Issue of Debentures – Basic Concept

Debenture is an instrument, which acknowledges a debt due from a company. It is issued under the common seal of the company and is duly signed by authorized signatory. It is an agreement for the repayment of principal sum of debenture and interest at a specified rate on a specified date. There are two stages in the cycle of a debenture: a) issue of debentures and b) redemption of debenture.

Procedure for issue of debentures

The procedure for issue of debentures is similar to issue of shares. First of all, a prospectus is issued in which terms and conditions of the issue are mentioned. After issuing prospectus, applications are received from the interest investors along with the application money. The company has the option to either call the full amount of debentures or to call the amount in installments.

The debentures can be issued at par, premium, discount, for consideration other than cash or as collateral securities. The same has been explained as below:

Issue of Debentures at Par:

Debentures are said to be issued at par when amount collected on debentures is equal to the face value of debentures. The issue price and the face value of debentures remain same. The journal entry for issue of debentures at par is:

Bank A/c Dr

To Debenture Application A/c

Debenture Application A/c Dr

To Debentures A/c

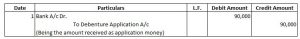

Question 1:

AB Ltd. issued 18,000 5 % Debentures of Rs. 10 each, payable as, Rs. 5 on Application, and the remaining amount on Allotment. The Debentures are redeemable after 15 years. All the Debentures were applied for and allotted. All money was received. Journal entry for money received on Allotment will be:

Explanation:

Question 2:

AB Ltd. issued 2,000 12 % Debentures of Rs. 20 each, payable as, Rs. 12 on Application, and the remaining amount on Allotment. The Debentures are redeemable after 5 years. All the Debentures were applied for and allotted. All money was received. Journal entry for Allotment will be:

Explanation:

Issue of Debentures at Premium:

Debentures are said to be issued at premium when they are isuued at a price which is more than its face value. Generally, premium money is collected along with the allotment money. The premium is not a revenue profit rather it is a capital profit due to which it is being used to write off capital losses like preliminary expenses, discount on issue of shares etc.

The journal entry for debentures issued at premium will be:

At the time of receipt of application:

Bank A/c Dr

To Debenture Application A/c

Debenture Application A/c Dr

To Debentures A/c

At the time of allotment:

Debenture Allotment A/c Dr

To Debentures A/c

Bank A/c Dr

To Debenture Allotment A/c

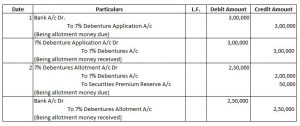

Question 3:

B Ltd. issued 10,000 7 % Debentures of Rs 50 each at a premium of Rs 5 per Debenture payable as: on Application Rs 30 ,on Allotment Rs 25 .The Debentures were fully subscribed and all money was duly received. Journal entry, at the time when the Allotment money is due will be:

Explanation:

Issue of Debentures at Discount:

Debentures are said to be issued at discount when they are issued at a price which is less than its face value. Discount on issue of debentures is a capital loss, hence it is written off in the year in which it occurs. Discount on issue of debentures is written off from:

a) General Reserve, or

b) Credit Balance of Profit & Loss A/c, or

c) Securities Premium Reserve

Issue of Debentures at Discount- Entry for Allotment money Due

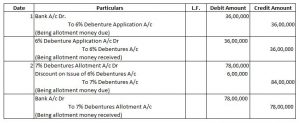

Question 4:

Ankush Ltd. issued 60000 6 % Debentures of Rs. 200 each at a discount of 5 % on 1st April 2017, payable as Rs 60 on Application, and balance on Allotment. The Debentures are redeemable after 10 years. Journal Entry for Allotment money due will be:

Explanation:

Debentures Issued as Collateral Securities:

‘Collateral Security’ means security provided to the lender over the principal security. It is a secondary security provided to the lender. Debentures are issued as collateral security when the borrower is not able to mortgage an asset for loan taken. The debentures issued as collateral security are returned to the company after the loan is repaid but if the loan is not repaid then the lender will first realise its debt from principal security and if full amount of debt is not realised from the principal security then it may claim all the rights of a debentureholder.

