Meaning of Redemption of Debentures

Redemption of debentures means repayment of debenture to the debenture holders by the company after a specified period of time. Debenture is a liability to the company so when the company redeems the debentures, the liability of the company is being reduced. Debentures can be : –

- Issued either at par and can be redeemed at par.

- Issued either at par and redeemed at premium.

- Issued at premium and redeemed at par.

- Issued at premium and redeemed at premium.

Debentures can be redeemed either out of capital or out of profit.

(i) Redemption of debentures out of the capital

When debentures are redeemed out of current resources of the company and adequate profits are not transferred to debenture redemption reserve (DRR) from Profit & Loss Appropriation Account, it is termed as redemption out of capital.

(ii) Redemption of debentures out of profit

When a part of the divisible profit is transferred to debenture redemption reserve (DRR) from Profit & Loss Appropriation Account before redemption, and the debentures are redeemed, it is redemption out of profit.

Debenture Redemption Reserve:

As per Section 71(4) of the Companies Act, 2013, a company using debentures has to create a Debenture Redemption Reserve(DRR), if it is issuing debentures. The company is required to transfer the amount to DRR account out of profits available for payment of dividend. DRR cannot be used for other purpose except redemption of debentures. The following guidelines have to be followed for creation of Debenture Redemption Reserves:

a) Created out of the profits of the company : The Debenture Redemption Reserve shall be created out of the profits of the company available for payment of dividend

b) Timeline to create DRR : Every company required to create Debenture Redemption Reserve shall create such reserve on or before the 30th day of April in each year

c) Every company shall deposit a minimum of 15% of the amount of debentures maturing during the year, ending on 31st March of the next year

d) In case of convertible debentures, DRR should be created for the non-convertible portion of such debentures

Some examples of redemption of debentures are as given below:

Redemption of Debentures out of profits – Investment in specified securities

Question : –

Green Ltd has 14000 8 % Debentures of Rs 30 each ,which are outstanding on 1st April 2016 ,due for redemption on 31st March 2017 .The amount of investment required in specified securities will be:

Explanation : –

Total value of Debentures to be redeemed = 14000 X 30

= 420000

As per section 71(4) of companies Act 2013 every company required to created DRR is also required to invest or deposit in specified securities by 30th April a sum which is at least equal to 15% of the amount of Debentures maturing for payment during the year ending 31st March of the next year

Total amount required to invest in specified securities = Value of Debentures to be redeemed X 15/100

= 420000 X 15/100

= 63000

Redemption of Debentures out of profits

Question : –

Akash Ltd has 12000 13 % Debenture of Rs 60 each which are outstanding on 1st April 2014 ,and are due for redemption on 31st March 2015 .The company has a Debenture redemption reserve of Rs 35000 on that date. The amount transferred to Debenture redemption reserve will be:

Explanation : –

Total value of Debentures to be redeemed = 12000 X 60

= 720000

Required amount of Debenture redemption reserve as per section 71(4) of the companies Act 2013 = 25% of the value of Debentures to be redeemed

= 25/100 X 720000

= 180000

Less: Opening Debenture redemption reserve already in the books of accounts 35000

Required amount of Debenture redemption reserve(DRR) 145000

Oversubscription of debentures

Question : –

Anju Ltd. invited Application for issuing 12000 18 % Debenture of Rs 10 each at a premium of Rs 4 per Debenture. Application were received for 13500 Debentures .Application for 1500 Debentures were rejected and Application money was refunded. Debenture were allotted to remaining applicants. Journal entry for transferring Application and Allotment money into Debenture account will be:

Explanation : –

18 % Debenture Application and Allotment A/c Dr 189000

To 18 % Debentures A/c 120000 ( 13500 – 1500 ) X 10

To Security premium Reserve A/c 48000 ( 13500 – 1500 ) X 4

To Bank A/c 21000 ( 1500 X 14 )

Journal entry-Redemption of Debentures out of profits

Question : –

ABC Ltd has 14000 8 % Debentures of Rs 60 each which are outstanding on 1st April 2014 ,and due for redemption on 31st March 2015 .The company has a Debenture redemption reserve of Rs 45000 on that date. The necessary journal entry for transferring profit to Debenture redemption reserve will be:

Explanation : –

Total value of Debentures to be redeemed = 14000 X 60

= 840000

Required amount of Debenture redemption reserve as per section 71(4) of the companies Act 2013 = 25% of the value of Debentures to be redeemed

= 25/100 X 840000

Required amount of Debenture redemption reserve = 210000

Less: Opening Debenture redemption reserve already in the books of accounts 45000

Required amount of Debenture redemption reserve(DRR) 165000

Entry for required profit to be transferred to Debenture redemption reserve account

Surplus i.e. Balance in statement of Profit and Loss A/c Dr 165000

To Debenture redemption Reserve A/c 165000

Accounting entries for Oversubscription of debentures

Question : –

Anju Ltd. invited Application for issuing 12000 18 % Debenture of Rs 10 each at a premium of Rs 4 per Debenture. Application were received for 13500 Debentures .Application for 1500 Debentures were rejected and Application money was refunded. Debenture were allotted to remaining applicants. Journal entry for transferring Application and Allotment money into Debenture account will be:

Explanation : –

18 % Debenture Application and Allotment A/c Dr 189000

To 18 % Debentures A/c 120000 ( 13500 – 1500 ) X 10

To Security premium Reserve A/c 48000 ( 13500 – 1500 ) X 4

To Bank A/c 21000 ( 1500 X 14 )

Accounting entries for Redemption of Debentures out of profits

Question : –

Akash Ltd has 12000 13 % Debenture of Rs 60 each which are outstanding on 1st April 2014 ,and are due for redemption on 31st March 2015 .The company has a Debenture redemption reserve of Rs 35000 on that date. The amount transferred to Debenture redemption reserve will be:

