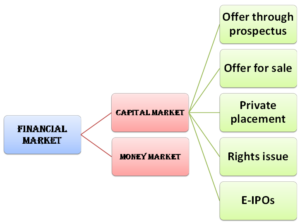

Capital Market Class 12 explains the meaning and types of the capital market. The capital market provides a platform for organizations from where they can raise long-term capital for the firm. A detailed explanation of all the topics is given below.

What is Capital Market Class 12?

What is Capital Market Class 12, The answer to this question is A capital market is a platform where funds are raised i.e. debt and equity. Here, the people or institutions who want to save their money i.e. a part of their income will save their money by buying debt or equity and this money is invested into the most productive areas. A good financial system is important for an economy because it helps it to grow and develop.

A capital market consists of developmental banks, financial institutions, merchant banks, commercial banks, stock exchanges, etc.

In a capital market, the people who want to save can buy shares or debentures from the company that is offering the same in exchange for money. This is done with the stock exchanges and brokers as middlemen. In an ideal capital market, the funds are available at a reasonable cost, and market operations are free and fair. There should be transparency in operations so that it does not create any conflict later on.

There are Types of Capital Market Class 12

Primary market under Capital Market Class 12

Capital Market Class 12 is divided into two types. The first one is, The primary market is the new issues market. Here, the securities are issued for the first time. Funds are required by the businesses for various purposes such as setting up the enterprise, day-to-day activities, expansion, growth, new project, diversification, modernizations, mergers or takeovers, etc. The funds can be thus raised from various sources including the primary market.

Here, the company will issue the securities of the company and then the people who want to save their money will buy these securities and the company will get the funds for their activities and then in return, the company will have to pay the dividend on the shares or interest on debentures.

The company can raise the funds in the form of equity shares, preference shares, debentures, bonds, deposits, and loans.

There are several methods for the flotation of funds in the primary market Class 12. They are as under:

Offer through prospectus

The prospectus is the printed advertisement and a legal disclosure document that is circulated including the information about the offering made to the public. It contains information about the company, its management, the consent of directors, bankers, and auditors, and other important information which will help the investor to make an informed decision. It is issued before making the offering to the public and the company should be listed on the stock exchange. The contents of the prospectus are in accordance with the provisions of the companies act and also with the SEBI guidelines.

Offer for sale

In this method, the securities are not offered to the public directly. They are offered to the public through intermediaries. These intermediaries include stockbrokers; issuing houses, etc. the companies sell the securities to these intermediaries at an agreed price who in turn will resell these to the general public.

Private placement

A private placement is a good method to raise funds if the company wants to avoid the excess cost of raising funds which includes some mandatory expenses. In this case, the company will offer the securities to only some institutional investors and to some individual investors. This is also helpful to raise funds quickly without spending much time in formalities.

Rights issue

Rights issue means the right given to the existing shareholders to buy the new shares of the company in the proportion of the available shares with them. The company thus saves significant amounts of money in the form of underwriting fees, advertising costs, etc.

E-IPOs under Capital Market Class 12

An initial public offer means that the first-time company is offering securities in the market. The IPO mean that the company will issue the securities for the first time and through electronic media. The SEBI registered brokers will have to be appointed, who will accept the orders from the public and place the order with the company. The company manager will coordinate the activity among the intermediaries in this offer.

Secondary Market

Capital Market Class 12 is divided into two types. The second one is, The secondary market is the platform where the existing securities are dealt with. Here, the new investors can invest in the securities and the existing investors can disinvest or invest more, as they wish. It is very helpful in economic growth and development as it channelizes the funds to the most productive use through the activity of investment, reinvestment, and disinvestment.

Here the main role is played by the stock exchanges or stock markets. With advanced technology, it has become easier to buy and sell securities as per the comfort from anywhere at any time. National stock exchange, Bombay stock exchange are some examples of the same.

The secondary market is thus the place where the existing securities are bought as well as sold. It has a geographical location and thus a physical existence. In secondary markets, there is not a fixed price for the securities but it fluctuates based on the demand and supply of the securities in the market. It is quick so that the investors can get the funds they invested quickly back in the form of cash..

Both money market and capital markets are the platforms where the savers save their money and the funds are put into the most productive areas but the main difference lies in the maturity period. The money market instruments are for a short period of time and the capital market instruments are for a long period of time i.e. more than one year.

The capital market Class 12 is thus the place where the investors can invest in the securities offered by the companies i.e. the new securities or the existing ones. It encourages economic growth and therefore, it is very important for the countries to develop.

BST Chapter 10 – Financial Markets