Customers might return the goods sold on to them for variety of reasons like defect in the goods, over supply, not right product etc. Sales return is also called as “Return Outward”. It records the return of goods which are sold on CREDIT. Sales return book should only record the return of goods sold and not any other sale like sale of asset or sale of used furniture etc.

Once the goods are returned by the customer, seller must issue a credit note to the customer for the amount of goods returned by him. This credit note can be used by the customer to adjust the payment due to the seller.

Let us see how transactions are posted to Sales Return Book.

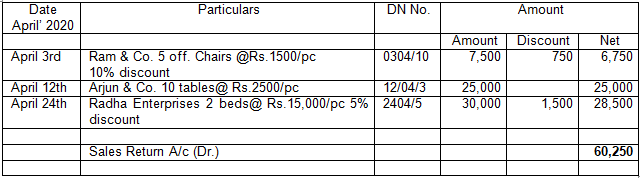

Example:-From the following particulars, prepare the Sales Return Book of a Furniture merchant M/s Krishna Enterprises, Mumbai for the month of April 2020

- 03/04/2020 goods returned by M/s Ram & Co. –5 pcs of the Chairs @ Rs 1500 per pcs with 10% discount

- 12/4/2020 goods returned by M/s. Arjun & Co.- 10 pcs of the Table @ Rs 2500 per pcs

- 24/04/2020 goods returned by Radha – 2 pcs of the King Size Bed @ Rs 15000 per pcs with 5% discount.

In the Books of Krishna Enterprises.

Sales Return Book

The final amount will be recorded either by way of deduction from sales or on debit side of Trading A/c

Chapter 4 – Recording of Transactions Accountancy Class 11

- Cash Book

- Purchases (Journal) Book

- Purchases Return (Journal) Book

- Sales (Journal) Book

- Sales Return (Journal) Book

- Journal Proper

- Balancing the Accounts