Explanation : –

Total value of Debentures to be redeemed = 12000 X 60

= 720000

Required amount of Debenture redemption reserve as per section 71(4) of the companies Act 2013 = 25% of the value of Debentures to be redeemed

= 25/100 X 720000

= 180000

Less: Opening Debenture redemption reserve already in the books of accounts 35000

Required amount of Debenture redemption reserve(DRR) 145000

Redemption of Debentures out of profits-Investment in specified securities

Question : –

Green Ltd has 14000 8 % Debentures of Rs 30 each ,Which are outstanding on 1st April 2016 ,due for redemption on 31st March 2017 .The amount of investment required in specified securities will be:

Explanation : –

Total value of Debentures to be redeemed = 14000 X 30

= 420000

As per section 71(4) of companies Act 2013 every company required to created DRR is also required to invest or deposit in specified securities by 30th April a sum

which is at least equal to 15% of the amount of Debentures maturing for payment during the year ending 31st March

of the next year

Total amount required to invest in specified securities = Value of Debentures to be redeemed X 15/100

= 420000 X 15/100

= 63000

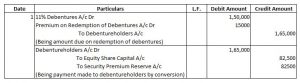

Redemption of Debentures – By conversion

Question : –

Anil Ltd redeemed 3000 11 % Debentures of Rs 50 each at a premium of 10 % on 31st March 2016 Debenture holders were given equity shares of Rs 10 each at premium of Rs 10 per share. Journal entries in the books of Anil Ltd will be:

Explanation : –

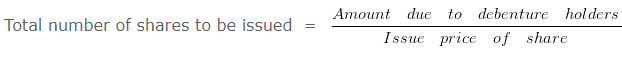

Amount of Debenture due for payment = Total number of Debentures X Value of per Debenture

= 3000 X 50

= 150000

Amount of premium on redemption of per Debenture = 50 X 10/100 = 5

Total amount of premium payable = No of Debenture to be redeemed X Amount of premium on redemption of per Debenture

= 3000 X 5

= 15000

Total amount due to Debenture holders = 150000 + 15000

= 165000

Issue price of share = 10 + 10

Issue price of share = 20

= (150000+15000)/20

= 8250

Entry for amount due to Debentureholders on conversion of 3,000 11 % Debentures:

When Debenture issued at a discount and are redeemable at premium

Question : –

Amit Ltd issued 6000 20 % Debentures of Rs 200 each at a discount of 10 % redeemable at a premium of 20 % .Journal entries in the books of .Entries in the books for issue of Debentures will be: Amit Ltd will be:

Explanation : –

Amount of discount per Debenture = 200 X 10/100 = 20

Amount of premium per Debenture = 200 X 20/100 = 40

Total loss on issue = 20 + 40

= 60

Entry for Application money received

Bank A/c Dr 1080000

To Debenture Application and Allotment A/c 1080000 [ 6000 X ( 200 – 20 )]

Entry for transferring application money to 20 % Debenture account

Debenture Application and Allotment A/c Dr 1080000

Loss on issue of Debenture A/c Dr 360000 ( 6000 X 60 )

To 20 % Debentures A/c 1200000 ( 6000 X 200 )

To Premium on Redemption of Debenture A/c 240000 ( 6000 X 40 )

When Debentures issued at a premium and are redeemable at par

Question : –

A Ltd issued 5000 5 % Debentures of Rs 15 each at a premium of 20 % redeemable at par. Journal entries in the books of A Ltd will be:

Explanation : –

Premium per Debenture = 15 X 20/100 = 3

Entry for Application money received

Bank A/c Dr 90000 [ 5000 X ( 15 + 3 )]

To Debenture Application and Allotment A/c 90000

Entry for transferring application money to 5 % Debenture account

Debenture Application and Allotment A/c Dr 90000

To 5 % Debentures A/c 75000 ( 5000 X 15 )

To Security premium Reserve A/c 15000 ( 5000 X 3 )

When Debentures issued at a premium and are redeemable at premium

Question : –

DK Ltd issued 10000 10 % Debentures of Rs 50 each at a premium of 10 % redeemable at a premium of 10 % .Entries for issue of debentures in the books of will be: DK Ltd will be:

Explanation : –

Premium on issue of per debenture = 50 X 10/100 = 5

Premium on redemption of per Debenture = 50 X 10/100 = 5

Entry for Application money received

Bank A/c Dr 550000 [ 10000 X ( 50 + 5 )]

To Debenture Application and Allotment A/c 550000

Entry for transferring application money to 10 % Debentures account

Debenture Application and Allotment A/c Dr 550000

Loss on issue of Debenture A/c Dr 50000 ( 10000 X 5 )

To 10 % Debentures A/c 500000 ( 10000 X 50 )

To Security premium Reserve A/c 50000 ( 10000 X 5 )

To Premium on redemption of Debentures A/c 50000 ( 10000 X 5 )

When Debentures issued at discount and redeemable at par

Question : –

B Ltd issued 5000 5 % Debentures of Rs 100 each at a discount of 10 % redeemable at par at any time after 5 Years. Journal entries in the books to record issue will be:

Explanation : –

Amount of discount per Debenture = 100 X 10/100 = 10

Entry for Application money received

Bank A/c Dr 450000

To 5 % Debenture Application and Allotment A/c 450000 [ 5000 X ( 100 – 10 )]

Entry for transferring application money to 5 % Debentures account

5 % Debenture Application and Allotment A/c Dr 450000

Discount on issue of Debentures A/c Dr 50000 ( 5000 X 10 )

To 5 % Debentures A/c 500000

Chapter 2 – Issue and Redemption of Debentures