken by D = 1/5 X 1/3 = 1/15

F s share taken by E = 1/5 X 2/3 = 2/15

New share of D = 2/5 + 1/15 = (6+1)/15 = 7/15

New share of E = 2/5 + 2/15 = (6+2)/15 = 8/15

New ratio = 7/15 : 8/15

= 7 : 8

Remaining partners acquire share of the retiring partner-I

Question 20 : –

D, E and F are partners sharing profits and losses in the ratio of 3 : 2 : 2 F is retired from the firm and his share is taken by D and E in the ratio of 3 : 1 . What will be the new share of A?

Explanation : –

Old ratio between D E and F = 3 : 2 : 2

F s share taken by D = 2/7 X 3/4 = 6/28

New share of D = 3/7 + 6/28 = (12+6)/28 = 18/28

Section 37 of Partnership Act 1932

Question 21 : –

A , B and C are partners sharing profits and losses in the ratio of 1 : 2 : 1 A died on 31-Mar-2017 after all the adjustments his capital account shows the credit balance of Rs. 160000 . The amount due to X is to be paid on 31-Jul-2017 . What will be the amount which A s executors are entitled to receive when profit upto 31-Jul-2017 was Rs. 80000 and total capital of A and B was Rs. 240000 .

Explanation : –

Months upto the date of payment = 4

Month in a year = 12

Calculation of amount which executors of A are entitled

Capital balance after all adjustments = 160000

1 Add: Interest @6% p.a. on 160000 upto the date of payment

160000 x 6/100 x 4/12 = 3200

OR

2 Add: Share in profit

Profit from the last balance sheet (X) =

= 160000/(240000+160000) X 80000

= 160000/400000 X 80000

= 32000

A s executors are entitled to choose higher from the above two i.e interest @6% p.a or share in profit as per Section 37 of Partnership Act,1932

Total Amount Due = 160000 + 32000

= 192000

Share of deceased partner in profits

Question 22 : –

A, B and C are partners sharing profits and losses in the ratio of 2 : 2 : 1 . A died on 01-Sep 2017 . His share of profits from the closure of the last accounting year i.e. 31-Mar 2016 till the date of death was to be calculated on the basis of the average profits of two completed years before death. Profit for the year 2014 , 2015 , 2016 were 30000 , 60000 and 90000 respectively. Calculate A ‘s share of profit till the death.

Explanation : –

Total months upto the date of A s death = 5

Total months in a year = 12

Total profit for 3 years = 30000 + 60000 + 90000

= 180000

Average profit = 180000/3

= 60000

Profit for the calculation of A s share = 60000 X 5/12

= 25000

X’ s share = 25000 X 2/5

= 10000

Theory Question

Question 23 : –

Gaining ratio of remaining partners is calculated by:

Explanation : –

The ratio in which the continuing partners acquire the outgoing ( retired or deceased ) partner’s share is known as gaining ratio.It is calculated by taking out the difference between new profit share and old profit share.

Transferring profit on revaluation to capital accounts

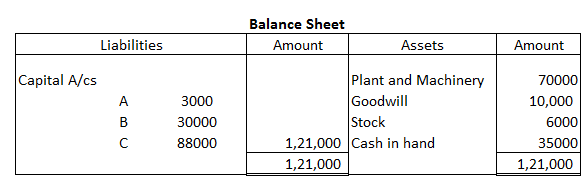

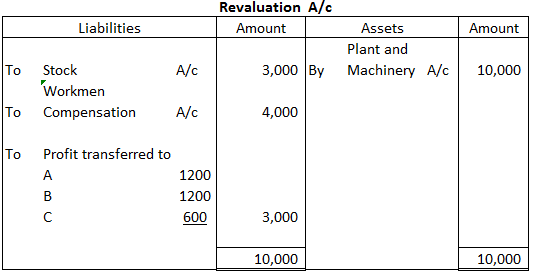

Question 24 : –

A , B and C are partners sharing profits in the ratio of 2 , 2 and 1 C retired from the firm on following terms: Plant and Machinery increased by Rs. 10000 , Stock decreased by Rs. 3000 and there was an unrecorded liability for Workmen Compensation claim for Rs. 4000 .The journal entry for recording effect of revaluation ofassets and liabilties into partners capital account will be:

Explanation : –

Chapter 4 – Reconstitution of a Partnership Firm

- Retirement/Death of a Partner

- Ascertaining the Amount Due to Retiring/Deceased Partner

- New Profit Sharing Ratio

- Gaining Ratio

- Treatment of Goodwill

- Adjustment for Revaluation of Assets and Liabilities/Adjustment of Accumulated Profits and Losses

- Disposal of Amount Due to Retiring Partner

- Adjustment of Partners’ Capitals

- Death of a Partner