Retiring of the Bill refers to the situation where the drawee upon whom the bill of exchange is drawn settles his account with the drawer prior to the expiry date agreed in the bill. This scenario takes place when the drawee of the bill has availability of excess funds which he can use to meet the amount so due. This retirement of the bill before the actual due date is based on mutual understanding between the two parties involved, i.e., the agreement of the drawer of the bill is also necessary.

The bill of exchange drawn by the creditor on its debtor specifies a certain period of time after which the payment becomes due. In order to receive funds before the agreed time as per the bill of exchange, the drawer of the bill offers some discount to the drawee which is known as the Rebate on bills. This is done to encourage the drawee to make early payment before its maturity. This rebate is calculated at an agreed rate of interest.

Accounting treatment of retirement of the bill –

This transaction of retiring the bill way before its actual expiry is treated in the same manner as to when a bill is honoured, i.e., when the payment is made on the expiry of the bill. However, the only difference in the two is that of recording the amount of rebate that is granted to the drawee on making the early payment.

The journal entries that are recorded in the books of accounts on retirement of the bill:

In the books of the holder

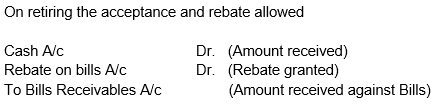

On retiring the acceptance and rebate allowed

In the books of the drawee

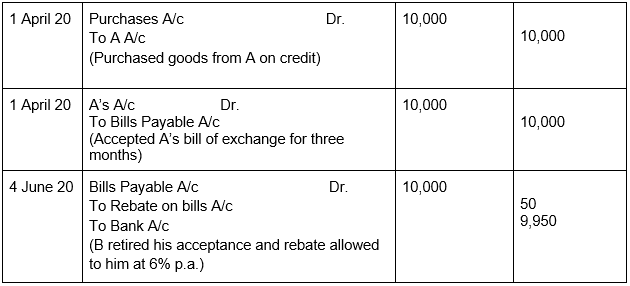

For example – A sold goods on credit to B for Rs. 10,000 on April 01, 2020 and drew a bill on B for a period of three months for the amount of Rs. 10,000. B agreed to the terms and conditions and accepted the bill so drawn. On June 04, 2020, B had funds at his disposal and therefore made a request to A to accept the payment of the bill before its maturity. A agreed to this request and so B retired his acceptance under the rebate of 6% per annum.

Journal Entries in the books of A (Drawer)

Journal Entries in the books of B (Drawee)

Thus, retirement of the bill is nothing but early payment of the amount due. The creditor offers some discount to its debtors so as to encourage them to make payments as early as possible. This discount is known as the rebate.

Chapter 8 – Bill of Exchange Accountancy Class 11 Notes