Solvency Ratio Analysis

Solvency Ratio Analysis: It measures the ability of a business to survive for a long period of time. These ratios are very important for stockholders and creditors as these ratios assess the ability of the firm to meet its long-term liabilities.

The solvency ratios are categorized into the following types :

a) Debt Equity Ratio

b) Total Assets to Debt Ratio

c) Proprietary Ratio

d) Interest Coverage Ratio

e) Debt to Capital Employed Ratio

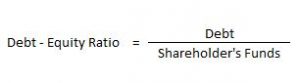

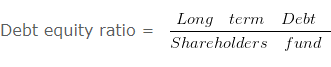

Solvency Ratio – Debt Equity Ratio

It explains the relationship between long-term debts and shareholder funds. The debt-equity ratio of 2:1 is considered ideal.

Here, Debt includes Long-term Borrowings and Long-term Provisions. Shareholder’s Funds include Share Capital and Reserve & Surplus.

Solvency Ratio – Total Assets to Debt Ratio

This ratio is a variation of the debt-equity ratio. In this ratio, assets are expressed in terms of long-term debts.

Here, Total Assets = Non- Current Assets + Non-Current Investments + Long Term Loans & Advances + Current Assets

Debts = Long-term Borrowings and Long-term Provisions

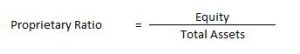

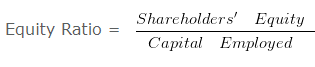

Solvency Ratio – Proprietary Ratio

It is the proportion of total assets funded by the shareholders. A higher proprietary ratio is an indicator of sound financial position from a long-term point of view.

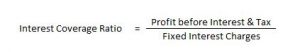

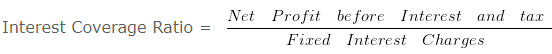

Solvency Ratio – Interest Coverage Ratio

The interest coverage ratio is a debt ratio and profitability ratio used to determine how easily a company can pay interest on its outstanding debt. This ratio indicates how many times the interest charges are covered by the profits available to pay interest charges.

e) Debt to Capital Employed Ratio

This ratio expresses the relation of long-term debt with the sum total of both external and internal funds (i.e., capital employed or net assets).

Debt to capital employed ratio = Long-term Debt/Capital Employed (or Net Assets)

Capital employed can be calculated by taking either the liabilities side or the assets side as the base.

Therefore, it is equal to the long-term debt of the company + shareholders’ funds. Or, it can be calculated by deducting current liabilities from the total assets of the enterprise.

The debt to capital employed ratio depicts the proportion of long term debts forming part of the capital employed. Thus, a lower ratio would provide the lenders with the security of their funds.

Solvency Ratio Examples

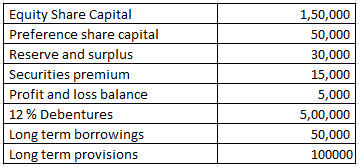

How to compute debt-equity ratio – Solvency Ratio Analysis – Question 1

From the following information calculate the debt-equity ratio.

Explanation: –

= 650000/250000

= 2.6 : 1

Working note 1 : Long term Debt = 12 % Debentures + Long term borrowings + Long term provisions

Long term Debt = 500000 + 50000 + 100000

Long term Debt = 650000

Working note 2 : Shareholders fund = Equity Share Capital + Preference share capital + Reserve and surplus + Securities premium + Profit and loss balance

Shareholders fund = 150000 + 50000 + 30000 + 15000 + 5000

Shareholders fund = 250000

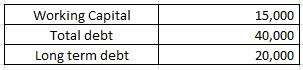

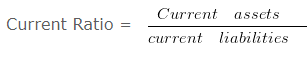

When total debts are given – Solvency Ratio Analysis – Question 2

From the following information compute the current ratio.

Explanation : –

Current Ratio = 35000/20000

Current Ratio = 1.75 :1

Workings:

Working Capital = Current assets (-) Current liabilities

15000 = Current assets (-) 20000

Current assets = 35000

Workings:

Current liabilities = Total debt (-) Long term debt

Current liabilities = 40000 (-) 20000

Current liabilities = 20000

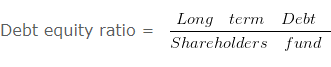

How to compute debt-equity ratio – Solvency Ratio Analysis – Question 3

From the following information calculate the debt-equity ratio.