There are below given two methods to treat the collateral security in the books of accounts.

First Method: No entry is passed in this method, as the debentures are not issued rather they have been given as collateral security.

Second Method: In this method, the below given journal entry is passed for issue of debentures as collateral security:

Debentures Suspense A/c

To Debentures A/c

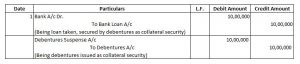

Question 5:

Akshay Ltd. took a loan of Rs. 10,00,000 from the bank and issued debentures as collateral security. Pass the necessary journal entries:

Explanation:

Issue of Debentures for Consideration other than Cash:

Issue of Debentures to Promoters:

The debentures are issued to the promotores in return for the services rendered by them. The journal entry for the same will be:

Formation Expenses A/c Dr

To Debentures A/c

Issue of Debentures to Underwriters:

In order to pay the commission of underwriters, the company may sometimes issue debentures to the underwriters. Underwriting commission should be written off in the year in which it occurs.

The journal entry for debentures issued to underwriters are:

1.At the time when underwriting commission is due:

Underwriting Commission A/c Dr

To Underwriters A/c

2.At the time when shares are issued to underwriters:

Underwriters A/c Dr

To Debentures A/c

Amount transfer to security premium-Where debentures are Issued for a consideration other than cash ( at premium)

Question 6: –

AB Ltd purchased assets of the book value of Rs 624000 from JK Ltd It was agreed that the purchase consideration would be paid by issuing 14 % Debentures of Rs 100 each. If Debentures are issued at premium of 4 %. The amount transferred to security premium reserve will be:

Explanation : –

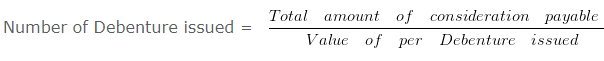

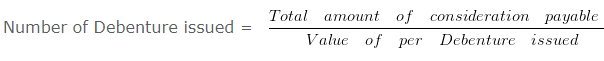

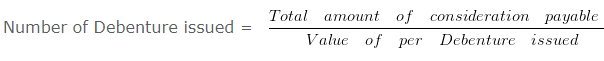

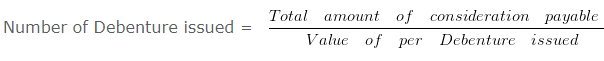

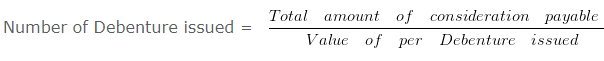

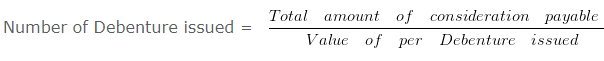

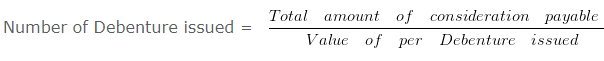

Calculation of number of debentures issued by the company

Number of Debenture issued = 624000/104

Number of Debenture issued = 6000

Amount of premium will be = Total number of Debentures issued x Premium on per Debenture

Amount of premium will be = 6000 x ( 100 x 4/100)

Amount of premium will be = 6000 x 4

Amount of premium will be = 24000

Calculation of number of debentures-Where debentures Issue other than cash at discount

Question 7: –

Akash Ltd purchased Machinery of the book value of Rs 544000 from Tarun Ltd . It was agreed that the purchase consideration would be paid by issuing 9 % Debentures of Rs 80 each. If the Debentures are issued at Discount of 15 %,the number of Debenture issued will be:

Explanation : –

Calculation of number of debentures issued by the company

Number of Debenture issued = 544000/80

Number of Debenture issued = 8000

Determination of discount amount -Where debentures Issue other than cash at discount

Question 8: –

Bansi Ltd purchased Machinery of the book value of Rs 200000 from JD Ltd . It was agreed that the purchase consideration would be paid by issuing 7 % Debentures of Rs 10 each. If the Debentures are issued at Discount of 20 %,the amount of discount will be:

