Writing off Discount/Loss on Issue of Debentures: When debentures are issued at a discount or any Loss on issue of debentures arises, it is required to be written off during the year in which such issue is made. It is a capital loss in nature. The securities premium reserve available can be used to write off such discount or loss on issue.

If capital profits are insufficient to write off this discount or loss amount, a company can choose to write off discount/loss on issue of debentures against any revenue profits earned during the year.

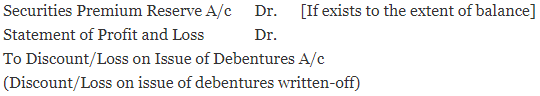

Journal entry passed is—

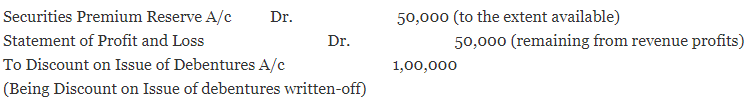

For example –

On October 01, 2019 a company issued 10,000, 8% debentures of Rs. 100 each at 10% discount. The balance available in securities premium reserve account is of Rs. 50,000.

The discount on issue of debentures of Rs. 1,00,000 will be written-off in the year ending March 31, 2020 as follows:

Thus, a company follows the above procedure for writing off discount/loss on issue of debentures during the year in which it issues such debentures. It either writes it off from Securities Premium Reserve account and if it has insufficient balance then from any revenue natured profits.

Chapter 2 – Issue and Redemption of Debentures

- Meaning of Debentures

- Issue of Debentures

- Over Subscription of Debentures

- Terms of Issue of Debentures

- Interest on Debentures

- Writing off Discount/Loss on Issue of Debentures

- Redemption of Debentures