Explanation : –

Debt equity ratio = 200000/400000

Debt equity ratio = 0.5 : 1

Working note 1: Long term Debt = Long term borrowings + Long term provisions

Long term Debt = 120000 + 80000

Long term Debt = 200000

Working note 2: Shareholders fund = Noncurrent assets + Working capital (-) Noncurrent liabilities

OR

Shareholders fund = Non current assets + Current assets (-) Current liabilities (-) Long term borrowings (-) Long term provisions

Shareholders fund = 500000 + 200000 (-) 100000 (-) 120000 (-) 80000

Shareholders fund = 400000

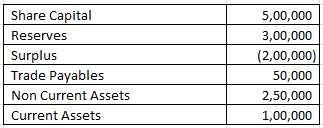

Calculation of Equity ratio – Solvency Ratio Analysis – Question 4

From the Following information calculate Equity Ratio

Explanation : –

Equity Ratio = 600000/300000

Equity Ratio = 2

Working note 1 :

Shareholders’ Equity = Share Capital + Reserves + Surplus

= 500000 + 300000 + -200000

= 600000

Capital employed = Non Current Assets + Current Assets (-) Trade Payables

Capital employed = 250000 + 100000 (-) 50000

Capital employed = 300000

Calculation of Proprietary Ratio – Solvency Ratio Analysis – Question 5

Compute Proprietary ratio if equity share capital is Rs. 125000, Preference Share Capital is Rs. 100000, Capital Reserve is Rs. 80000, Profit & Loss Balance is Rs. 55000. The value of 7 % Debentures is Rs. 62500 and 9 % Mortgage loan- Rs. 112500. Value of Current Liabilities is Rs. 262500 Non-Current Assets is worth Rs. 275000 Value of Current Assets is Rs. 125000.

Explanation : –

Proprietary Ratio = 360000/400000

Proprietary Ratio = 0.9

Working note 1: Shareholders’ Funds = Equity share capital + Preference share capital + Capital reserve + Profit and loss balance

Shareholders’ Funds = 125000 + 100000 + 80000 + 55000 Shareholders’ Funds = 360000

Working note 2 : Total Assets = Non current assets + Current assets

Total Assets = 275000 + 125000

Total Assets = 400000

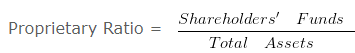

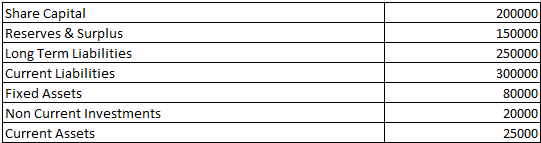

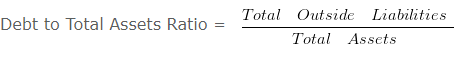

Debt to total assets ratio – Solvency Ratio Analysis – Question 6

Compute Debt to Total Assets Ratio from the above information.

Explanation : –

Debt to Total Assets Ratio = 250000/125000

Debt to Total Assets Ratio = 2 :1

Working note 1 :

Total Assets = Fixed Assets + Non Current Investments + Current Assets

= 80000 + 20000 + 25000

Total Assets = 125000

Interest Coverage Ratio – Solvency Ratio Analysis – Question 7

Compute Interest Coverage ratio if equity share capital is Rs. 1200000, Preference Share Capital is Rs. 720000, Capital Reserve is Rs. 360000, Profit & Loss Balance is Rs. 600000. The Value of 13 % debentures is Rs. 250000 and 11 % Mortgage loan of Rs. 300000. The value of Current Liabilities is Rs. 1180000 Non-Current Assets is worth Rs. 2400000 Value of Current Assets is Rs. 3000000.

Explanation : –

Interest Coverage Ratio = 589500/65500

Interest Coverage Ratio = 9 times

Working Notes:

Interest on debenture = 13% x 250000

= 32500

Interest on loan = 11% x 300000

33000

Total interest charges = 6550

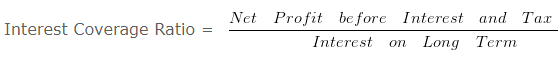

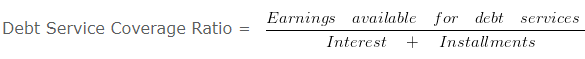

Interest Coverage Ratio & Debt Service Coverage Ratio – Question 8

Calculate- Interest Coverage Ratio & Debt Service Coverage Ratio from the following information. Net Profit before interest and tax is Rs. 300000. 5 % Long Term Debt 500000 (Principle amount is repayable in 10 equal installments) .

Explanation : –

= 300000/25000

= 12 times

Debt Service Coverage Ratio = 300000/(25000+50000)

Debt Service Coverage Ratio = 300000/75000

Debt Service Coverage Ratio = 4 times

Working Notes:

1. Interest on Long Term Debt = 5 % x 500000

25000

Chapter 5 – Accounting Ratios