Explanation : –

Calculation of number of debentures issued by the company

Number of Debenture issued = 200000/(10-2)

Number of Debenture issued = 25000

Amount of Discount will be = Total number of Debentures issued X Discount on per Debenture

Amount of Discount will be = 25000 X ( 10 X 20/100)

Amount of Discount will be = 25000 X 2

Amount of Discount will be = 50000

Determination of discount amount -Where debentures Issue other than cash at discount

Question 9: –

Amit Ltd purchased Machinery of the book value of Rs 480000 from VK Ltd . It was agreed that the purchase consideration would be paid by issuing 11 % Debentures of Rs 75 each. If the Debentures are issued at Discount of 20 %, the journal entry for issue of Debenture will be:

Explanation : –

Calculation of number of debentures issued by the company

Number of Debenture issued = 480000/(75-15)

Number of Debenture issued = 8000

Amount of Discount will be = Total number of Debentures issued X Discount on per Debenture

= 8000 X 15

Amount of Discount will be = 120000

Entry for issue of Debenture

VK Ltd A/c Dr 480000

Discount on issue of Debenture A/c Dr 120000

To 11 % Debentures A/c 600000 ( 8000 X 75 )

Determination of number of debentures- where debentures issue other than cash (at par)

Question 10: –

A company purchased assets of the book value of Rs 1000000 from Best Ltd .It was agreed that the purchase consideration would be paid by issuing 13 % Fully paid Debentures of Rs 40 each. If Debentures are issued at par then how many such Debentures would be issued by the company to Best Ltd

Explanation : –

Calculation of number of debentures issued by the company

Number of Debenture issued = 1000000/40

Number of Debenture issued = 25000

Determination of number of debentures- where debentures issue other than cash (at premium)

Question 11: –

Aarti Ltd. purchased assets of the book value of Rs 1725000 from Agni Ltd. It was agreed that the purchase consideration would be paid by issuing 15 % Debentures of Rs 60 each. If Debentures are issued at premium of 15 % . The number of Debentures issued to Agni Ltd. will be:

Explanation : –

Calculation of number of debentures issued by the company

Number of Debenture issued = 1725000/69

Number of Debenture issued = 25000

Journal entry- Issue of debentures other than cash (for purchase of assets)

Question 12: –

A company purchased assets of the book value of Rs 1100000 from ML Ltd . It was agreed that the purchase consideration would be paid by issuing 13 % Debentures of Rs 50 each. If Debentures are issued at par journal entry for purchase of assets from ML Ltd will be:

Explanation : –

Entry for issue of debenture:

Assets A/c Dr 11,00,000

To ML Ltd 11,00,000

Journal entry – debentures Issue other than cash (at premium)

Question 13: –

Black Ltd purchased assets of the book value of Rs 140000 from White Ltd . It was agreed that the purchase consideration would be paid by issuing 13 % Debentures of Rs 25 each. If Debentures are issued at premium of 40 % . The journal entry for issue of Debentures to White Ltd will be:

Explanation : –

Calculation of number of debentures issued by the company

Number of Debenture issued = 140000/35

Number of Debenture issued = 4000

Entry for issue of Debentures to White Ltd:

White Ltd A/c Dr 1,40,000

To 13 % Debentures A/c 1,00,000 ( 4000 X 25 )

To Security premium reserve A/c 40,000 ( 4000 X 10 )

Issue of Debentures other than cash ( Balance credited to capital reserve)

Question 14: –

Bright Ltd purchased assets of Rs 1500000 and took over liabilities of Rs 300000 at an agreed value of Rs 1100000 . Bright Ltd issued 4 % Debentures at par in full satisfaction of the purchase price. The journal entry for purchase of asset and liabilities taken over will be:

Explanation : –

Entry for assets and liabilities taken over by Bright Ltd:

Sundry Assets A/c Dr 15,00,000

To Sundry Liabilities 3,00,000

To Vendor A/c 11,00,000

To Capital Reserve A/c (Balancing fig) 1,00,000

Chapter 2 – Issue and Redemption of Debentures