Financing Activities in a Cash Flow Statement

What are financing activities in a cash flow statement: Cash flow from financing activities is a category in a company’s cash flow statement that accounts for external activities that allow a firm to raise capital. It is the net amount of funding a company generates in a given time period, used to finance its business.

Examples of Cash flow from financing activities are:

- Cash receipt from the issue of shares.

- Payment of preliminary expenses.

- Repayment of loans.

- Payment of Preliminary Expenses.

- Payment of interest on borrowings.

- Proceeds from issue of debentures.

- Payment of Dividend.

- Payment for Buy-Back of Equity Shares.

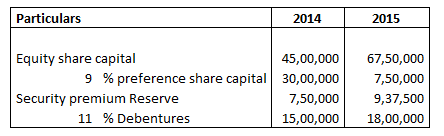

What are financing activities in a cash flow statement: Example 1

Following particulars are provided by Akash Ltd. The total money received from the issue of equity shares will be:

Additional information:

a Preference dividend on preference shares and an interim dividend on equity shares @ 3 % were paid on 30th September 2014.

b Preference shares were redeemed on 31st March 2015 at a premium of 18 %. Such premium has been provided out of profits. New shares and debentures were issued on 1st October 2014.

Explanation: –

Issue of share capital = Closing balance of share capital (-) Opening balance of share capital

Equity share capital = 6750000 (-) 4500000

= 2250000

Premium on issue of shares = Closing balance of security premium (-) opening balance of security premium

= 937500 (-) 750000

= 187500

Interim dividend paid = 4500000 x 3 %

= 135000

Total amount received from issue of equity shares = Total amount of shares issued + Security premium received on issue (-) Interim dividend paid

= 2250000 + 187500 (-) 135000

= 2302500

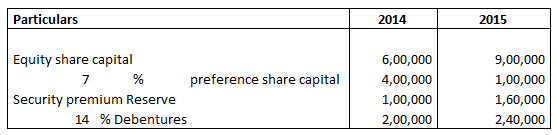

What are financing activities in a cash flow statement: Example 2

Following particulars are provided by Akash Ltd. The total amount paid to preference shares holders will be:

Additional information:

a Preference dividend on preference shares and an interim dividend on equity shares @ 15 % were paid on 30th September 2014.

b Preference shares were redeemed on 31st March 2015 at a premium of 12 %. Such premium has been provided out of profits. New shares and debentures were issued on 1st October 2014

Explanation: –

Redemption of preference shares = Opening balance of preference shares (-) Closing balance of preference shares

= 400000 (-) 100000

= 300000

Premium on redemption of preference shares = 300000 X 12/100 = 36000

Preference dividend = 400000 X 7%

= 28000

Total amount paid = 300000 + 36000 + 28000

= 364000

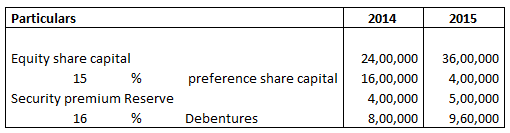

What are Financing activities in a cash flow statement: Example 3

Following particulars are provided by Amit Ltd . Net cash flow from financing activities will be:

Additional information:

a Preference dividend on preference shares and an interim dividend on equity shares @ 12 % were paid on 30th September 2014.

b Preference shares were redeemed on 31st March 2015 at a premium of 15 %. Such premium has been provided out of profits. New shares and debentures were issued on 1st October 2014

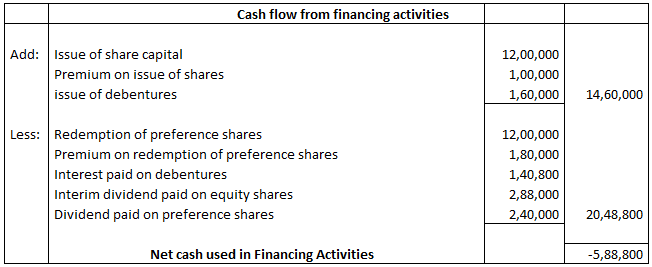

Explanation: –

Issue of share capital = Closing balance of share capital (-) Opening balance of share capital

Equity share capital = 3600000 (-) 2400000

= 1200000

Premium on issue of shares = Closing balance of security premium (-) opening balance of security premium

= 500000 (-) 400000

= 100000

Issue of debentures = Closing balance of debentures (-) Opening balance of debentures

= 960000 (-) 800000

= 160000

Redemption of preference shares = Opening balance of preference shares (-) Closing balance of preference shares

= 1600000 (-) 400000

= 1200000

Premium on redemption of preference shares = 1200000 X 15/100 = 180000

Interest paid on debentures = 800000 X 16% = 128000

Add: Interest on new debentures issued = 160000 X 16% X 6/12 = 12800

Total interest on debentures = 128000 + 12800

= 140800

Dividend paid on equity shares = 2400000 X 12/100 = 288000

Dividend paid on preference shares = 1600000 X 15/100

= 240000

What are Financing activities in a cash flow statement: Example 4

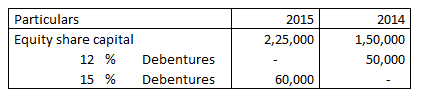

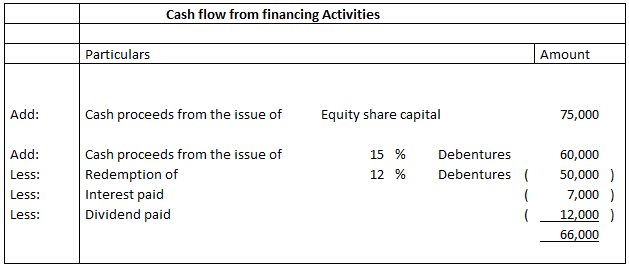

Akash Ltd provides the following information. Cash flow from financing activities will be:

Additional information:

1 Interest paid on debentures Rs 7000.

2 Dividend paid Rs 12000.

Explanation: –

Issue of equity share capital Closing balance of debentures (-) opening balance of debentures

225000 (-) 150000

75000

Cash proceeds from 15 % Debentures = Closing balance of debentures (-) opening balance of debentures

= 60000 (-) 0

= 60000

Redemption of 12 % Debentures = opening balance of debentures (-) Closing balance of debentures

= 50000 (-) 0

= 50000

Chapter 6 – Cash Flow Statement